How to read your super statement

If the pandemic has left you flat and badly in need of a sugar hit, open your annual super statement. If you are in a balanced or MySuper default fund, where most people's money is invested, you will have scored big time.

Funds achieved returns of 20% in the year to June 30, the best result in 15 years. Hopefully, the endorphin rush will prompt you to take your statement more seriously and read it carefully from cover to cover.

For whatever reason, many of us neglect to do this. Alex Dunnin, executive director of research and compliance at the Rainmaker Group, puts the inertia down to the way super works: much of it happens without our involvement.

"The strength of super is that it's all automatic, but it's also one of its weaknesses," he says. "If I'm on $100,000 a year, $10,000 goes into super automatically, without me having to hand it over. If you were doing that physically you'd think about it differently."

The upshot is people delay paying attention to their super until the run-up to retirement.

"We ignore it until we need it, by which time it's too late," he says. "People subsequently realise they're in the wrong fund or the wrong investment choice. But all that information is there in the statement.

Treat it as your annual wake-up call.

"This money could be worth a tonne. Your fund is trying to tell you what's going on. Don't read it if you don't want to, but in years to come you'll realise your fund is terrible, you're paying high fees and it's all gone pear-shaped."

Basically, your statement shows the super fund you're in; your investment option; your account balance; all transactions; insurance cover; and the returns.

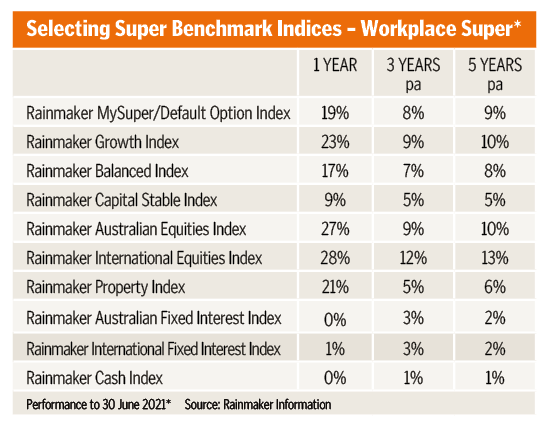

"If you're not getting at least 15% in the MySuper product you should be wondering what's going on.

This has been a boomer of a year - you should have strong returns of 20%," says Dunnin. The top funds have earned up to 24%.

"If you pay more than 1% in fees, that's high. You can get much better fee deals than that. There are funds that charge 0.6%-0.7%. When returns are high you might say, 'Well, who cares about fees',

but over the long run it really matters."

Also check your insurance and understand the types of cover you have, he recommends. "Is it just death cover, or is it death and total and permanent disability cover? You might have income protection thrown in.

"Figure out if the cover is adequate. Think about your mortgage: 'If I dropped dead now would my partner be able to pay it out?' Maybe it isn't enough.

"Not all insurance is the same, there are cases where people thought they had proper cover, but it turns out to be basic, like $120,000, which may not go far."

Dunnin likes to think of the annual statement as a report card.

"If your fund is speaking to you in terms that mean nothing to you, you're in the wrong fund. Why give your money to someone who can't explain clearly what's going on?"

He says you can change funds at any time and without penalty.

"As consumers we have massive control. But you have to exercise some discipline and be proactive."

Dominique Bergel-Grant, a financial planner and director at Leapfrog Financial, says insurance is the number one cost people seem to be unaware of. Some are even surprised that premiums are being deducted from their account.

However, she says it generally makes sense to hold life insurance through super, as there are tax advantages. "But you need to know what you've got and what you're paying for." The rules governing who you can nominate as a beneficiary are limited.

"It is important that people understand that your will does not control what happens with your super death benefit. The money from your super does not pass through your will unless you specifically say that's where you want it to go," she says.

Some people may forget to nominate a beneficiary or unknowingly run foul of the rules.

"The trap for the non-advised is that they may nominate someone who isn't eligible. With super you are only allowed to nominate someone who is a spouse, someone who is financially dependent, someone who is interdependent on you, or your children," says Bergel-Grant.

She comes across clients who have nominated their siblings or parents, or they've still got their ex-spouse listed as a beneficiary, underlining how important it is to be on top of the details.

Note that if your super account is inactive for 16 months or longer, your fund may cancel your insurance.

"You need to be proactive and opt in to keep it if you haven't made a contribution to your super," she warns.

That's why Dunnin says the arrival of your annual statement is a trigger to do some housekeeping to ensure everything is in order.

Bergel-Grant warns that if you ignore your statement, year after year, you may find the high-risk growth option you chose several decades ago is no longer suitable.

"It's important to look at the asset allocation section of your super statement. If I'm 55, should I have all my money in the sharemarket or should I have a more balanced or conservative investment?" she asks.

She also points out the level of risk varies between balanced funds.

"People need to be curious about where and how their super money is invested and change it if need be. Those details will be on the fund's website. It will give you their top 10 holdings and what level of risk you are taking."

She's not overly concerned if the fund fee is higher (within reason) providing it is giving you a much higher rate of return than a lower-cost fund.

"What you want to know is whether this manager is outperforming the benchmark consistently?"

Nevertheless, fund members need to keep an eye on fees.

"There is always going to be two sets of fees. There's the admin fee that you are paying the super fund to provide the platform, send you the statements and fulfil the trustee and tax obligations. The second, depending on what investments you've chosen, will be an investment management fee. That's the fee that goes to the fund manager."

She says you may be happy to keep things simple and be in a super fund that has only five investment options, whereas other people may want lots of choice.

"They want to be involved in choosing the investments themselves, or with their financial adviser, choosing direct shares or exchange traded funds or managed funds. Obviously, the more flexible the fund, the more likely you are to pay a higher fee because it's a more complicated platform for the provider to run."

Bergel-Grant says people who take an interest in their super know what insurance they've got and how their money is invested, and as a result, are far more likely to be in a better position when they get ready for retirement.

"It isn't something you can get serious about in your 50s. If you invest badly through your 20s, 30s and 40s, and only start thinking about it 10 years out from retirement, you are far less likely to achieve your retirement goals and it's too late to make significant changes.

"I would like to see people look at their super statement, jump on the government's SmartMoney website, go to the retirement calculator and use their current super balance to work out whether they will have enough to retire on."

For many people, super will become their biggest asset outside their family home.

"You've got to be serious about this from the start."

Get stories like this in our newsletters.