Choosing the best income stream for your retirement

When you retire you need to ensure you will get regular income. One way to do this is by choosing the right retirement income stream product. But what are they and how do you choose between them?

- Retirement income stream products are special financial products designed to pay retirees a regular income. Some have facilities to help manage your investments.

- When you retire you should consult with Centrelink, your super fund and a financial adviser.

- Different types of retirement income steam products are designed with different features. This can make choosing between them complex.

- After you've retired you won't pay annual income tax on earnings on at least the first $1.6 million and potentially up to $1.7 million of your superannuation savings. But earnings from the rest are taxed at 15%.

You've worked hard for years and saved up a sizeable nest egg and now you want to retire.

This simple decision, however, puts you right into the thick of having to make up your mind about how to structure your retirement income so you can maximise your Centrelink entitlements while also minimising your tax liabilities and ensuring that your money lasts as long as possible.

The type of financial products you use to structure your retirement income this way are known as a retirement income streams. These are products specially designed to pay you regular income, with some products also enabling you to manage your investments. These features make these products more complex than normal pre-retirement superannuation funds.

To make this decision process as smooth as it can be, when you retire or are approaching retirement, you should:

1. Contact Centrelink and speak to one of its financial information services officers

These specialists are not financial advisers but they will explain to you what your Centrelink entitlements are, how the assets and income tests work, what retirement income stream options you might have and how you might wish to structure things to maximise your entitlements regarding the age pension, healthcare and other ancillary benefits.

2. Talk to your superannuation fund

It probably already has a range of specially designed retirement income stream products, and you should try to understand how they work and which ones might be suitable for you.

3. Arrange a meeting with your financial adviser, if you have one

Choosing the right retirement income stream product is complex. If you don't have your own independent adviser, make an appointment to speak to one associated with your superannuation fund.

As you work through these steps you will start to understand the interlocking taxation, superannuation, investment, social security, psychological and personal issues that must be resolved before you can confidently choose your retirement income stream product.

| UNDERSTANDING THE TRANSFER BALANCE CAP

On July 1, 2017, the government introduced the concept of the transfer balance cap (TBC). which is the maximum amount you can transfer from your regular superannuation account, which is taxed at a nominal rate of 15%, into a retirement account, which is tax-free. Any residual is left in your regular superannuation account, meaning its earnings are taxed at the standard 15% rate. For 2022-23, the general cap is $1.7 million. This cap will apply to you if you have not yet commenced a retirement income stream. However, if you commenced a retirement income stream prior to July 1, 2021, then your personal cap will be set between $1.6 million and $1.7 million. You should consult a financial adviser to assist you with calculating the maximum amount of your tax-free retirement savings. |

What are your income needs?

ASFA estimates, based on its regular Retirement Standard surveys of retirees, that for a "comfortable" retirement lifestyle you will need $66,725pa if you are in a couple relationship or $47,383pa if you are a single person. For a "modest" retirement lifestyle, ASFA says you will need $43,250pa and $30,063pa respectively.

The amount of income you need each year will vary depending on your lifestyle expectations, expenses, where you live, your family situation, your life expectancy and health. But regardless of whether you think you need to prepare for a comfortable or modest standard of living in retirement, a good way to think about your retirement is to separate it into at least two core elements:

- Basic necessary income to meet daily expenses, for example, housing, food, utilities, clothes.

- Discretionary income to cover irregular expenses, for example, holidays, entertainment, healthcare.

You need a greater level of certainty to meet your daily income needs, meaning it should be regular and preferably stable income. Discretionary income, on the other hand, enables you to maintain your desired lifestyle and meet unexpected expenses. This income can be generated from your regular income source or through withdrawals from your retirement income account, that is, by accessing your capital.

Once your income needs are met, you should put aside some cash as a reserve. Any money that is left over can be invested in growth assets to build capital for future needs or to help provide a growing income stream to increase your discretionary income lifestyle component.

Another issue to be aware of is that when you retire you may become risk-averse, that is, more fearful of investment risks than you were before you retired. This is because you may believe you won't have the time or opportunity to replace any capital losses if the market suffers a downturn. But take note, when most people retire, they should be planning for a 20-year-plus timeframe.

For their savings to last over this period, they need some growth assets in their portfolio to at least deal with inflation. It is also important to consider that your total income needs may not reduce as you age, even though the components of what income you need might.

| HOW MANY AUSTRALIANS RELY ON THE AGE PENSION?

Two-thirds of older Australians rely on the government age pension or a related allowance as their main source of personal income in retirement. |

Handling your longevity risk

Australia has the third highest life expectancy of any country in the world and it is not unreasonable for retirees to expect to live beyond 85 years of age. If you are healthy, highly educated or have been earning a reasonable income throughout your working life, chances are you will live longer still. This has a big impact on your retirement income planning.

The age pension payment that retirees receive will also most likely be less than what many people need to live on, at least according to ASFA. As a result, most retirees can't afford for their private superannuation investments to run out. If this happens, it could severely affect their standard of living in their older years.

Adding even more complexity, the age at which the age pension can be accessed is also increasing just as the asset test thresholds are decreasing - so you may need more savings to be self-sufficient than you planned,

particularly in the earlier years of your retirement.

Illustrating this, on July 1, 2021, it increased to 66 years and six months if you were born from July 1, 1955, to December 31, 1956, inclusive. This age threshold is gradually increasing and by July 1, 2023, it will be 67 years if you were born on or after January 1, 1957.

Social security and your retirement

Social security benefits, being the age pension and other entitlements, are available to retirees to top up their private income, provided they satisfy the eligibility criteria. This system aims to ensure that everyone is able to at least purchase the basic necessities of life. Veterans receive their payments through the Department of Veterans' Affairs.

These payments and their amount are based on your age, relationship status, and assets and income levels.

The maximum age pension is indexed each six months in March and September. This indexation is generally linked to the consumer price index (CPI). The age pension for a single person is guaranteed to remain at least equal to 27.7% of the male total average weekly earnings (MTAWE). For couples it is guaranteed to be at least equal 67%.

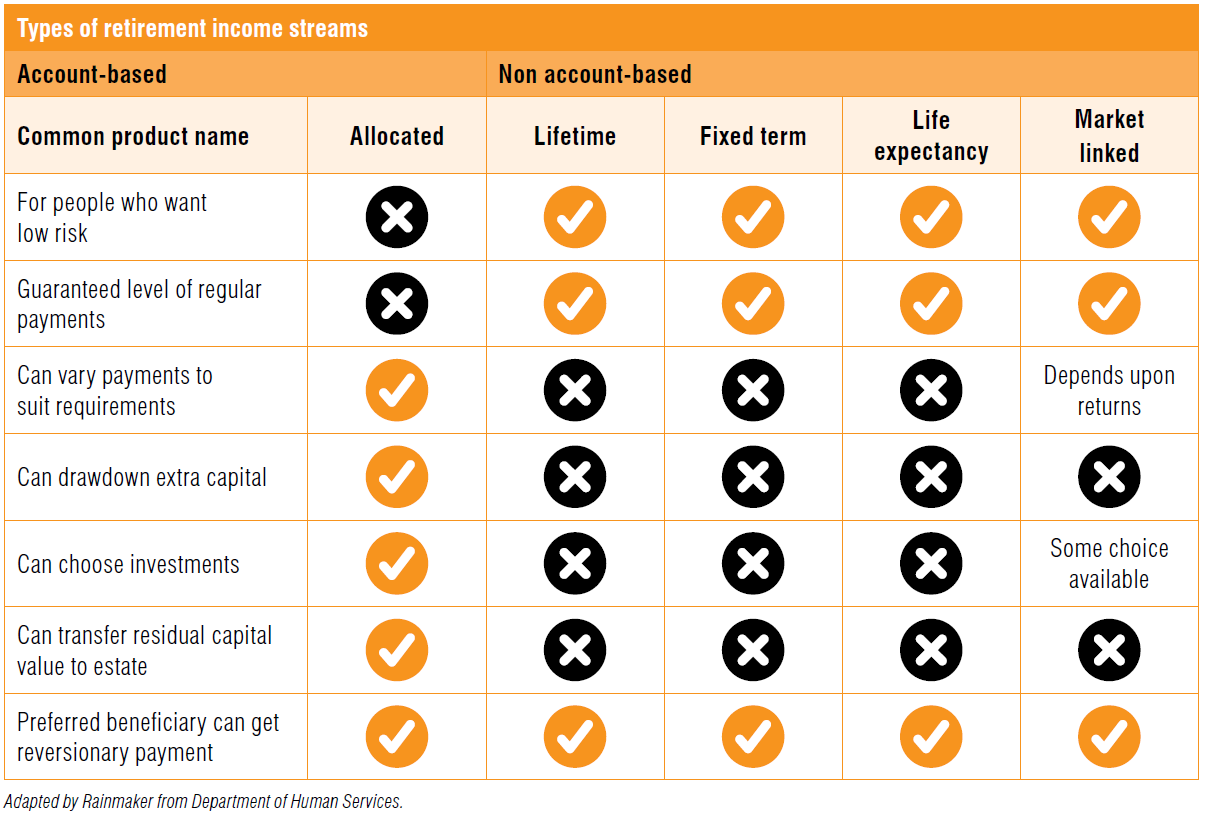

| Account vs non-account-based income streams

Account-based income streams place the individual in charge of their retirement account in much the same way that most individuals are in charge of their superannuation accumulation account during their working lives. Account-based income streams are the most popular type of income stream for Australians who convert their accumulated superannuation into an income stream. Reflecting this, account-based income streams can only be purchased with superannuation money. Non-account-based income streams involve contracting with either a superannuation fund or a life insurance company to provide an income stream. They are generally for a fixed term or your lifetime:

You don't have to choose one or the other because they can work together. Non-account-based income streams may be used to provide your basic income needs (that is, to reduce uncertainty) and you can combine this with an account-based pension for your discretionary income needs or to produce higher potential returns to help manage inflation risk. Account-based pensions are, however, used by most retirees to fund all or most of their income needs because they provide greater flexibility in both timing and amounts that can be withdrawn. But there's a new breed of account-based pension emerging that guarantee to pay a certain amount of income for life, even after the account balance reduces to nil. These are often generically referred to as longevity income streams or deferred income streams, but they can operate under various other marketing names. The table below summarises the features generally offered by the different types of income stream types. It will help you decide which type is best for you.

Account-based minimum drawdownsIf you have an account-based retirement income stream, you are required to take a minimum payment from it each year. This is because it's a retirement product, and the government wants to encourage you to spend the money on yourself rather than leave it all in your estate. Using the money in your account-based pension also makes you less reliant on the age pension, which is the whole reason why we have superannuation in the first place. The minimum payment is calculated using specified percentage factors based on your age. No maximum income limit applies unless it is a transition-to-retirement (TTR) income stream, where the maximum is 10% of the account balance at the start of each financial year. The minimum drawdown rates have been reduced by the government (for 2020-21, 2021-22 and 2022-23) in response to the Covid-19 pandemic.

|

|||||||||||||||||||||||||||

| A special type of income stream that you can design yourself or in a private group is known as group self-annuitisation (GSA). In these income streams, you contribute funds into a highly defined pool of financial assets with regular payments being made from the pool to surviving members.

Pooling mortality risk in these GSAs delivers higher income in retirement than an account-based pension that is drawn down at the minimum rate, while also providing significantly more protection against longevity risk. GSAs allow members to share, but not completely eliminate, longevity risk and do not require capital to back guarantees. GSA income is however not guaranteed like annuity income, but it's expected to be higher due to the absence of capital requirements to back these guarantees. |

|||

Fees

The types of fees you are likely to pay your income stream provider will vary depending on the provider and how many and what types of features it has. As with super during the accumulation phase, the main types of fees are ongoing management fees, member fees and investment fees.

But because you now receive regular income, there will often be a regular extra administration fee associated with your provider having to make these payments. According to Rainmaker Information's latest 2022 retirement income stream fee survey, these products cost on average 1.05%pa.

Other factors likely to increase your fees are that the more investment choices available in your income stream product the more expensive it can be. The investments you choose for your portfolio, especially in account-based pensions, and how often you wish to receive regular payments can also affect your fees. For example, you should expect to pay higher fees if you wish to receive 12 monthly payments rather than just one annual payment.

| TRANSITION TO RETIREMENT PENSION

If you've reached preservation age (that is, the age at which you can begin accessing your superannuation benefits) and are still working, a transition-to-retirement (TTR) pension may suit you. TTRs can be used in conjunction with increased concessional contributions to reduce your working hours while maintaining your income or to reduce your tax. Many super funds that offer account-based income streams also offer TTR pensions. An important feature of TTR pensions is that they do not count towards your lifetime transfer balance cap. Before signing up to a TTR you should get financial advice. |

| Our checklist to help you choose the right super fund |

| Your guide to self-managed super funds |