Why your SMSF needs at least $1 million to be viable

By Susan Hely

Let's face it. Running a self-managed superannuation fund (SMSF) cheaply isn't easy. The average SMSF member is facing mounting costs with total annual investment and administration costs rising from around $5300 in 2013 to around $7200 in 2016 according to the ATO.

How much you need to hold in your SMSF to make it viable is one of the hotly debated questions in the superannuation industry. If you have too little, it is ridiculously expensive to run a SMSF and the costs drain any investment returns. You would be better off in a low-fee, high-performing industry super fund.

For many years investors were told that you could start up an SMSF with $200,000 as long as you were contributing heavily to it. Some experts recommended more like $300,000 or $400,000.

But according to the Productivity Commission's final report in the efficiency and competitiveness of superannuation funds, it pays to have more than $1 million in your SMSF. It is only when you reach $1 million, the Commission points out, that the costs become comparable with APRA-regulated funds.

What happens if you have less than $500,000 in assets in your SMSF?

"Costs for SMSFs under $500,000 in size are particularly high, on average, and significantly more so than for APRA-regulated funds," explains the Commission. It found that about 42% of all SMSFs (some 200,000 in 2016, with an estimated 380,000 members) have been under $500,000 in size for at least two years, and appear to persist with high average cost ratios and low average returns.

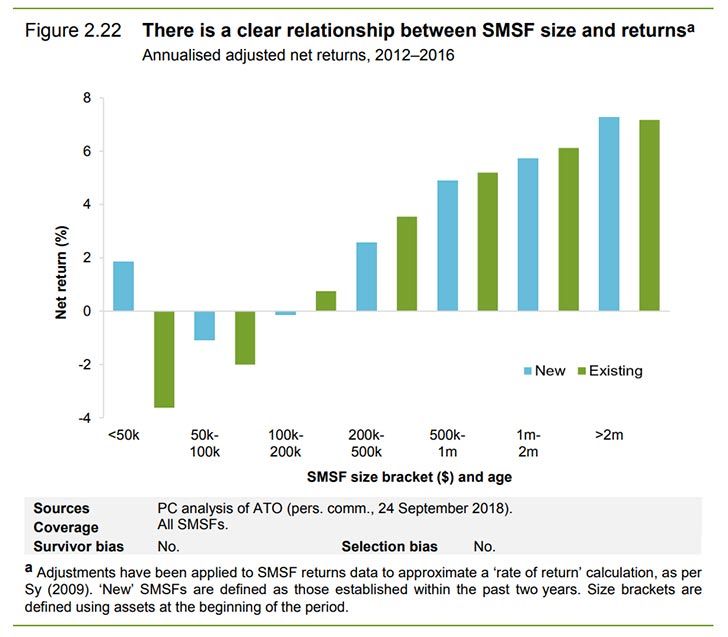

"Larger SMSFs have consistently delivered higher net returns over the five years to 2016, compared with smaller SMSFs," says the Commission.

"Over the same period, all but the largest SMSFs appear to have earned lower net returns than APRA-regulated funds, on average which returned 7.3% a year, compared with 6.0% for SMSFs. Expense ratios are the main driver of differences across SMSFs of different size brackets."

It found SMSF funds under $100,000 lost money over the four years from 2012-2016 while those SMSFs with $200,000 to $500,000 returned under 4%pa and those under $1 million earned around 5%. It compared the returns of new and established SMSFs over the four years with new SMSFs returning less because of the establishment costs that eat into returns.

However, this does not mean that all members in smaller SMSFs will be receiving poor returns, points out the Commission. It says some are earning high net returns or have tax advantages that are not fully reflected in the net returns data.

Some may also have been set up as part of broader strategies to manage members' financial risks, with regard to their assets outside of superannuation.

New SMSFs with very low balances (under $100,000) are falling according to the Commission from 35% new SMSFs in 2010 to 23% in 2016.

Get stories like this in our newsletters.