Why defensive stocks appeal as war rages

By John Bilsel

What if you told somebody that stocks with lower risk earn a higher return? They may look at you and think you're crazy.

But going into a potential recession in 2024 and with geopolitical tensions rising, we could see lower risk or more defensive shares have a more resilient outcome than higher risk shares and the overall share market.

With war raging in Gaza and Ukraine, the US economy slowing and oil prices headed towards $US100 a barrel, global recession is looking inevitable in the coming months.

In this scenario, investors can use low volatility or defensive investment strategies in their portfolios to reduce overall volatility and enhance risk-adjusted returns over the long term.

With inflation still high and economic growth slowing, it is the companies with the most defensive earnings that are most likely to fare relatively well and outperform the overall share market. In contrast, companies with earnings more sensitive to slowing economic growth, such as growth companies, are likely to underperform.

Global asset markets are made up of dozens of asset classes and millions of individual securities. Within this all, there are a few important factors that drive returns across asset classes. These factors are driven by different economic rationales and tend to outperform at different times.

What are low volatility investments?

Low volatility is characterised by being a defensive factor, meaning it has tended to benefit during periods of economic contraction.

This strategy is more concerned with the management of the volatility of returns than with maximising gains.

Value stocks are those that have low prices relative to their financial fundamentals such as earnings.

Quality involves investing in companies with healthy balance sheets including strong earnings and low debt, while size refers to investing in small or large companies. A growth strategy involves investment in high-growth stocks.

Why are low volatility strategies more resilient?

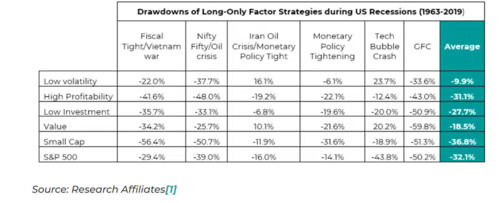

Paradoxically, a minimum volatility strategy has produced a premium over the market for long periods. Moreover, low volatility investment strategies were also the most resilient throughout the below six recessions/drawdowns on average, as the chart below shows.

That is because low volatility strategies tend to be biased to more defensive sectors such as utilities and consumer staples and healthcare, though the defensiveness of a particular sector may change over time depending on economic and business trends.

Research from US finance company MSCI has also examined how different equity factors have performed in different inflationary and growth environments since the 1970s.

How do low volatility companies perform?

MSCI has found that minimum volatility investing will outperform the overall share market during periods of economic contraction and during periods of stagflation, that is, when inflation is rising and economic growth is minimal, a situation the world potentially faces today given high levels of inflation, rising energy prices and interest rates.

One reason for this outperformance of low volatility companies is that investors are inherently biased towards investing in higher-risk stocks in search of higher returns and tend to overpay for them.

You can see this with the strong run towards technology stocks in the US this year; investors have been paying sky high prices for the mega-cap technology companies and the rally in the US share market to July 31, 2023, has been highly concentrated in the Magnificent 7 largest companies of the S&P 500 which are exposed to artificial intelligence.

How do tech stocks compare?

We see these high-risk technology stocks among news headlines a lot more commonly than the more boring low-risk stocks in sectors such as utilities and consumer staples. Empirical evidence too has indicated investors undertake disproportionally large allocations to high-beta stocks within managed funds.

As a result, they tend to see investors overpaying for high beta or high-risk shares and under-pricing for low volatility stocks. This typically leaves those low-risk stocks to yield a premium for investors. During 2023, low volatility companies have become cheaper relative to the broader market in recent times.

More generally, given that low volatility strategies have proven to be a protector of capital in most recessions, and with a potential drawdown looming, it may be appropriate for investors to have defensive sectors in their portfolios, especially with valuations being around fair value.

Low volatility investing can diversify risk and returns and complement other investment strategies such as an allocation to value or growth shares. Given that more asset managers and ETFs are offering low volatility strategies, there are several options for investors to get such potentially important exposure to some level of defensiveness.

Get stories like this in our newsletters.