How to protect your home from a hefty $6000 repair bill

By Darren Snyder

Homeowners have paid $10.5 billion to cover building defects in the past decade.

New research by the comparison website Mozo has revealed that it cost $6434 to fix the average apartment defect and $5839 if something went wrong in your house.

Mozo property expert Steve Jovcevski says the survey of more than 1200 people found those who bought a new apartment or house in the past decade have all experienced building defects.

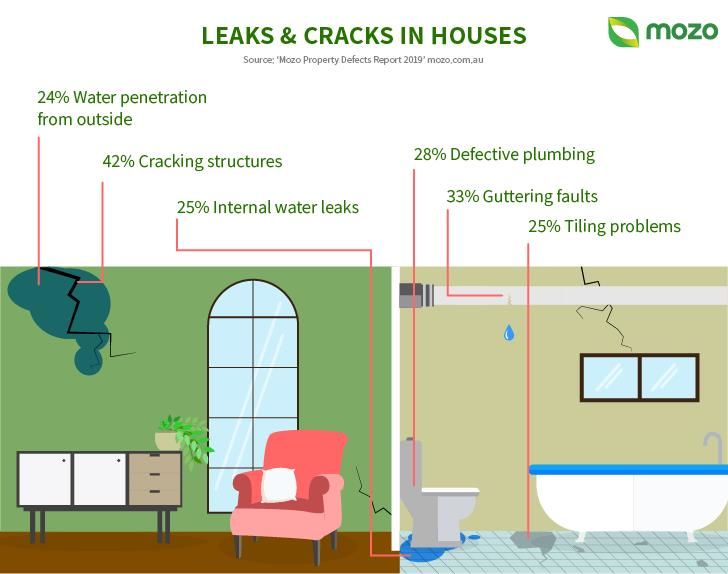

Internal water leaks, cracking to internal or external structures, water penetration from the outside, guttering faults, tiling problems and defective plumbing were the most common problems, he says.

To avoid a defect disaster, Jovcevski recommends that prospective homeowners use the following checklist before and after buying:

A separate report from Chubb Insurance, also released last month, confirms reports that internal water leaks are on the rise and are potentially costing Aussies thousands.

The insurer estimates the average claim from water damage has increased 72% in the past five years, from $17,627 in 2014 to $30,361 in 2018.

It says 34% of all its claims are now related to water damage, compared with 16% for fire and 9% for burglary.

"Australians are increasingly more aware of the damage caused by floods and fire, yet few are prepared for the threat from water damage to their homes," says Michelle O'Dowd, Chubb's underwriting manager, personal lines, Australia and New Zealand.

"In the US, where we have been tracking water damage claims for many years, it was revealed in a recent survey that only 19% of homeowners recognise internal water damage as the main threat to their homes and only 1.5% of Chubb-insured residences have installed water shut-off devices. The figure for shut-off devices is likely to be even lower in Australia, although every home is required by law to have a smoke detector fitted," says O'Dowd.

The insurer's research also reveals that those living in Western Australia and Victoria are 20% more likely to make a water damage claim than other homeowners.

Mozo's report says when it came to dealing with building defects, 60% of apartment owners facing a problem had to contribute to a sinking fund and 24% had to pay special levies to fund repairs.

It says the findings come as regulators continue to grapple with the fallout over the serious safety issues plaguing apartments in Melbourne's Southbank and at Olympic Park, Erskineville, Zetland and Mascot in Sydney.

While the average cost of apartment repairs was $6434, Mozo found 4% of owners had to pay more than $50,000. For house repairs, 32% had to pay more than $5000.

Most apartment repairs (57%) were completed in less than three months, but 21% had to wait up to six months and 9% are still waiting for the defects to be fixed.

"If you're still waiting to have your apartment or house repaired, it's time to act," says Jovcevski. "With fixed building warranties across the country, once the regulated time period to claim has passed you'll struggle to get a developer or builder to fix defects with your property."

Get stories like this in our newsletters.