A winning super fund

By Alex Dunnin

About the fund

My AutoSuper is the MySuper product available through the MTAA Super public offer industry fund that has been custom-built to work with Australia's motor trades and associated industries. It's a $10 billion full-service fund with 240,000 members.

What it offers

My AutoSuper is one of MTAA Super's eight investment choices, four of which are diversified choices while the other four are asset-class-specific choices.

Like all full-service funds, MTAA Super has superannuation and retirement products, life, TPD and income protection insurance and also provides financial advice, which for most members comes at no extra cost. It was one of the first industry funds in Australia to offer a specialist pension product that wasn't just a bolted-on pension option but a highly tailored, full-featured retirement product. My AutoSuper members pay fees of 1%.

MTAA Super is led by a nine-person board boasting three independent directors and, perhaps unexpectedly for a motor trades fund, three women. But more significant is the heavy commitment to transparency: it is one of the first super funds in Australia to have publicly available whistleblower and conflicts of interest policies on its website.

Investment performance

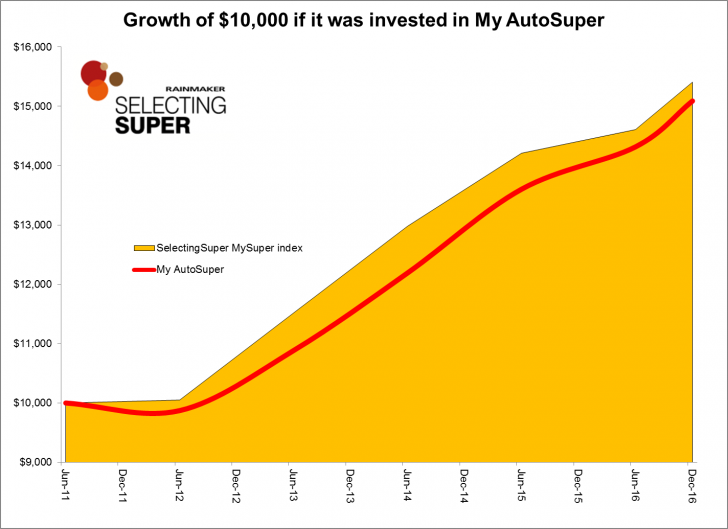

A member who invested $10,000 in My AutoSuper in 2011 would have accumulated $15,090 by December 2016, which is only $300 less than if they had invested in an average fund that matched the SelectingSuper MySuper default index.

This makes My AutoSuper a highly consistent MySuper product on par with a very competitive market. It achieved 7.8%pa over the past 51/2 years, compared with the SelectingSuper index's 8.2%pa.

Its three-year performance is even sharper, as in the past three financial years My AutoSuper beat the market index twice each time by a wide margin.

Rainmaker SelectingSuper's conclusion

With its consistent returns, innovative product design and low fees, MTAA Super, including its My AutoSuper option, earns its AAA SelectingSuper rating. MTAA Super is a past winner of the SelectingSuper Fund of the Year.

Key fund data

| Size | $10 billion | 5-year performance | 7.4%pa as at June 30, 2016, after fees | |

| SelectingSuper rating | AAA | Investment choices | 8 | |

| Fees | 1% in the MySuper option | Insurance choices | 39 |

Get stories like this in our newsletters.