Shoppers blast Big W over hefty hike in lay-by fees

By Nicola Field

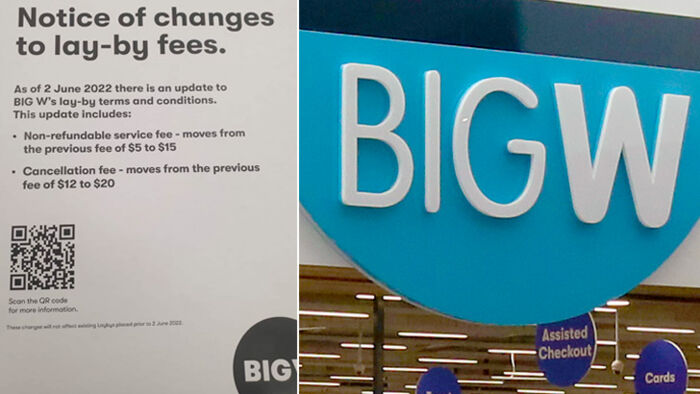

The discount retailer is copping the ire of customers following a hefty increase in lay-by charges.

June is Toy Mania month at Big W - part of the Woolworths stable of brands. It's a chance for parents to score big savings on toys and children's electronics.

For many families, Toy Mania is also an opportunity to use lay-by to steadily pay off Christmas presents without interest charges, while also having gifts stored securely away from the prying eyes of kiddies.

However, a quick check of Big W's social media shows some parents are less than impressed about the retailer's decision to hike its non-refundable lay-by fee from $5 to $15.

It's a small increase in dollar terms. But for a family putting $150 worth of toys on lay-by, the $15 service fee adds an extra 10% to the cost of purchases.

How lay-by works

A generation ago, lay-by was the go-to method of paying for big-ticket buys.

And it still holds appeal.

At Big W, shoppers can use lay-by for a minimum spend of $50, putting down 10% deposit, and paying off the balance over 24 weeks with minimum payments of just $5 every fortnight.

In recent years, lay-by has fallen out of favour with many retailers.

The rise of buy now, pay later (BNPL) has meant stores no longer have to wear lay-by storage costs. For consumers, BNPL offers a key advantage - you get to enjoy purchases straight away.

For parents buying children's Christmas gifts however, immediate gratification isn't always a plus.

After all, there can't be many of us who didn't wait until mum and dad were settled in front of the telly to start scoping for hidden presents.

So, how does BNPL compare to lay-by?

Based on the example of a parent who spends $150 on toys, using Afterpay would mean paying off the tab in four installments every two weeks - that's about $37.50 each fortnight.

The danger zone can arise if you fall behind with payments. This is when late charges can start to rack up.

On purchases over $40, Afterpay can charge total late fees of 25% of the original order value or $68, whichever is less.

Worst case scenario, late fees on a $150 purchase could add up to $37.50.

But you would only need to miss one repayment to be slugged $17 in late fees assuming the payment was still outstanding seven days after the due date.

Seen through this lens, the $15 Big W lay-by charge doesn't look so bad.

The sting in the tail is that if you cancel your Big W lay-by, a cancellation fee of $20 applies.

So, if you put a toy on lay-by only to find grandma has purchased the same item, you could lose $35 comprised of the $15 lay-by fee plus the $20 cancellation charge.

Why the higher lay-by fee?

Hiking a lay-by fee from $5 to $15 - a tripling of the cost from one month to the next, is a big hit for consumers facing the highest cost of living increases seen in years.

Big W took to Facebook to explain the uptick, saying it was "due to an increase in the costs of managing and storing goods for lay-by, as well as a rise in the number of orders that are later cancelled".

A solution

Of course, consumers do have the option to vote with their feet.

Kmart also offers lay-by, and requires the same minimum spend of $50 and minimum deposit of 10%.

The difference is that Kmart's non-refundable service fee is a pint-sized $3. And if you change your mind about the purchase, you'll pay an administration fee of just $11.

That leaves it up to shoppers to work out if Kmart offers better all-round value or if the savings of Big W's toy sale outweigh the higher lay-by fee.

Get stories like this in our newsletters.