The property types that still remain a risky investment

By Graham Cooke

The Australian housing industry is booming.

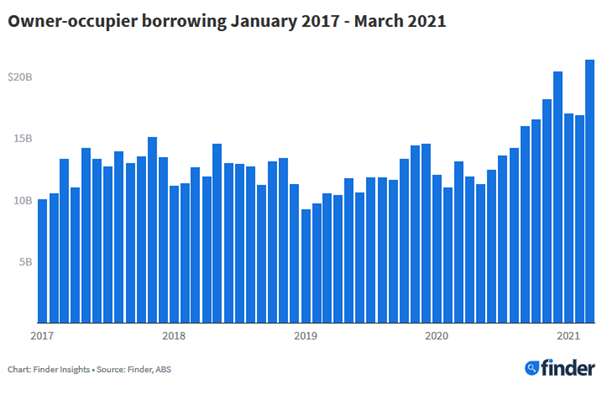

Having never exceeded $16 billion, the monthly amount of money borrowed to purchase owner-occupier property in Australia hit $16.5 billion in October 2020, then $18.2 billion in November.

It has remained at record levels since, with $21.4 billion - the highest amount on record - borrowed in March 2021.

This record borrowing has been driven by historically low home loan interest rates.

Borrowing costs are, according to the economists on Finder's RBA Cash Rate Panel, set to remain low for many months to come. This, along with measures introduced in the 2021 budget to encourage more first home buyers into the market, should ensure that property remains a good investment for the foreseeable future.

Despite all of this, future price growth for apartments looks far less certain than for houses.

Australia's international borders remain closed and will remain so until at least 2022.

This means there are far fewer international students in the country to rent out inner-city apartments. Additionally, many universities have switched to optional at-home learning for all students.

Even when borders fully re-open, the majority of economists (72%) on our panel think that student numbers will not return to pre-pandemic levels any time soon. This all adds up to an uncertain future for the apartment rental market.

Apartments tend to be slower to recover from economic downturns than houses, as can be illustrated by examining the performance of both property types in Ireland following the global financial crisis (GFC).

Data from Ireland's Central Statistics Office shows that apartment prices dropped by a staggering 63% following the GFC, with houses faring significantly better with a price drop of 53%. Interestingly, while the house price index has now recovered to roughly where it was before the GFC, the apartment price index has not.

Apartments in Ireland are still worth, on average, 26% less than they were in 2007.

In Australia, property data firm Core Logic measures the 12-month average sale price across all Australian cities. Over the last three months, the average price for houses in Sydney has grown by 2.1%. For apartments, there has been no growth at all - this figure sits at 0%.

A similar pattern plays out across the other capitals. The three-month growth of house prices in Melbourne and Brisbane sits at 2.9% and 2.3% respectively. Those figures for apartments are only 1.6% and 1.8%.

Perth is the only notable outlier, with a 2.5% growth in apartment prices compared to 2.0% for houses over the same period - but it is a bit of an anomaly in the Australian housing market.

In March, we asked economists if they thought apartments were a risky investment across five capital cities. In all cases, the majority of economists said they were. The highest results for apartment risk went to Melbourne (where 68% of experts said apartments were risky), Sydney (63%) and Brisbane (63%).

However, it may be the case that some apartments are riskier than others.

In Ireland, it was the apartments and new housing estates built furthest from the city and existing transport networks that felt the most brutal impact of the housing crash. In Australia, the same is likely to be true. Location is always an important consideration when it comes to property and it may be more important than ever for apartment buyers in the current climate.

If you're looking to buy a property as a long-term place to live, apartments right now are offering excellent value compared to the traditional housing market.

Either way, if you are hoping to hop onto the property ladder in our current low-interest environment, bear in mind that your interest rate could still go up even if the cash rate doesn't, so make sure to factor in an extra affordability buffer before jumping in.

Correction: An earlier version of this story said the monthly amount of money borrowed to purchase owner-occupier property in Australia hit $16.5 billion in October 2021. This has been corrected to October 2020.

Get stories like this in our newsletters.