Should you buy, hold or sell Altium shares?

By Jun Bei Liu

In the dynamic field of electronics, Altium, headquartered in San Diego, has been a driving force in electronic design systems since its founding in 1985.

Focused on Printed Circuit Board (PCB) design, Altium's primary offering, Altium Designer, is globally recognised as the most popular PCB design tool with over 60,000 commercial subscribers.

Altium went public on the Australian Securities Exchange (ASX) in 1999, setting the stage for a journey marked by innovation and success. Altium Designer, renowned for its capabilities, has become a staple in electronic design across various devices.

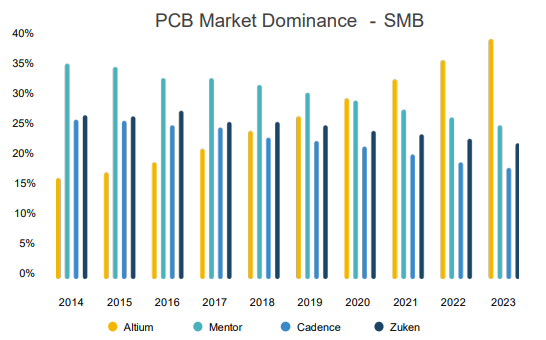

Altium's market dominance

With approximately 40% market share in the small medium business (SMB) segment, Altium has historically excelled among freelance designers. This success is attributed to a low-touch approach, emphasising online sales and the product's strength.

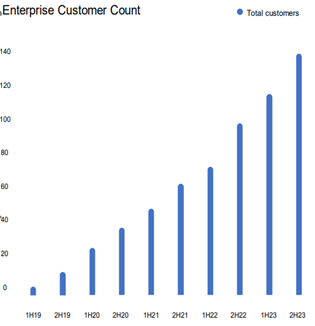

Enterprise ventures

Recognising the need for a more hands-on strategy, Altium entered the enterprise market in recent years.

Building an enterprise sales team in 2019 has yielded positive results, evident in growing traction and notable reference customers such as John Deere, Mercedes Benz, NASA, and Breville.

Future vision

Altium aims to cloud-enable industry processes involved in electronics hardware creation, aspiring to unify the entire electronics design and supply chain on a single platform.

Financial principles

Aside from its strong market position and successes in new market segments and possible future artificial intelligence (AI) applications, we also like Altium's financial principle and discipline.

Altium is highly profitable and uses a "Rule of 50" principle to underpin strategic decisions.

This principal target annual revenue growth plus EBITDA margin, greater than 50% (e.g. EBITDA margin of 34% and top line growth, greater than 16% per annum). This has led to a long history of profitable growth, and we believe its success now in the enterprise markets will mean meaningful growth in coming years.

Get stories like this in our newsletters.