The Aussies most likely to complain about their tax return

By Nicola Field

Doing your own tax return? You're more likely to complain than those who get professional help.

Each year millions of Australians lodge their annual tax return. Three out of four of us rely on the help of a tax agent, but the remainder are happy to take a DIY approach.

You'd think that by completing their own tax return, the DIYers would be comfortable with what it contains.

But apparently not.

A new report from the Taxation Ombudsman shows that over half the objections received by the Australian Taxation Office (ATO) over the three financial years spanning 2019 to 2021 came from people who prepared their own tax returns.

Karen Payne, the Inspector-General of Taxation and Taxation Ombudsman (IGTO), says the report raises important questions, namely "Why are so many objections lodged by taxpayers against their own self-assessment?"

She asks, "Is this simply taxpayers requesting an amendment to their prior year returns because an objection is the only way to amend when they are out of time or is something else going on?"

It's an area the Taxation Ombudsman plans to look into.

What is clearer is that there may have been some confusion over COVID-related measures such as the early release of super scheme and JobKeeper payments, which the report lists as areas of dispute.

What if I want to complain?

If you're not happy with a Tax Office decision - including how much tax you owe, you have 60 days to take action from the date of receiving an assessment.

And there's a good chance your claim could be successful.

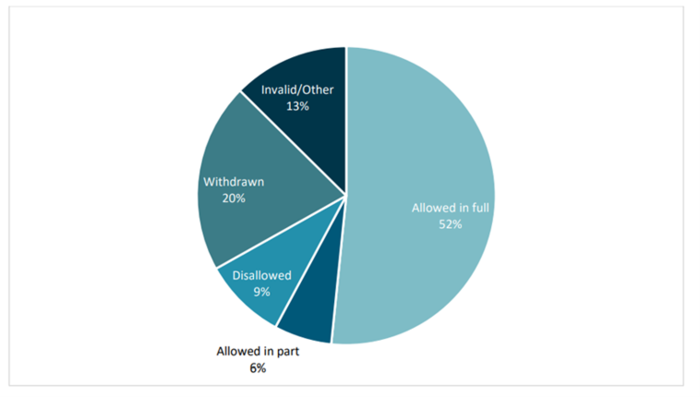

Over half the objections made by individuals for the 2021 financial year were allowed in full.

Outcomes of tax objections by individuals for 2021 financial year. Source: Source: Australian Taxation Office's Administration and Management of Objections Interim Report, October 2022

Maybe consider a tax agent

The Tax Ombudsman's report shows that around 29,877 objections were resolved for the 2021 financial year. It's not a bad result when you consider that over 11 million individuals, 4 million small businesses and a multitude of large companies and super funds all lodge tax returns.

But really, who needs the hassle of raising a complaint?

Australia's tax rules are complicated, and it can be a lot easier to hand your tax return over to a registered tax agent, especially if your tax affairs are complex.

The fee for preparing your tax return can usually be claimed as a deduction.

Time to get cracking

If you are doing your own tax return, it needs to be lodged with the ATO by October 31.

The ATO says it "generally" doesn't impose penalties in isolated cases of late lodgment, but late penalties of $222 or more can be issued. If you owe tax, you could also cop an interest fee of 7.07% on the money owed.

If you need help, ATO Assistant Commissioner Tim Loh says there are a number of options available.

"People with simple tax affairs can lodge through our free myTax service in under 30 minutes. Most of the information you need will already be there; just check it's correct, add any additional income, and claim deductions you're eligible for."

Free support measures are also available including the ATO's Tax Help program. It's run by trained volunteers and is available to taxpayers earning $60,000 or less who have simple affairs. Head to the ATO website for details - you need to create a myGov account and link it to the ATO to get started.

If you need more time to prepare your tax return, you can lodge with a registered tax agent though you need to speak to a tax professional and be on their books by October 31.

Get stories like this in our newsletters.