First Home Loan Deposit Scheme extended for 10,000 Aussies

By David Thornton

Ten thousand additional first home buyers will be able to access the First Home Loan Deposit Scheme (FHLDS), allowing them to get into their first home with a deposit as small as 5%.

The new places will be available from today until June 30 next year.

"Helping another 10,000 first home buyers to buy a new home through our First Home Loan Deposit Scheme will help to support all our tradies right through the supply chain including painters, builders, plumbers and electricians," says Treasurer Josh Frydenberg.

Unlike the first iteration of the scheme, the extended FHLDS is for loans on newly constructed properties only.

"At around 5% of GDP, our residential construction industry is vital to the economy and our recovery from the coronavirus crisis," says Frydenberg.

"Combined, the First Home Loan Deposit Scheme, HomeBuilder and the First Home Super Saver Scheme represent an unprecedented level of Federal Government assistance for home buyers and the construction industry alike," adds Housing Minister and Assistant Treasurer Michael Sukkar.

The government's focus on construction has been warmly received by the industry.

"Putting building and construction at the centre of the Budget recovery makes perfect sense. With every $1 spent generating $3, construction is recovery's accelerator," says Master Builders Australia CEO Denita Wawn.

"The Government's HomeBuilder scheme is proving to be one the most effective interventions in decades. Its First Home Loan Deposit Scheme helps tackle the crux of the issue for first home buyers which is the deposit gap and is supporting more people to access the single most effective method of building financial security. But more is needed."

The FHLDS guarantees to a participating mortgage lender up to 15% of the home deposit. Because most home loans require a 15% deposit, first home buyers can buy a property with a 5% deposit.

Launched on January 1, 2020, the scheme was taken up by almost 10,000 first home buyers, with one in eight first home buyers supported by the scheme between March and June 2020.

To qualify for the new places, you have to earn less than $125,000 as an individual or $200,000 as a couple.

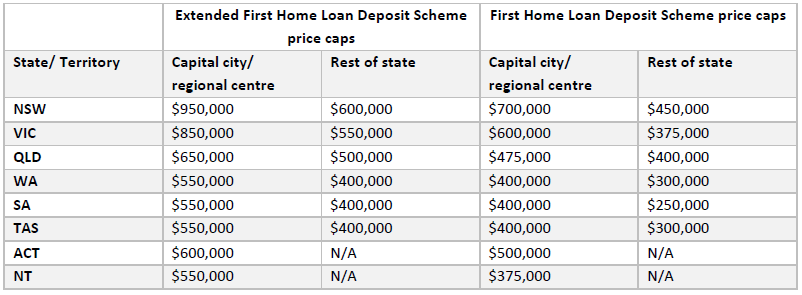

The extended FHLDS also has increased price caps. For instance, while version one restricted Sydneysiders to properties of $600,000 or less, the extended scheme sees that number lifted to $950,000.

Moreover, the extended scheme can be used together with First Home Super Saver Scheme and the $25,000 HomeBuilder grant.

The new scheme will be welcome relief for first home buyers, who still face high property values despite the COVID-19 pandemic. National property values net out to 0% change since January, according to data from CoreLogic.

Prices rose in Sydney (1.4%), Brisbane (1.5%) and Adelaide (2.2%), but this has been offset by falls in Melbourne (-2.9%) and Perth (-0.9).

This resilience could be due to the insulation provided by the government's range of social support measures, putting a floor under prices.

According to the CoreLogic Pain and Gain report for the June quarter, "mortgage repayment referrals have reduced the incidence of distressed sales, and kept stock level low, which may have supported dwelling prices. Low mortgage rates and sustained bank liquidity have also helped limit further price reductions".

Get stories like this in our newsletters.