The new retirement rule of thumb you need to know

By David Thornton

Budgeting is hard at any stage of life, not least retirement.

The good news is that by retirement, the investing side of the equation has - hopefully - been largely taken care of. The main job now is to understand how much you can responsibly take out each year, and stick to it.

A group of Australian actuaries has done some heavy lifting here, devising a three-part 'rule of thumb' for retirees to work out how much to draw down their super each year.

It works like this: draw down a baseline rate, as a percentage, that is the first digit of your age, and 2% if your account balance is between $250,000 and $500,000. This is subject to meeting the statutory minimum drawdown rule.

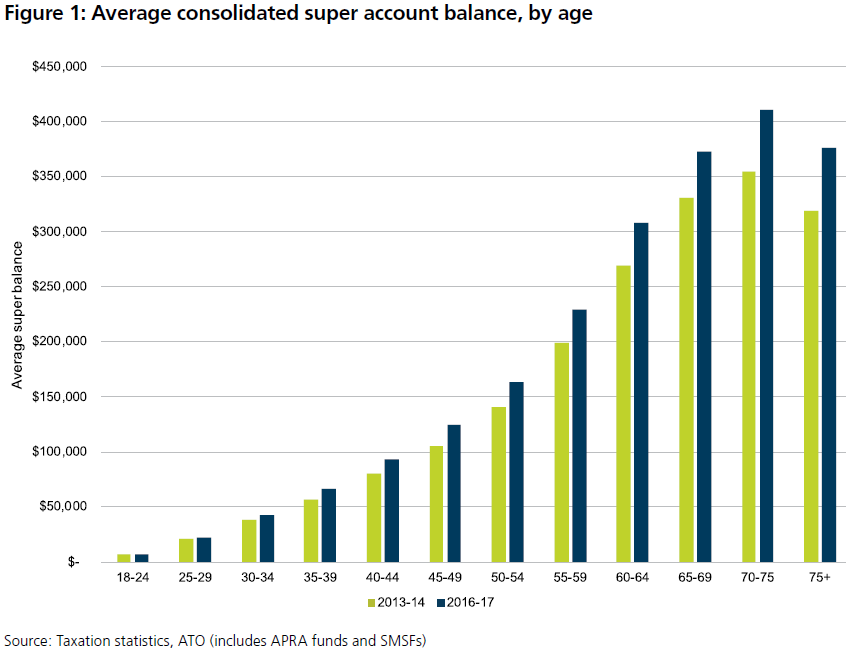

For instance, a retiree aged 60-69 with a super balance of 350,000 would draw down 8% of their savings - 6% for the decimal age plus another 2%. The annual drawdown would therefore be $28,000 (8% of $350,000).

"Many retirees draw a bare minimum from their account-based pensions, or their savings, after they stop work," says Actuaries Institute president Nicolette Rubinsztein.

"They can't afford to pay for professional advice from a planner, and they live frugal lives because they fear outliving their savings. But the 'rule of thumb' is simple and accurate and takes into consideration a retiree's asset base and age."

The rule of thumb takes much of the guesswork out of retirement spending.

"It is very hard for retirees, who are generally risk averse, to work out how much of their savings they should live off at any point in time," says co-author John De Ravin.

"The federal government has encouraged the industry to develop better products to help ensure retirees don't outlive their spending.

"But that's still a way off. In the meantime, we've taken a complicated set of equations and scenarios, and worked out what is a simple guideline that works."

The rule of thumb doesn't mean those nearing retirement age should hang up their working boots altogether, at least initially.

Marshall Brentnall, director and financial adviser at Evalesco, says people are often anxious about nominating a single retirement date.

"It is also riskier. By easing clients into retirement it lessens the impact that a fall in investment markets could have, a risk commonly known as sequencing risk."

Brentnall also recommends "gradually provisioning for up to two years of income requirements in liquid and secure strategies such as cash and term deposits in the lead up to retirement, before moving to three years when in retirement".

Get stories like this in our newsletters.