The real reason you can't be bothered consolidating your super funds

By David Thornton

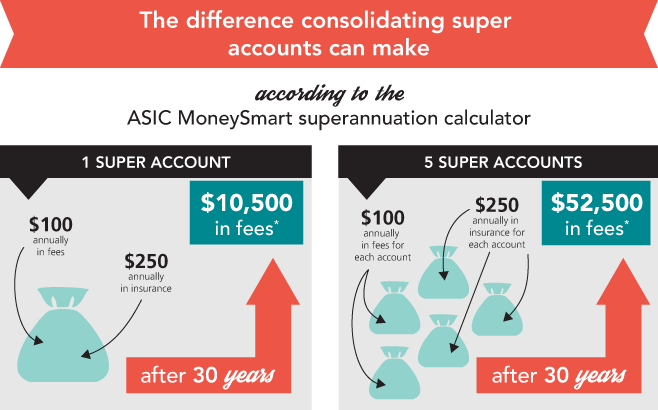

Consolidating your superannuation takes a handful of clicks on the MyGov website. And yet many - including yours truly - put it off, pouring money down the drain through excess fees.

Much of this has to do with basic human nature.

"It's a little like fight or flight," says Suncorp behavioural economist Phil Slade.

"When people are anxious about their future, some people attack the problem, constantly monitoring the situation to search for potential threats and that makes them feel safe. Others take a more 'flight' approach, which usually looks like running away from problems or preferring not to know they exist," says Slade.

People also tend to avoid complexity and change.

Change is painful and avoiding things that are painful is how our survival instinct has kept us alive. This is why we tend to just maintain the status quo, Slade adds.

This is closely related to the mental disconnection young people have with retirement.

"Superannuation was designed to provide for our retirement but that message is sadly a turn-off for younger Australians because retirement is both a long way off and doesn't feel like a relevant word to many," says Tristan Scifo at Purpose Advisory.

Scifo says super's unique investment structure combined with low financial literacy is another reason people don't consolidate their funds.

"Because super is paid by the employer, over and above our salary, many people don't even realise it's there," he says.

When people don't feel they have any skin in the game, they don't value their super. The only place they would regularly see their super growing is on their payslip.

"But many people don't look at payslips and even more people don't know how to read them," says Scifo.

There are still valid reasons for holding multiple superannuation accounts - losing the insurance benefits unique to some funds is one example.

However in most cases consolidation is a no-brainer, and not just for financial reasons.

Source: Association of Super Funds of Australia (ASFA).

"The financial benefits of getting your super into a single, low cost fund with an investment mix that matches your preferences, are more than reason enough to spend a few hours getting it all sorted," says Scifo.

"[But] it's about more than the act of 'rolling their super into one bucket'. It's what young people learn on the way and it's the fact that they brought order to an area of chaos in their mind."

On a broader level, society needs to get over the social taboo that keeps people from discussing personal finance.

"Talking about your long term financial health with family and friends creates a social expectation effect, where you start to link some part of 'who you are' with your financial literacy," says Slade.

"This also has the benefit of group learning as we become smarter when we draw upon the collective genius and learn from others' mistakes."

Get stories like this in our newsletters.