How managed funds handle currency risk

- When managed funds invest overseas they need

foreign currency to make the transaction. - Mismanaging currency risk can cost managed funds and their investors a lot of money.

- Managed funds can lock in their currency conversion rates using a process known as currency hedging.

Managed funds that invest overseas have currency risks because when they buy their foreign assets or receive income from that asset they have to do these transactions using foreign currencies. Misjudging these currency transfers can turn a seemingly profitable investment into a loss.

YWhenever a managed fund buys an overseas asset it has to pay for it using foreign currency, and when it brings income from that investment back to Australia it has to convert that income into Australian currency.

The chance that an investor suffers a loss due to adverse movements in the currencies of the foreign country versus the Australian dollar is known as currency risk.

This example illustrates how this can play out: say a managed fund buys $10 million in equities that are listed on the New York Stock Exchange (NYSE). To do this it has to convert its Australian dollars (AUD) into US dollars (USD). When it made the conversion 1 USD was worth AUD 1.33 - that is, 1 AUD was worth US 75 cents - so the AUD 10 million actually bought it a USD 7.5 million parcel of

those equities.

Now say that the price of those foreign equities rose 20% over the next year from USD 7.5 million to USD 9 million. While this is a very good investment return, the real question for the managed fund is: how does this convert into AUD? To work this out we need to analyse the currency conversion change over the same timeframe.

In the 12-month period, if the AUD currency conversion rate against the USD went up from 75 cents to 85 cents, that is, each USD is now worth AUD 1.18 compared with 1.33 before, the USD 9 million equity placement would be worth AUD 10.62 million (USD 9 million x 1.18). This means that the 20% equity return on the NYSE after taking into account the 13% currency appreciation converts to an effective reduced return of 6.2%.

In this example the rising value of the AUD reduced the managed fund's investment return. But it works in reverse, too, because if the AUD had depreciated (that is, gone down) the investment return would have gone up because each USD would be worth more AUD than before. For example, if the AUD to USD conversion rate had gone down from 0.75 to 0.65, the 20% equity return on the NYSE would have converted to an effective return of 38% from an Australian dollar perspective.

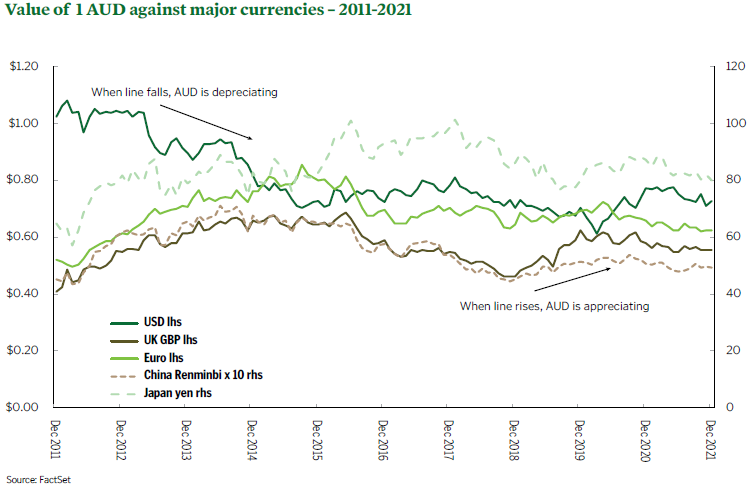

This means that when managed funds invest overseas and buy overseas assets they are also making judgments (or bets) regarding what they think will happen to the value of the AUD on world currency markets. While most of the time currency exchange rates are fairly stable and reasonably predictable, there are periods when exchange rates change rapidly and dramatically. When this happens it can have large effects on the capital value of a managed fund's investments.

Reduce currency risk by hedging

Currency risk can be reduced or eliminated by something called currency hedging, which is when a managed fund buys insurance against the currency changing value. When an investor hedges a currency they agree to a futures or derivatives options contract that locks in a particular currency conversion rate. While this sounds complex, in practical terms the investor is simply agreeing to buy back Australian dollars at a predetermined exchange rate. This way, if there is a change in the exchange rate it doesn't affect the investor.

Currency hedging costs money to set up and this cost reduces the net return of the investment.

Generally speaking, investments in international equities are purchased without currency hedging even though many international share managed funds have a currency hedged option. If the investor has a particular view on the valuation of the AUD they can choose between these options in order to reduce risk or increase their returns.

Investments in international fixed income are generally currency hedged. This is because the majority of fixed interest returns are expected to come from the coupon of the bond. Investors in fixed interest consider this a defensive asset and do not like capital values fluctuating due to movements in currency exchange rates.

Currency risk upsides and downsides

Currency risks are not always bad news. When the AUD appreciates (goes up in value) it lowers the price of overseas assets (in AUD terms). But this rising AUD reduces the AUD value of any income these overseas assets generate. If the AUD depreciates (goes down in value) the price of new overseas assets goes up in AUD terms, but the AUD value of any income these assets

generate goes up.

The more countries in which a fund invests, however, the more complex its currency risk.

| ESG investing |

| What is my investment risk profile? |