When you have a gift card for a store goes into administration

By David Thornton

Chances are you've received more than your fair share of Christmas gift cards. But what happens when the gift card is for a retail company that goes into administration, an all too frequent occurrence these days?

The answer differs case by case, and really depends on the size of the company's assets and the list of creditors in line to recover what they can.

How it works

A common misconception is that gift cards guarantee the money paid for them. They don't.

They're simply a set of terms and conditions that allows the holder to acquire a specific amount of goods or services from a company.

The objective of an Administrator is to either salvage the business or, in the case of liquidation, wind up the business to achieve the best outcome for creditors.

Gift card holders are unsecured creditors and are a fair way down the pecking order, which goes:

1. Liquidation and legal fees;

2. Secured creditors;

3. Priority unsecured creditors (such as employees owed unpaid wages and super);

4. Unsecured creditors.

What to do

"As an unsecured creditor, you have few options," says consumer advocate Christopher Zinn of Determined Consumer.

"Wait and hope there's some kind of refund, knowing you are at the end of the queue. Or put more money in to be able to use the gift card and walk away with the good or service quick smart."

The reality

According to Chamberlains Law Firm, administrators are often reluctant to honour gift cards because this would reduce the company's stock level or cash reserves while providing marginal benefit to the company.

"For the same reasons, liquidators often won't provide refunds for gift cards, as there are either no funds to do so or it would diminish the asset pool available to creditors."

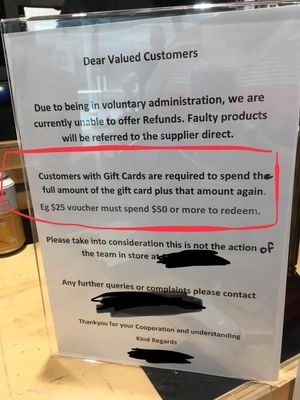

If the business keeps trading, the administrator may honour gift cards with or without additional terms and conditions.

For instance, customers may have to spend a dollar for every dollar of value on the gift card. So, to use up the full value of a $50 gift card, a customer would need to purchase $100 worth of goods and services.

If a business is being wound up, gift card holders should lodge a Proof of Debt (POD) to ensure you're "on the list" should there be enough cake to go around.

Christopher Zinn's advice is more straightforward: "Keep it in your wallet, not your top drawer, and spend and enjoy promptly."

Get stories like this in our newsletters.