Why Aussies aren't contributing more to super

By Nicola Field

The annual Love Your Super survey from Money reveals how Australians feel about our retirement nest egg, and shines a light on why we're not contributing more.

Australians come in all shapes, sizes, colours and creeds. The common thread is that the vast majority of us have superannuation savings.

The good news is that we're taking more of an interest in our super.

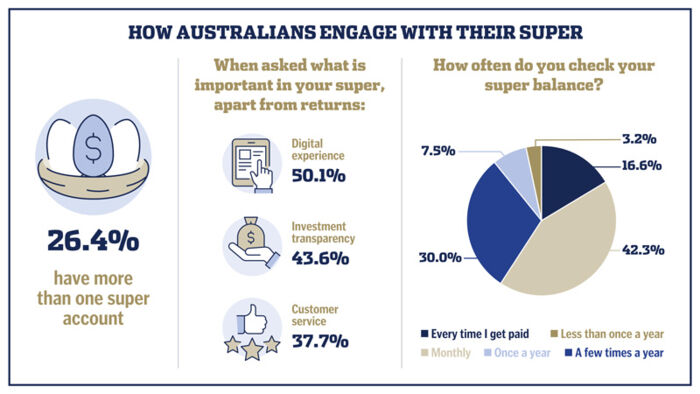

Close to one in two Australians check their super monthly, while 17% look in on their account every pay day.

On the downside, over one in four people admit to having multiple super funds - up from fewer than one in five last year.

This can see more of us doubling up on fund fees and insurance premiums, which will eat into our retirement savings.

One reason for the jump in multiple balances may be that no one fund meets our expectations.

While almost all Australians (91%) want their super to earn high returns, the rest of our wish list is varied, and includes:

- Easy-to-use apps and websites: 53%

- Transparency around investments: 50%

- Great customer service: 41%

- Ethical investing: 19%

How often Aussies change super funds

Nonetheless, one aspect of super stands out. Once we sign up to a fund, we rarely move on.

In the last five years, only one in three of us have changed or consolidated funds. More than one in five (22%) have never changed funds at all.

Part of this 'loyalty' could boil down to the fact that most Australians (56%) say they understand super but wish it was easier.

Our tendency to join a fund and stay indefinitely certainly isn't always a sign of satisfaction.

Fewer than 12% of us are happy with our super balance.

What's stopping us from contributing more to superannuation

One in three (30%) Australians point to the cost-of-living crunch, 10% say they are concerned about possible future changes to super, and others are simply in the dark about how to make contributions.

But more one than in four (29%) of us admits nothing is stopping us from contributing more to super.

Maybe 2024 could be the year we all aim to get our super growing.

Get stories like this in our newsletters.