Demand for luxury goods drives up Cettire share price

By Jun Bei Liu

One of the best-performing stocks this reporting season so far is a small and less-known company called Cettire (CTT: AU).

Listed in 2020, the share price has gone up more than 10-fold underpinned by strong earnings growth and international market expansion.

Cettire is an online marketplace for luxury goods wholesalers and consumers.

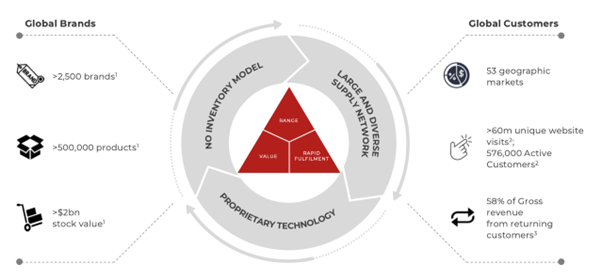

Established in 2017, the company has gained traction by offering a diverse range of luxury products sourced from more than 2500 brands, from Alexander McQueen to Zimmermann. Cettire's platform allows luxury wholesalers to clear excess inventory effectively and offer large discounts to end consumers.

Unlike traditional clearance platforms, Cettire operates on a sophisticated technology platform that it developed over many years.

The platform seamlessly integrates with suppliers' order and inventory systems, providing real-time visibility of more than $2 billion worth of stock.

Cettire's automated systems manage invoicing, order processing, and logistics coordination, ensuring streamlined operations and efficient fulfillment.

One other distinction that separates it from competitors such as Far Fetched is that Cettire does not carry any inventory. The platform is purely a marketplace, which makes it capital-lite and highly scalable.

Cettire sees robust growth trajectory

Cettire has been growing at a fast rate, and now has a product catalog exceeding 500,000 items and a presence in 53 geographic markets.

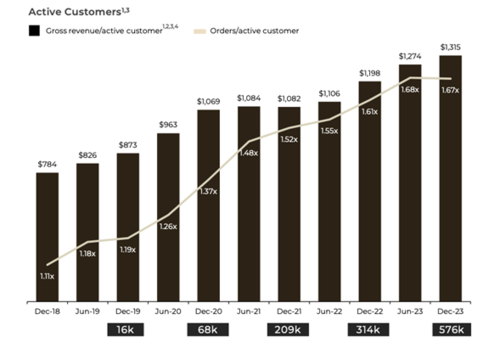

Cettire has more than 576,000 active users and the customer demographic primarily comprises high-income Millennials and Gen Z individuals, with a notable presence among expatriate Chinese consumers.

Its value proposition is clear to the consumer, which has seen rapid growth in its active user base and increased user spending.

New markets

Armed with strong success in multiple markets, the company is about to launch in mainland China, where there is significant demand for luxury goods.

The launch will initially be a partnership with one of the largest online platforms in China, JD.com.

Investment thesis

Cettire is a high-growth emerging platform retailer that operates in the attractive online luxury market where there is projected double-digit industry growth. It is also at the cusp of launching in multiple new markets including China where there will be exponential growth.

With strong historical performance across all of its operating markets, we have high confidence in its ability to capture market share.

What's more, Cettire runs a profitable and cash-generating growth business. Its negative working capital provides a long runway for its growth funding.

Despite recent strong share price performance, it trades on a forward earnings multiple of 35x FY25 with growth projection almost double that, which makes it very attractive on a price-to-growth ratio. It's a buy.

Get stories like this in our newsletters.