How did your super fund perform in 2016?

By Susan Hely

Australia's super funds are doing well.

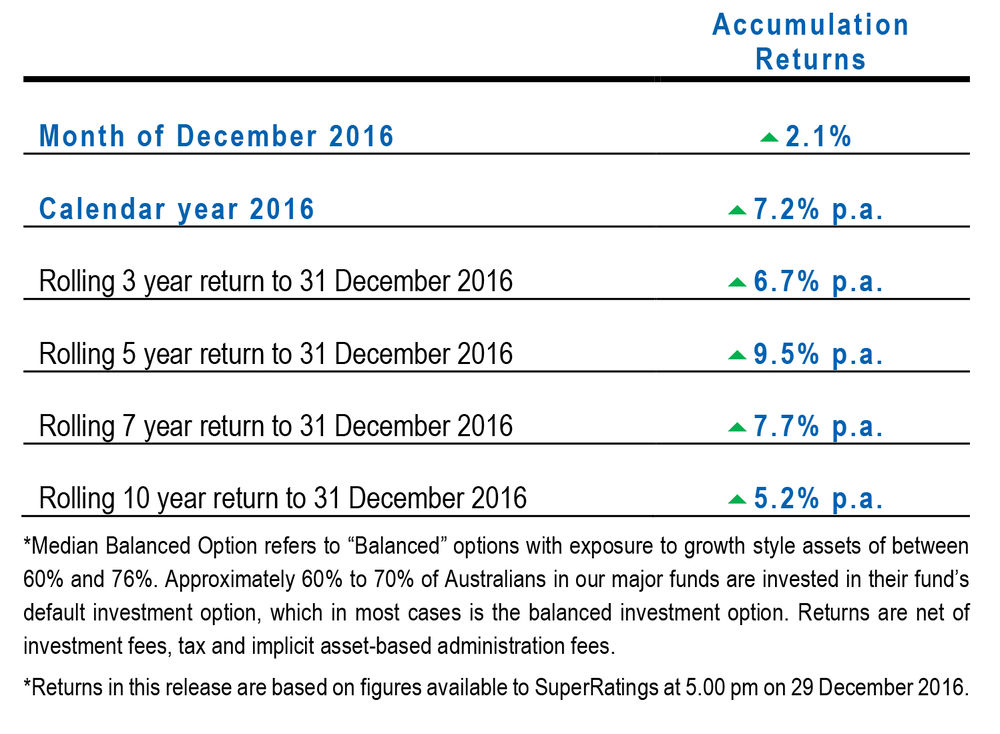

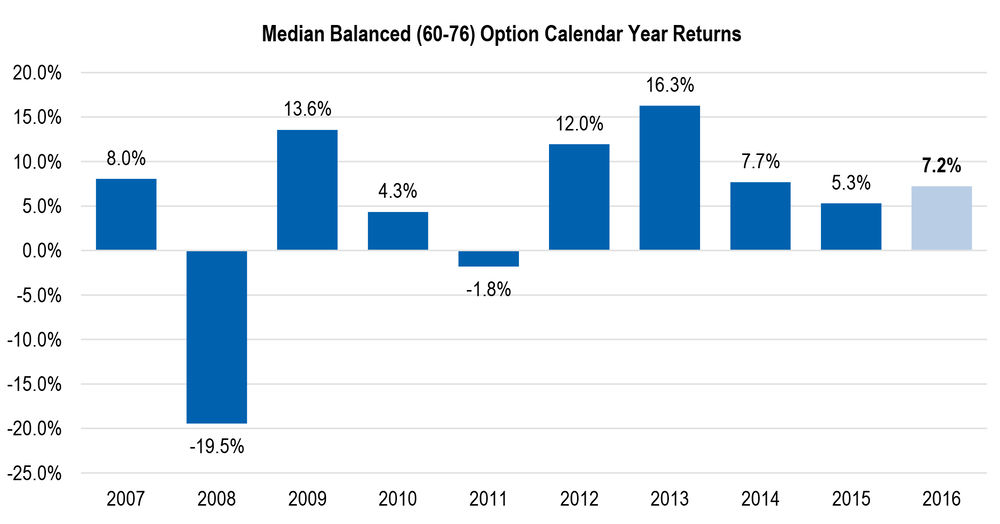

Members with employer superannuation have plenty of reasons to be happy about its performance. The median balanced fund finished 7.2% higher in calendar 2016.

The year got off to a rocky start with weak sharemarkets and lots of knee-jerk reactions to political events but in the past few months super funds have gone from strength to strength.

"If I had to sum up 2016, I would say it has been a year of extremes," says Jeff Bresnahan, chairman of SuperRatings.

"Super funds struggled at the start of the year, with many posting significant losses, but recovered as markets stabilised. Of course, we then had Brexit and the corresponding rebound, a bearish October ahead of the US election, and then a big lift to end the year, led by equities.

"While volatility may have induced a few nosebleeds, funds have generally had a strong, positive year, ending the calendar year above their long-term objectives."

The strong performance has boosted average returns to 7.7%pa over the past seven years, well outstripping inflation.

Bresnahan says funds performed above the 10-year average (5.2%pa) in 2016, showing the remarkable resilience of the superannuation system in what has proved to be a highly challenging and eventful environment.

He says a 2.1% rally in December indicated a noticeable shift in confidence and a change in market dynamics that will present new opportunities and challenges. Funds have delivered five consecutive years of positive returns.

Challenges that super funds faced included new historical lows for bond yields mid-year before they rose at an unprecedented rate in the final two months.

Commodities have been on a wild ride with markets battling a global oversupply of crude oil, while metals, including copper, have been running hot.

Energy commodities had remarkable gains, with the spot price of premium coking coal reaching a five-year high.

Get stories like this in our newsletters.