Bushfire recovery demands support long after cameras leave town

By David Thornton

It's hard to fathom - walking into your local banking branch accompanied by the family dog, having lost everything to bushfires bar the clothes on your back. This was the grim reality faced by one Bendigo Bank customer, and echoes the experiences of others.

Stories like this underscore the front-line role banks play in helping individuals, families and businesses get back on their feet. The big four and a host of smaller lenders, including ING, Bendigo and Adelaide Bank, Rabobank, Bank of Queensland and Suncorp, have provided relief packages. Affected customers can get their fees waived, repayments deferred and loans restructured.

While immediate relief is essential, recovery will require sustained, ongoing support long after the news trucks have left town.

"We need to be looking at that time when the economic recovery has yet to catch up to the physical rebuild," says Alexandra Gartmann, executive rural bank, partnerships, marketing and corporate affairs at Bendigo and Adelaide Bank.

Gartmann says economic conditions in a fire-affected community two to three years after a disaster are as bad or worse than those in the immediate aftermath.

In the interim, communities benefit from the sugar high of a false economy driven by private and public spending on the physical rebuild of homes, businesses and infrastructure.

Needs will evolve as government support flows, appeal money flows, and insurance is paid out.

After this has happened, the economics may still be dire, so it's not enough to say, "we did our bit in the first 12 months".

"It's about having locally led recovery arrangements, on top of and alongside how we will be supporting individual customers," says Gartmann.

The long-term impact of bushfire is more than just razed buildings. Recent studies have found that school children in bushfire-affected areas are more likely to fall behind academically.

"We knew from our ongoing work in the Black Saturday communities that anecdotally the school performance of kids was suffering, but there was no data to back that up," says Professor Lisa Gibbs from the University of Melbourne's school of population and global health.

"But we now have the data and a clear message that we need to be on the front foot in providing interventions to support ongoing learning in the wake of disasters."

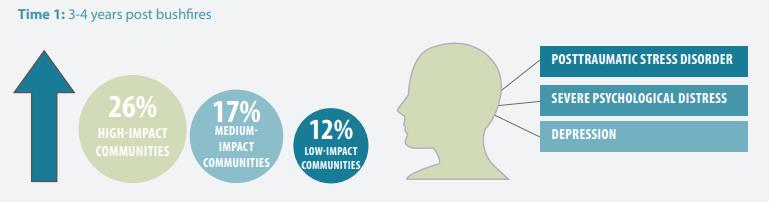

Mental health also takes a hit, with conditions such as posttraumatic stress disorder, severe psychological distress and depression rising by about 20% in high-impact communities.

If you've been affected by bushfire and require assistance:

ANZ

Contact ANZ's financial hardship team on 1800 149 549 or visit anz.com/hardship. To lodge an insurance claim, you can call 13 16 14 or visit anz.com/insuranceclaims.

NAB

Visit your nearest NAB branch, or contact the NAB Assist team on 1300 683 106.

CommBank

Visit your nearest CommBank branch, or phone the Special Assistance hotline 1300 720 814.

Westpac

Contact Westpac Assist on 1800 067 497 or call your local Bank Manager.

Bendigo and Adelaide Bank

Contact your local Branch Manager, Business Manager or the Mortgage Help Centre on 1300 652 126. To lodge an insurance claim, call 13 24 80.

Homestar

Contact Homestar on 1300 099 382 for more info on its financial care package.

Suncorp

Contact your relationship manager, or phone Suncorp on 13 11 55. To lodge an insurance claim, call 13 25 24 or visit www.suncorp.com.au.

Bank of Sydney

Contact your local Branch Manager, call 1300 266 546 or visit www.banksyd.com.au/financial-hardship.html.

Get stories like this in our newsletters.