Should you buy, hold or sell shares in Cobram olive oil?

By Simon Brown

Cobram Estates was established in 1998 by founders Rob McGavin and Paul Riordan.

It has come from humble beginnings to stand out as a trusted staple in the pantry of Australian families. Cobram's game is olive oil, and their focus is on the least processed form of olive oil, extra-virgin olive oil.

This form of oil largely retains its natural antioxidants and vitamins, which are often lost in processing, enabling the Cobram product to stand out for its quality and reliability.

The Cobram Estate's olive oil footprint is impressive, boasting 18,956 ha of freehold farmland, 3 million olive trees and ownership of Australia's top two home-grown olive oil brands, Cobram Estate and Red Island.

Cobram operates under a vertically integrated model, which sees the company grow, press, and market olive oil in both Australia and the United States.

Primary production in Australia is located at sites in northwest Victoria, while Cobram's olive groves are located in California, in the United States.

Cobram's business strategy

Cobram utilises a high-low pricing strategy to command strong market share, which means its product will sit slightly below competitor prices to absorb market share. The strategy bodes well, with Cobram capturing about 35% of the Australian retail market.

By aiming to keep pricing affordable, Cobram solidifies their position as a staple in the pantry of Australian families.

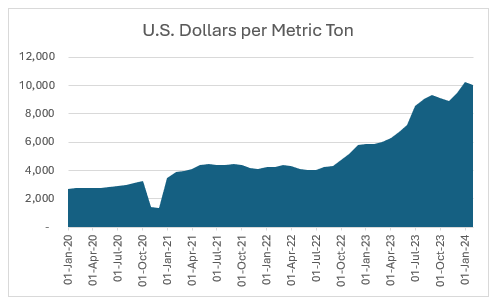

Olive oil pricing has rapidly appreciated over the past three years.

Poor weather in Europe, predominantly Spain which accounts for 46% of the global olive oil market, has constrained olive oil supply.

Consequently, pricing has continued to react, albeit domestic prices have only risen around half of those overseas.

Reports of overseas competitors going bankrupt are becoming more and more frequent as a lot of growers have recently endured two unprofitable seasons in a row.

Pricing has reached such a high level in Spain that olive oil has is now the most stolen supermarket item.

This mere fact speaks to how important olive oil has become to consumers as a part of their basket of goods.

The current fast-increasing pricing environment has a double benefit to Cobram.

Firstly, consumers are forced to frequently look for cheaper alternatives, like Cobram's dominant entry-level Red Island brand. Secondly, it continues to push through price increases while remaining the cheaper, higher-quality alternative.

As olive oil prices increase Cobram can take more market share because higher prices force consumers to compare and reconsider the value of using more expensive brands, particularly those overseas importers exposed to higher costs and not necessarily representing higher quality.

Cobram's last price increase was in October 2023 of 12%, and was well below that of the global commodity price, contributed to their strong 1H24 results.

Outlook

Thinking beyond 2024, Cobram presents a compelling growth investment case in Australia and its United States operations.

Firstly, domestic olive oil retail sales in Australia have been growing at 6.5% compound annual growth rate (CAGR) since 2015.

Cobram will capture a significant share of this growth moving forward as 35% of their groves are considered 'immature' and in the coming years will reach maturity with higher yields and more production.

The best part about the Australian operation is that it is fully funded with no more growth capex required.

The United States operation is an underappreciated piece of their growth story, in our view, we anticipate it will dwarf their Australian operations in time.

With much of their olive groves there yet to mature, Cobram is in a strong position to employ their high-low pricing model to claw market share from European brands in the US.

Shaw and Partners capture Cobram's growth prospects best in the below graph.

Cobram is well positioned for strong growth in the US, as it now has distribution in 17,361 stores across the US and was ranked the second best olive oil in the world by The New York Times.

Returns

Since listing on the ASX in August 2021 at $2.00 per share, the share price has declined 13% since that time.

This presents an opportunity, in our opinion, for a cheaper entry point to a unique set of growth assets supplying a consumer staple product with market demand growing at GDP plus. All the while owning a share of a business run by founder shareholders who have plenty of skin in the game.

Recommendation

We value Cobram at $2.35 via discounted cash flow model, representing 34% upside, with a forecast dividend yield of 2.3% fully franked in FY25.

We recommend a buy on Cobram Estates or as we call it 'oro liquido', which translates to liquid gold!

Get stories like this in our newsletters.