Big banks scramble to ride the digital banking wave

By David Thornton

Westpac's foray into digital banking stepped up a gear this week, with the announcement of a digital-only platform. The move is seen as an attempt to coax younger customers away from the new wave of neo banks.

"We're preparing for our digital future by investing in a new digital-only banking platform that will complement our existing banking businesses," says Westpac CEO Brian Hartzer.

"This will initially operate a 'bank-as-a-service' model and we intend to bring new digital products and services to market through fintech and institutional partners."

The move comes amid growing demand, here and abroad, for digital banking services that are easy, instant, and align to customers' broader lifestyle goals.

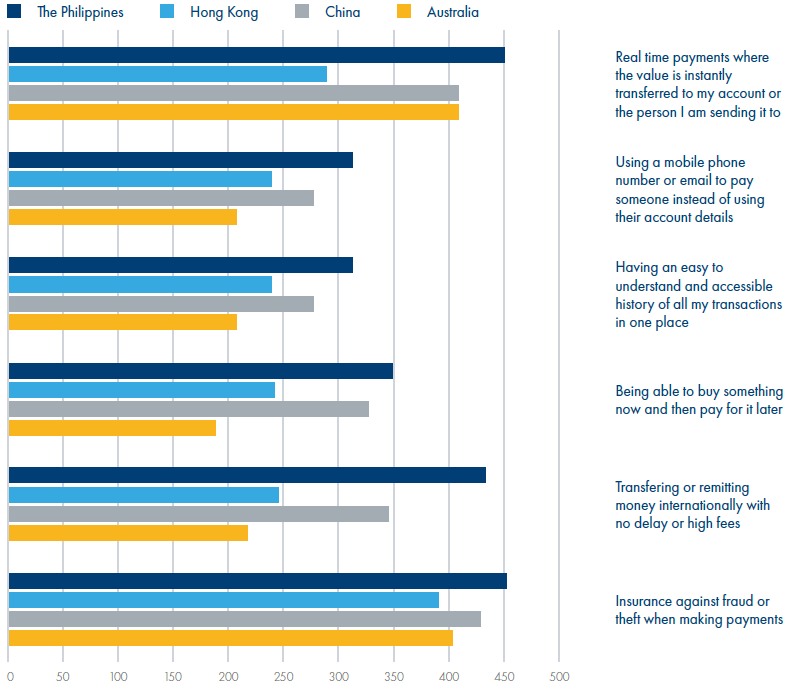

A new report by Tech Research Asia surveyed consumers in China, Hong Kong, The Philippines and Australia about what they want from a digital banking product. It found:

- More than 60% of participants use or want a service that "lets me pay my friends or family directly";

- More than 60% of those in Hong Kong and China would like to use a financial management tool to aid saving and spending;

- 40% of Australian respondents want to use a comparison site for choosing products or services.

Against this backdrop, Australian customers are increasingly turning to neo banks for their digital banking needs, in much the same way Airbnb has replaced real estate agents in the holiday rental market.

"Our customers express various frustrations but a lot of them are about banks being difficult to deal with and not 'getting' it; they are baffled as to why the apps and service can't be as slick, smooth, 100% digital as other services they use," says Xinja founder and CEO Eric Wilson.

"They are frightened of banking being too onerous, too complicated, taking too long, and missing out or not making the most out of their money."

Wisr CEO Anthony Nantes agrees.

"The traditional banking model of being a hub for all financial services is no longer profitable and the idea of a banking relationship that holds everything is dying. I think that's clear for everyone."

Westpac's push into digital is recognition that the days of traditional banking are numbered, he says. If banks don't change with the times, they'll be left behind.

"What we will see is the banks allowing big changes in their business models and that's exactly what Westpac has started to do with their new tech platform and alluded to fintech partnerships."

Get stories like this in our newsletters.