Ask Paul: My car is worth more than I paid - should I sell it?

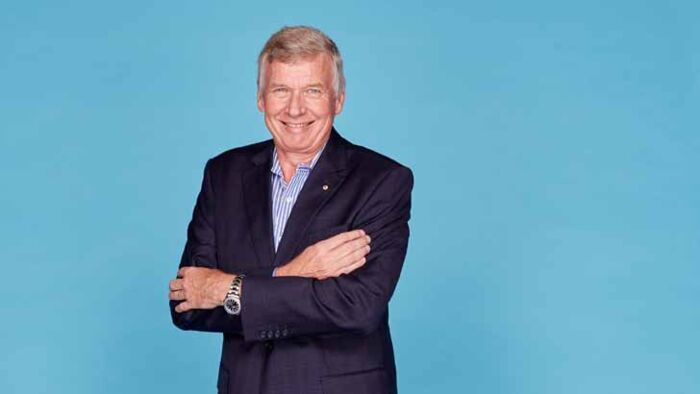

By Paul Clitheroe

Dear Paul,

First, thanks for giving practical advice based on years of experience and being so neutral about the options. My question is about used cars.

My 2018 Toyota Fortuner is worth more than the price I paid. Should I just sell it, given the rise in interest rates, or do you think it is better to own an asset at this time than converting it to cash.

I presume I would have to pay capital gains tax on it? My thinking is that it is only a short-term thing that used cars are so costly and I should make the best out of the situation while I can. - Rob

This is a fun question, but with a lot of potential upside for you. The fun bit comes from my very longstanding comment on cars: "buy the cheapest car your ego can live with."

I first used that on the Channel 9 TV show Money, which I hosted from about 1993 to 2002. My car-loving mates give me a fair bit of grief about this, but it really is true.

Cars are just awful to our money. They normally depreciate at a rapid rate, cost a fortune to run and insure, and are basically a financial disaster.

What is really unique, though - in fact, something I have never seen - is the fact that second-hand cars can be worth more than we paid for them.

I have a six-year-old, low-mileage, small 4WD. It is a diesel and burns little fuel, so that also helps its value. I am not selling it, because I do need a small, diesel, 4WD for my work and also for carting sailing gear, dogs and kids' stuff around.

So if I sold it, I would need to replace it. There is no money win there.

But if you sell and move to public transport, you've won the financial equivalent of a small lottery prize. You would have tax-free cash. There's no capital gains tax on the sale of a personal car. Then you would save, I guess, some $25,000 a year on depreciation, insurance, maintenance and fuel. You could make a lot of great money decisions with that!

If you need a car and are happy to go to something cheap but reliable, then the numbers may stack up, but you'll need to do those based on the car you would buy.

We have done this before. When interest rates on our mortgage hit 18.75% in January 1990, we sold quite a nice car for around $12,000 and bought an ancient Ford Falcon for $3000.

The $9000 difference really helped us not to lose our house. Mind you, the bloody thing leaked oil everywhere, but not losing our home was far more important.

Get stories like this in our newsletters.