Should you buy, hold or sell Treasury Wine Estates?

By Jun Bei Liu

Treasury Wine Estates is the owner and producer of the great Australian Penfolds brand, which has been a topic of discussion for investors for many years.

It was once a local Australian luxury brand, which actively began to expand and grow its presence in the Asian market, in particular in China.

Overtime it captured the taste buds of the Chinese consumer.

How Treasury Wine Estates responded to Chinese tariffs

At one stage, it was the fastest-growing luxury wine imported into China.

However, Chinese politics caused deterioration between the Australian/Chinese relationship, implementing heavy tariffs on Australian wine and almost overnight halting the fastest growing market for Treasury and 30% of earnings.

While many investors thought this would be the end of the business, within two years Treasury Wine Estates was able to reallocate much of this volume into other fast-growing Asian markets as well as growing its US luxury wine business.

We are impressed by the agility of management and their execution of this major transition.

China to remove tariffs on Australian wine

In March of this year, China announced all tariffs on Australian wine would be removed and welcomed back the import of Australian wine, which Chinese consumers had long been waiting for.

While this is great news for Treasury Wine Estates, its management has taken a steady but slow approach to this news.

Treasury Wine Estates' management remains committed to the newer markets it has penetrated and expanded into while gradually bringing back volume to the Chinese market.

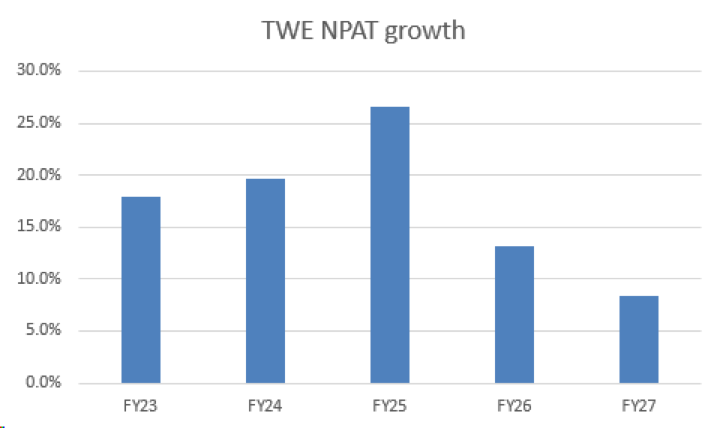

What this means for the company is that it will continue to grow its earnings in the double digits through both volume and price which is a much-liked trajectory for long-term investors.

Are Treasury Wine Estates a buy, hold or sell?

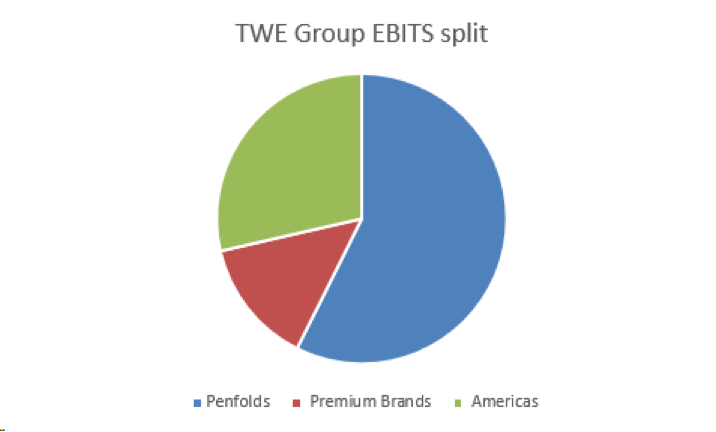

Treasury Wine Estates is our key pick because of its portfolio of luxury brands, most notably the Penfolds range, as well its growing penetration of international markets.

It has displayed its diverse growth drivers from two of the largest markets in the world - US and China - with earnings growth in the double digits for the next five years.

We believe the company is undervalued on an earnings multiple, just under 20x FY25. Not to mention a large part of the share price continues to be underpinned by large inventory of the luxury wines that is becoming more valuable every day. Our recommendation is a buy.

Get stories like this in our newsletters.