Should you buy, hold or sell shares in Sandfire Resources Limited?

By Simon Brown

Sandfire Resources Limited (ASX: SFR) is an international and diversified sustainable mining company, listed on the ASX. The company is predominantly involved in copper mining, operating the DeGrussa mine in Western Australia and the recently purchased Minas De Aguas Tenidas (MATSA) mine in south-western Spain. Sandfire is also developing Motheo T3 in Botswana with first copper production due in 2023, and is in the process of applying to develop the Black Butte copper project in Montana, USA.

The current 2023 fiscal year is transitional for Sandfire. Operations at the DeGrussa copper/gold mine are coming to an end and transitioning to care and maintenance. The initial discovery was made back in 2009 in a region better known for gold and was one of the most celebrated mineral discoveries of the past 15 years.

The cashflows from DeGrussa has enabled the company to purchase and develop other opportunities, helping to de-risk the single mine operation that was coming towards the end of its life.

Development commenced in 2021 fiscal year at the Motheo Copper Mine (Motheo), located in the Kalahari Copper Belt in Botswana, and the greenfield operation is forecast for first production in the June 2023 quarter. The MATSA Copper operations in Spain was purchased for circa US$2 billion in February 2022 through a combination of equity and debt and is now Sandfire's cornerstone asset.

Strategy

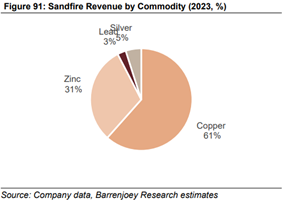

The recent acquisition of the Minas De Aguas Tenidas (MATSA) complex in Spain has transformed Sandfire and we estimate it now accounts for approximately 70% of Sandfire valuations.

With more than US$1.7 billion spent since 2005 in building the mines and processing infrastructure, the operation would appear to have strong asset integrity. However, the company paid a very full price in our opinion, and February 2022 production and cost guidance was below forecasts made at time of acquisition, driven chiefly by lower ore grades.

It is likely these issues at MATSA are temporary, and the focus looking out is on extending the current mine life of five years based on known ore reserves. The current reserves of 36 metric-tonnes (Mt) compares to resources of 122Mt, and the asset has a strong history of converting resources to reserves, with research highlighting conversion of approximately 80% with infill drilling. Outside of near mine exploration, there is numerous regional potential upside.

MATSA holds approximately 2450 square kilometres of exploration tenements across Spain and Portugal and the company's planning a material drill program (approximately 50,000 metres) for some priority and greenfield targets.

The Motheo Copper Mine (Motheo), in Botswana, came via the 2019 acquisition of MOD Resources. Development commenced in 2021 fiscal year and will initially mine a significant sediment-hosted copper and silver deposit (T3 Deposit).

Approval has been granted for the initial T3 mining pit with the Motheo processing plant to 3.2 million-tonnes per annum (Mtpa) of capacity and that project is in execution to produce approximately 28 kilo-tonnes per annum (ktpa) of copper. Sandfire is targeting expansion to 5.2 Mtpa via a new mine some 8 kilometers away from the current operation. The approvals should be less onerous than for the initial permitting and would add an additional 12ktpa with production peaking at 60ktpa once the operation is fully ramped up.

As a result of the various projects underway and forecast to come online, Sandfire's copper and zinc production profile exhibits an attractive growth profile. Additionally, there are opportunities to continue to expand the mine lives at MATSA and Motheo.

Lastly, Sandfire currently holds an 87% interest in one of the one of the world's highest-grade undeveloped copper projects at Black Butte in Montana, USA. Phase 1 permitting is currently the subject of a legal challenge and is subsequently before the courts. There is little implied in the share price, in our view, should this project eventually proceed to development and production.

|

|

|

Copper supply and the green energy transition

Over the past 12 months, investors have been constantly remined that over the next two to three years we should expect the copper market to be in surplus, as a final burst of mine supply growth temporarily softens supply/demand fundamentals. Copper prices are down 20% from highs based on this narrative and expectations of demand destruction from the forthcoming slowdown.

However, this surplus has failed to materialise, with the copper market in clear deficit in 2022 and global visible stocks falling to the lowest level in 14 years. These factors should assist in curtailing any further downside to prices, in our view.

Further, previous expectations for surplus into 2023 are under threat, with sharp downgrades to expected mine supply over the next year, together with material upgrades to global renewable and infrastructure-related demand.

Meanwhile, copper mine greenfield and brownfield project approvals having plunged to cycle lows this year, ensuring there is little new available supply in the medium to long term. Lastly, there is now a clear sequential recovery path now expected for China in 2023, as authorities move towards reopening its economy alongside a greater stabilisation focus on the property sector.

The current economic slowdown will affect mostly the demand from non-green cyclical sectors, highly sensitive to growth and consumers' expenditure.

However, we also anticipate energy-transition related demand growth (such as renewables, electric vehicles and power grid) to partly offset the construction-cantered demand decrease, thanks to an acceleration in EVs and renewable demand in the US, driven by the Inflation Reduction Act and a renewed commitment in Europe to electrification, as countries there try to shy away from Russian gas and secure their energy supplies long term.

We believe we are approaching a pivotal point in the copper market, fuelled by a lack of investment in supply and decarbonisation policies stimulating unprecedented levels of demand around the world. In order to incentivise new supply and give producers the confidence to invest, we expect prices will need to move higher for a long period of time. This should benefit the cashflows of existing producers such as Sandfire, much as we have seen in the lithium space recently.

The scarcity of potential copper investment alternatives on the ASX is an added tailwind for Sandfire.

Oz Minerals (ASX:OZL) is currently under takeover offer from BHP, with the two recently signing a scheme implementation deed. Should the takeover be completed, there would be $9 billion of investor funds potentially looking for alternative listed copper exposure. Sandfire is the next largest alternative at $2.5 billion market cap, with a small number of much smaller listed companies with copper exposure below that.

Returns

Over the past five years, an investment in Sandfire would have returned minus 2% a year, this compares with an annualised return for the S&P/ASX 200 Accumulation Index of 4%. Sandfire has paid semi-annual dividends since 2015, alongside its investment in replacement production and acquisitions.

Given the current funding requirements to bring on the Motheo Mine in Botswana, the company may elect to defer dividend payments in the near term, however, these should resume once production ramps up. An increasing production profile over the medium term should drive strong earnings growth together with any benefits associated with higher commodity prices.

Recommendation: Buy

We rate Sandfire a buy. Concerns over the company's balance sheet have now been addressed post their recent equity raise, which relieves pressure on the timing of cashflows from the Botswana mine ramp-up.

New CEO Brendan Harris has a wealth of experience and possibly brings a fresh perspective to this attractive suite of well-positioned assets.

We believe the continued challenges in delivering expected mining volumes as well as energy transition related policies should support a tight copper market, with higher prices required to attract investment in the much-needed additional supply.

We believe Sandfire is very well placed to take advantage of the expected favourable conditions and lack of alternative ways of gaining exposure to this thematic.

Get stories like this in our newsletters.