What you need to know before investing in property

Buying a home has always been the great Australian dream, but with soaring prices, rising rates, and shrinking supply is purchasing a home still the golden ticket Australians once believed it to be?

Financial independence has become the new dream, outranking homeownership according to 2023 research from McCrindle.

Lifestyle has surpassed stability, but brick-and-mortar investment can still play a big role in achieving the life of our dreams.

Investing in property with strong growth potential and attractive returns can give investors momentum to achieve wealth goals.

The secret: a data-led approach. Following the numbers, conducting extensive research, and partnering with the right people are vital. Wondering where to start?

Here are the trends you need to know about if you want to invest in property in 2024.

1. A recovering housing market

Stabilising interest rates and a boost to consumer confidence will see Australia's housing market begin to recover.

After a year of rising rates, many leading economists have moved their attention to rate cuts, which are anticipated as early as the the quarter of 2024.

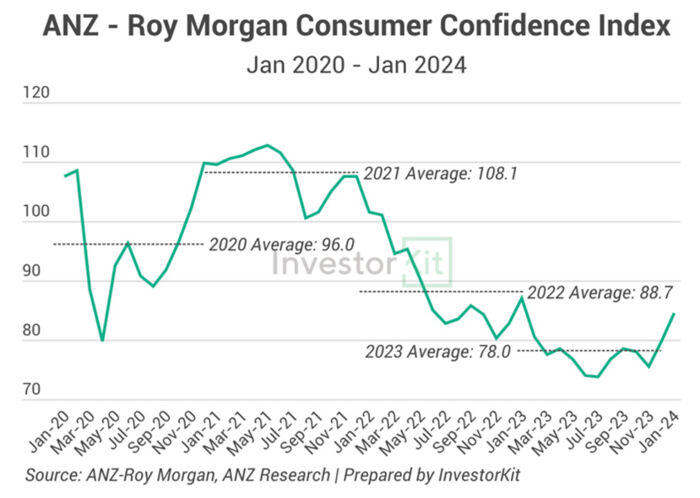

Australia's consumer confidence has already risen to an 11-month high entering 2024 and we believe this figure will continue to increase.

The upward trend in home loan commitments is a leading indicator of Australia's confidence recovery, with both the number of investment home loans and owner-occupier loans 15% higher than three months ago.

As inflation becomes under control and consumer confidence is regained, housing demand is expected to increase.

2. Affordability driving popularity

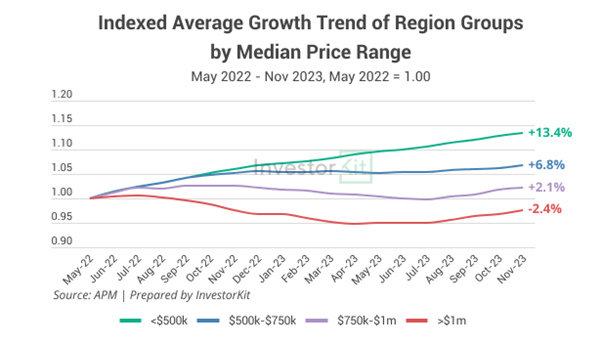

Buyers will continue to favour affordable locations with healthy rental yields. Since interest rates started rising, these markets have outperformed due to shrinking borrowing capacity.

With rates expected to remain high, buyers will continue to be heavily influenced by borrowing capacity and mortgage serviceability. As a result, affordable locations with proven performance will continue to attract both owner occupiers and investors.

3. Rental crisis continues to sting

The national average vacancy rate has been in steep decline, now reaching historic lows with no signs of improvement.

Among the capital cities, all but Darwin are seeing declining vacancy rates. Brisbane, Adelaide, and Perth's vacancy rates are at crisis levels, below 1%.

Rental pressures are being driven by a surge in overseas migrants; increased internal migration; declining household sizes; lack of social and affordable housing; insufficient new supply; and a decline in rental stock due to subdued investor activities.

All signs show the rental crisis is far from over and will continue well into 2024.

4. Supply shortage the main price driver

Australia's annual population growth has reached a 49-year high, but the nation is struggling with a severe housing shortage.

Over the past three years there has been a 30% decline in houses for sale and a quick recovery is not expected in 2024.

|

|

|

New supply is struggling to meet demand, with the total number of new housing approvals in the past year 17% lower than the previous five-year average.

This is leading to an expected dwelling shortage of more than 100,000 by 2027.

Construction challenges are further exacerbating issues.

The severe shortage in both established and incoming homes, combined with robust population growth, means supply will remain the primary driver of price.

5. Regional migration remains strong

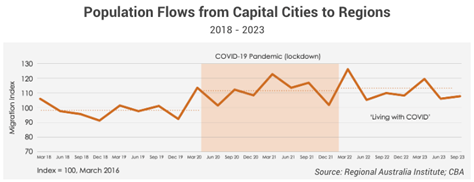

We will continue to see relocation from capital cities to the regions.

Regional migration is now almost 12% higher than pre-COVID levels.

Lower cost of living, better work/life balance, booming local economies, infrastructure improvements, and employment opportunities are among the main drivers of this migration.

Companies increasingly adopting hybrid work models are also encouraging city dwellers to consider regional markets.

Is now a good time to invest?

History shows us that property is a performer. In the last 20 years, Australia's property prices have tripled in value, increasing by a massive 186%.

This is despite a multitude of economic pressures, including the global financial crisis, a turbulent economy and rate environment, and COVID-19.

To put it simply, despite current market pressures, now is a great time to jump in.

The country's property market is healthy with solid demand and tight supply, and a great track record of value growth.

As an investor, compound growth is more significant when your asset base is bigger.

Top tips to start investing

While opportunity is abundant, it pays to take a careful, considered approach.

- Tune out the noise: Property dominates news headlines and conversation; it can be hard to tune out myth from fact. Have a clear investment goal, a solid plan of attack, and the right team to get you there - that may include friends and family or a professional, like a broker or buyer's agent.

- Do your research: While Australia experienced a nationwide boom in 2021-22, this is the exception not the rule. Australia has hundreds of submarkets that all have unique supply and demand patterns. Where and how you invest will depend on your individual goals and timeline. Doing extensive macro and market research and having a good understanding of the data is essential.

- Don't get hooked on a "good deal": There's no doubt price plays a big role in purchasing choices, especially in today's market. However, "good deals" could be masking issues, such as a cooling market, structural issues, or an unfavourable location with flood risks, high crime rates, etc. Do your research and remember, sometimes you get what you pay for.

Pick up a copy of the February 2024 issue of Money to find out our top 50 property and share buys, on sale from February 1.

Get stories like this in our newsletters.