How would the $123b Commonwealth Future Fund stack up as a super fund?

By Alex Dunnin

Critics of regular super funds sometimes point to the Future Fund as a guide for how trustees of other super funds should manage their long term investments.

So, if the Future Fund was a regular super fund how would it stack up?

About the Future Fund

The Future Fund is a special sovereign fund set up by the Commonwealth government in 2006 to help build up capital that in future will be available to offset the huge costs associated with paying out unfunded defined benefit superannuation liabilities to public servants.

It's currently valued at $123 billion which makes it the biggest single pool of investment capital Australia has ever accumulated.

Investment performance

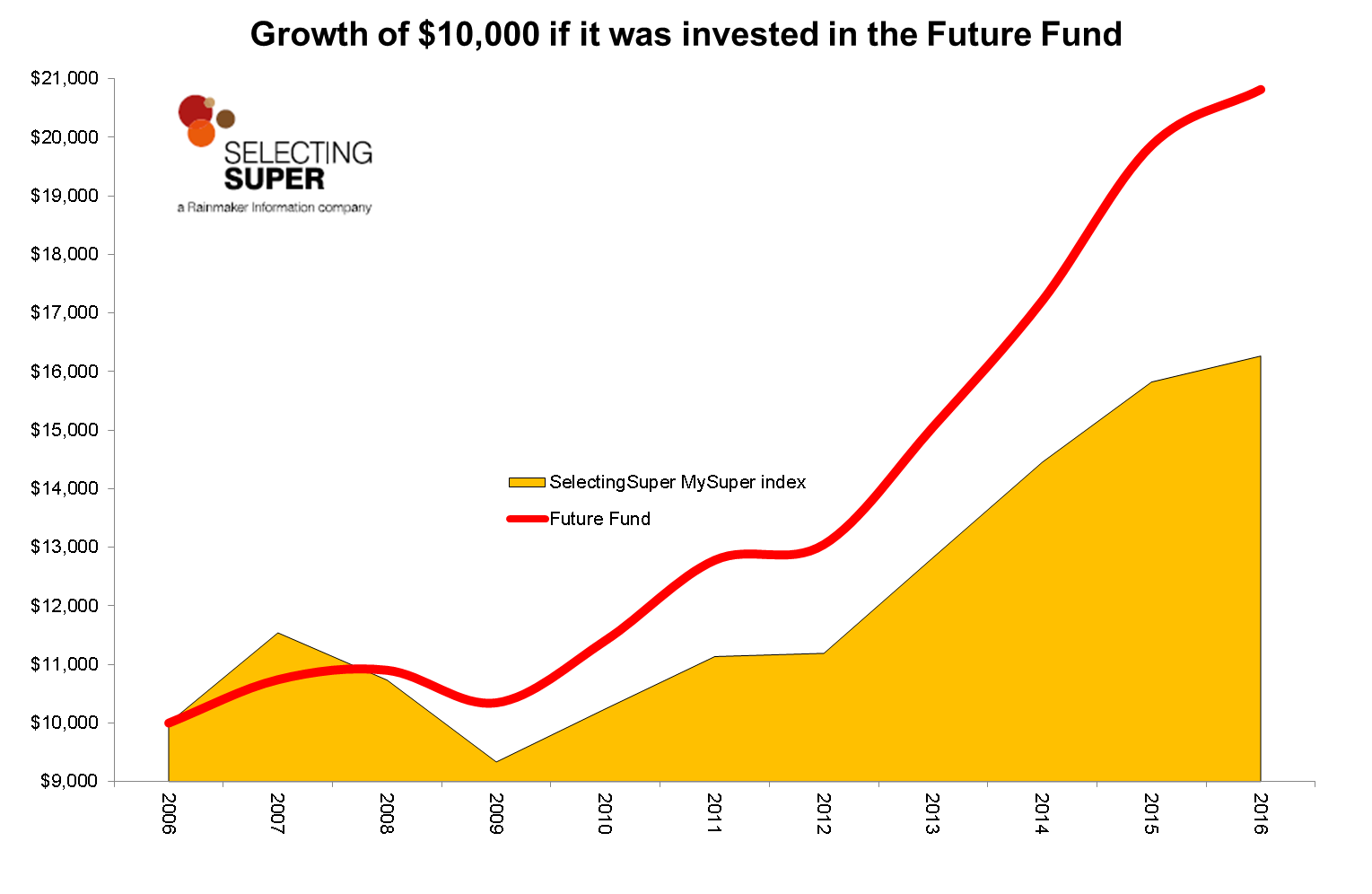

The Future Fund's single portfolio earned 4.8% in 2015-16 returns which would rank it equivalent to Australia's 14th best MySuper product.

Its 7.7% pa return over the past decade would rank it number one although it has the advantage of having no members and not having to pay tax in Australia which enables it to keep its operating costs to a wafer thin 0.21% - less than one third of even the lowest price regular super fund.

What it invests in

The Future Fund being a sovereign fund means it can invest over the very long term without having to worry about paying benefits until at least 2020.

As a result it holds only 29% of its assets in equities and 7% in property, preferring instead to hold a very high 31% weighting into alternative assets like infrastructure, private equity, commodities and hedge funds. But it holds a very high 22% weighting to cash.

These alternatives and cash weightings are nearly three times the level in most normal super funds.

Rainmaker SelectingSuper's conclusion

If the Future Fund was a super fund it would be among Australia's best which is why it's a good fund to benchmark your own superannuation investments against.

Key fund data

| Size | $123 billion | 5 year performance | 10.2% pa as at 30 June, 2016 after fees | |

| Fees | 0.2% | Investment choices | 1 |

Alex Dunnin is director of research at Rainmaker Information, publisher of SelectingSuper.

Get stories like this in our newsletters.