What Aussies are searching for when it comes to property

By Nerida Conisbee

With almost 6 million people coming to realestate.com.au each month, we have access to real-time data which shows us Australia's housing preferences.

With so much talk about property crashes, oversupply, affordability and rising household debt, what is really going on in the residential sector?

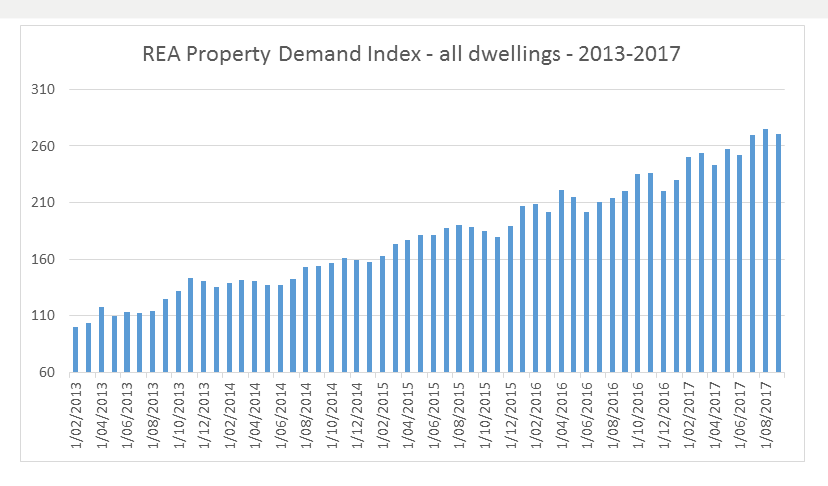

No crash in sight but market is slowing

Conditions need to be pretty bad for a housing crash - think rapidly rising unemployment or very high interest rates.

Right now the market is slowing but there is certainly no crash looming on the horizon.

A slowing market isn't surprising given many banks are starting to increase interest rates independently of the Reserve Bank and we can see that demand from buyers on our site is very sensitive to interest rate rises.

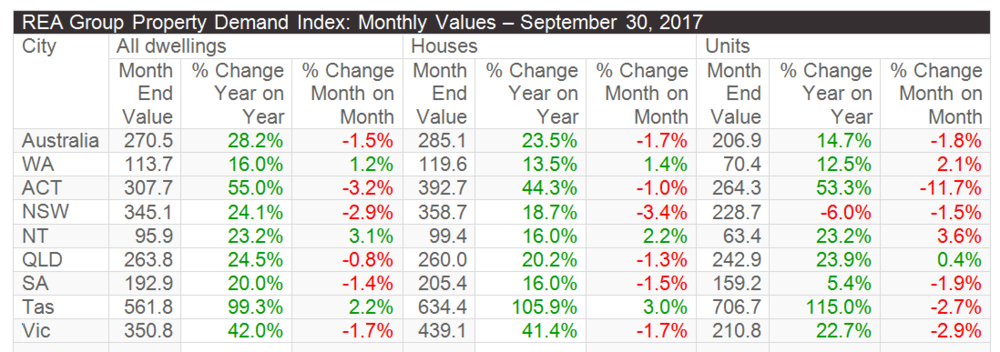

Despite the slowdown in demand, levels are still at record highs, showing that Australians continue to have an obsession with property.

While this is similar to the rest of Asia Pacific, it's very different from Europe and North America. Australians have done very well out of the property market, with many people aspiring to own more than one dwelling. It's this lust for more property that continues to drive high demand levels.

Recovery in mining towns

Following the end of the mining boom, we saw Perth and Darwin prices strongly decline as more people left these cities in search of employment.

But over the past month, both Western Australia and Northern Territory have seen growing demand from buyers, a very different situation from the rest of Australia.

In addition to this, a house in Townsville recently came up as the most "clicked" property in Queensland, with this city starting to show price growth in premium suburbs.

Across mining towns, prices are still subdued. However, in the best suburbs we're starting to see growth again. With demand picking up, it's likely price growth will extend to other areas.

However, although demand is returning, don't expect it to rebound strongly - it will be a slow and steady recovery.

Housing is now very expensive in Melbourne and Sydney and the ability to buy a home without going into mortgage stress has decreased significantly over the past few years.

Affordability is changing demand

This is changing the way people look on our site, with more affordable locations seeing a rapid rise in popularity.

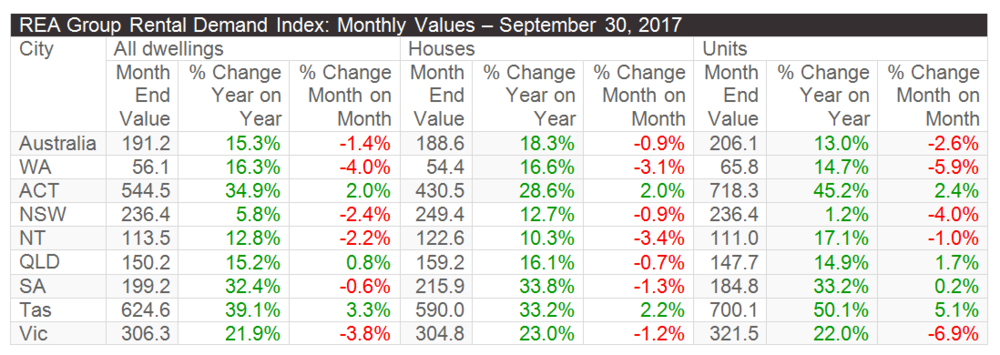

Tasmania is now showing the strongest demand in Australia when we compare the number of people looking to buy with listings.

Not only is Tasmania the most affordable state, it is also seeing jobs growth, which is in turn supporting population growth.

In NSW the Central Coast and Wollongong appear to be the main beneficiaries of high prices in Sydney, with both regions seeing very high demand on our site.

This has now translated to price growth with the Wollongong suburb of Stanwell Park showing one of the strongest increases over the past 12 months.

For investors, looking at areas with strong demand can lead to better decisions.

With about a third of Australia on our site every month, data from realestate.com.au can provide unique insights into where people are looking to buy and rent.

Get stories like this in our newsletters.