Aussies aren't spending enough in retirement and they regret it

By Patrick Clarke

Australia has one of the strongest superannuation schemes worldwide, according to Mercer.

A standout feature of our system is that people save well for retirement. However, the real purpose of superannuation is to provide income in retirement.

This aspect of our system is not working so well, as evidenced by the fact that retirees are leaving around 90% of the assessable assets they had at the original point of retirement when they pass away.

A well-known challenge that people face in retirement is how to address longevity risk, which is the concern of running out of money too soon. People manage this risk by being conservative in their spending and living more frugally than necessary.

Focusing on this alone heightens the chance of exacerbating a lesser-known risk, which we call "regret risk".

This is the risk that in later years, retirees will look back with regret and wish they had spent more in their earlier years of retirement when they were younger, more active and able to enjoy it.

When the lifelong message has been to accumulate, learning how to decumulate can be daunting at first.

Spending levels in retirement are not constant. Studies show that as we get older and our mobility levels decrease, so too does our spending.

A more nuanced approach to retirement income planning is then called for where spending is increased in the earlier years.

This allows retirees to tick off more bucket-list items while they're better able to physically enjoy them and live out the retirement they've always dreamed of.

Psychological shift

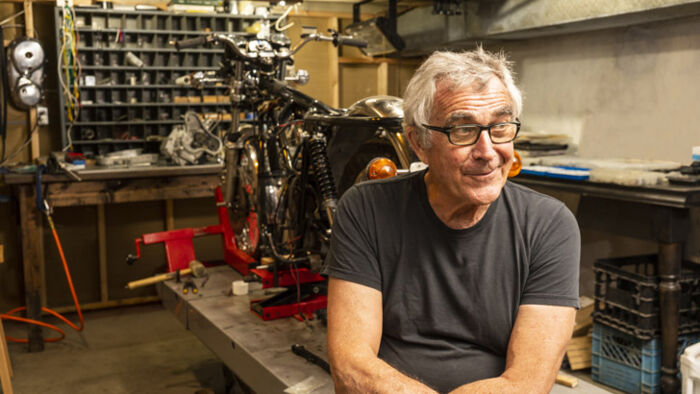

Retirement is a freeing prospect. For the first time, your time is your own; you can spend more time doing the things you enjoy, embarking on the travel adventures you've been dreaming about and making precious memories with loved ones.

However, it also comes with a loss of routine and stability that going to your familiar workplace each day used to provide. While retirement is an undoubtedly exciting prospect, there is a great deal of uncertainty as you head into this new, lesser-known stage of life.

It's not surprising that the Australian Super-Monash Retirement Confidence Index found that around a third of Australians aren't confident heading into retirement.

A refreshed approach to spending and saving is needed when shifting away from a regular, employer-generated income to living off superannuation and longer-term investments. A significant change in mindset is required.

Everyone's retirement will be different, because everyone's objectives, preferences and circumstances are different. Therefore, a tailored approach that suits each individual is required, where the emotional considerations of retirement are as important as the financial considerations.

Approaching income planning with confidence, not trepidation, is the key to unlocking the retirement you've been working towards. It's not a one-size-fits-all approach. A financial adviser can play a pivotal role in assessing changes in the market and understanding the best investment opportunities for your specific needs.

Don't try to go it alone

Say you need a hip replacement. You wouldn't ask your friends to operate, nor would you Google how to operate on yourself. You would consult a medical professional with the expertise, credentials and tools to give you back years of mobility.

This same mentality should be applied to retirement income planning. With the help of a professional financial adviser, Australians can stop living below their means and start spending the right amount in retirement.

Retirement rarely takes people by surprise.

You can - and should - optimise those precious years in the lead-up to retirement by developing a solid and robust plan. Planning and working closely with a financial adviser at least five years before retirement will help you to build confidence and approach those later years without concern for running out of money or living with regrets.

When it comes to optimising income in the earlier years of retirement, you may consider asking an adviser about lifetime annuities. There has been growing popularity of investment-linked lifetime annuities to supplement retirees' investment portfolios over the past two years or so - and with good reason.

They offer retirees long-term investments that consistently deliver returns throughout the course of their life, with the option of bringing forward income when it's needed most.

Get stories like this in our newsletters.