Forget the brands - it could be time to invest in the billboards

By Roger Montgomery

Key statistics: ASX: QMS

Closing share price 02.08.17: $1.090 52-week high: $1.4 52-week low: - Most recent dividend: 0.8c Annual dividend yield: 2.09% Franking: 100%

QMS Media (ASX: QMS) is one of the leading outdoor media companies in Australia and New Zealand. It offers a range of outdoor advertising such as landmark digital billboards, static billboards, retail, street furniture and transit. The company was founded in 2014 and is headquartered in south Melbourne.

These days it's hard to go far without being distracted by outdoor advertising.

Displays are everywhere: from roadsides to shopping malls to bus stops. We believe the industry is poised to enjoy continued revenue growth.

The industry's body, the Outdoor Media Association, recently released the advertising revenue data for June.

It showed that for the month overall Australian outdoor advertising industry revenue, excluding commissions paid as well as production and installation revenue, increased by 5.3% relative to the previous year. It was up 6.4% for the June half year. This is reasonable growth given the overall advertising market has been roughly flat on the same basis.

Within this, the large-format roadside category showed the strongest growth, with revenue up 12.1% in June and up 13.6% in the June half year. Large-format roadside revenue growth has exceeded that of the overall outdoor industry for the past two years.

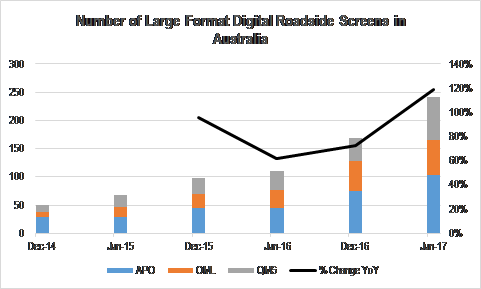

The table shows the dramatic acceleration in the number of large-format digital billboards operated by the three major roadside operators in Australia: APN Outdoor (APO), oOh!media (OML) and QMS.

Given the exposure of QMS to this category, this would appear to be reasonably encouraging.

Digital sign revenue is the driver of revenue growth for the industry, increasing by 30% in the June half year relative to the previous year. This compares with a 7.4% decline in revenue for static outdoor assets over the same period.

On thorough research, the longer-term drivers present an attractive investment case for the outdoor advertising industry and there are several reasons why it should grow its share of the overall advertising pie over the next five to 10 years.

There has been something of a land grab occurring in the industry with digital capacity growth outstripping the rate of demand growth.

While we continue to like the longer-term opportunity for outdoor advertising, it appears there may be some short-term pressures that could threaten earnings expectations.

We will be watching the August full-year reporting with interest.

The Montgomery Funds own shares in QMS Media.

Get stories like this in our newsletters.