Should you buy, hold or sell shares in CSL?

By Jun Bei Liu

From humble beginnings as a small Government entity, CSL (ASX:CSL) has been an extraordinary Australian success story, becoming a global leader after a number of audacious acquisitions.

The management team have consistently excelled across a number of disparate disciplines including highly complex manufacturing, sales and marketing in competitive global markets and sophisticated and high-risk R&D projects.

CSL is now the clear leader in an important niche of the pharmaceutical sector - therapies derived from blood plasma. It is also the second largest player in the flu vaccine segment and most recently has diversified into renal disease and iron deficiency following the acquisition of Vifor in 2022.

CSL's core plasma business was challenged through the pandemic as the US plasma donors it relies on were caught in lockdowns and later received significant stimulus payments which reduced the sale of plasma to CSL. CSL reacted by opening more centres and increasing donor payments. By mid-2022 plasma collections had recovered to pre-COVID levels but due to the long lead times with fractionation, this supply is only now starting to support sales.

CSL is well positioned for two years of strong earnings supported by the recovery of its core plasma business and the benefit for the Vifor acquisition. The initial stage of the earnings recovery is largely locked as supply of plasma has already recovered to above pre-pandemic levels underpinning the expected uplift in FY23 and the first half of FY24. The Vifor deal is expected to deliver around 15% earnings per share (EPS) uplift in its first year before the benefit of synergies and new product launches support further growth in FY24.

An additional attraction of CSL is the defensiveness and counter cyclical nature of its core business - the plasma business benefits from lower input costs when economic conditions deteriorate as more donors become available. While sales of its lifesaving therapies are largely unaffected by economic conditions. This combination of recovering and counter-cyclical earnings makes CSL particularly attractive in the current environment.

What it does

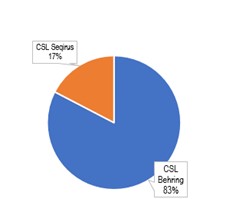

CSL is a complex business with three divisions - plasma therapies (CSL Behring), flu vaccines (CSL Seqirus) and CSL Vifor a supplier of renal disease and iron deficiency therapies.

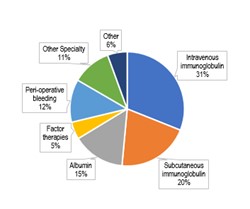

The pie chart below shows the approximate revenue contribution from each of these divisions. The righthand pie chart shows sales of the major plasma therapies by CSL Behring.

| Sales by division | Revenue contribution by plasma therapy |

|

|

|

CSL Behring

The plasma business starts with plasma collections, predominantly in the US, where regulations allow donors to be paid. The images below show a bag of plasma on the left and the donation process on the right. CSL has the largest and most efficient plasma collection infrastructure which has long been a competitive advantage.

The average payment to donors rose rapidly during the pandemic as the supply of plasma fell. This along with higher wages caused the average cost of plasma to rise sharply weighing on CSL's margins. This trend has begun to reverse in 2023 as supply has normalised and the level of competition for plasma has started to moderate. Still the average cost of a litre plasma remains well above pre-pandemic levels.

After testing and pooling over a number of months (to reduce the risk of transmitting blood borne diseases), the now frozen plasma is transferred to the group's facilities in the US, Switzerland, Germany and Australia where it undergoes a multistage fraction process to extract and purify the various therapies. It takes six to nine months for the plasma donation to be turned into the finished goods. The pictures below show some of the group's fraction facilities.

CSL fractionates a number of therapies from plasma. The driver of the economics of the business is immunoglobulin - both intravenous and subcutaneous forms. CSL and its peers fractionate immunoglobulin and albumin from every litre of plasma and hence the sales of these two therapies determine the marginal earnings from the last litre of plasma fractionated. The other therapies are not extracted from every litre as there is less demand due to the rarity of the diseases they treat.

Plasma fractionation is a scale business which requires multibillion dollar investment in plants and manufacturing facilities to be competitive. The lead times on such investments are measured in years due to the complexity of the processes and the regulatory oversight from the Food and Drug Authority in the US and other regulators around the world. CSL has a clear scale advantage as it has developed the largest plasma fraction and collection infrastructure in the world.

As illustrated in the charts below CSL in the largest supplier of plasma therapies and this has ensured it also has higher gross margins than its peers, thanks to this scaling advantage and the efficiency of its collection centres.

| Sales of plasma derived therapies | Gross margins from plasma therapy sales |

|

|

|

CSL Seqirus

CSL has a long history of producing flu vaccines for the Australian market, first as Government entity, and as a private provider since 1994. The business stepped onto the global stage after CSL acquired Novartis' flu vaccine business in 2015 and renamed the combined business Seqirus.

The Novartis acquisition was a huge success with CSL able to turn around a loss-making operation. The group is now the second largest supplier of flu vaccines globally and generates an operating profit of over US$1 billion. While this business has been a great success, the market is relatively mature and faces the threat from mRNA vaccines. We expect the rate of growth to moderate.

CSL Vifor

The group's latest acquisition of Vifor has seen it step into an adjacent therapy area. Vifor has a world leading injectable iron business and a strong position in the supply of drugs for dialysis patients.

The integration of this acquisition is at an early stage with CSL well positioned to improve the operations and earnings at Vifor. The company has guided to double digit sales growth for the foreseeable future along with solid cost synergies.

Strategy

The new CEO, Paul McKenzie, has a lot on his plate given the complexity of CSL's large operations and the challenges the business faced during COVID. The key focus for investors will be the earnings from the plasma business as supply recovers.

This should in turn ensure margins rebound after a few years of downward pressure. With collection volumes back above pre-pandemic levels and payments to donor dropping, a turnaround is already locked in. However, costs are now higher, and this has only partially been offset by higher finished goods prices.

Efficiency improvements will be required to drive margins back to historic levels.

Key opportunities on this front are the introduction of new plasma collection technology through a deal with Terumo and improvements to the fractionation process which increase yields (i.e. lift the number of grams of immunoglobulin extracted from every litre of plasma). CSL is progressing on both projects, and we expect this will support margin expansion and hence strong earnings growth well beyond expected post-COVID recovery.

In terms of threats, all eyes will be on the upcoming results from a clinical trial by Argenx. The trial is testing a new therapy to treat chronic inflammatory demyelinating polyneuropathy (CIDP), a disease which currently accounts for over 20% of immunoglobulin sales.

Phase III trial results are due in July with most experts expecting positive results. This "anti-FcRn" therapy is likely to become a competitor to CSL's immunoglobulin sales by 2025. CSL management will look to foster growth in other ways to ensure sales of immunoglobulins continues to grow.

Vifor will be another area of focus as the group works through the integration. This business moves CSL into new markets and comes with its own complex manufacturing and a complex web of arrangements with suppliers and distributors. It also faces a pending patent expiry for Vifor key product, injectable iron. I am confident the group will exceed the promised cost synergies and Vifor is well positioned to grow given the rising prevalence of the conditions it treats and the low market penetration.

Finally, CSL's growth outlook rests on the success of its US$1 billion plus annual investment in R&D projects across its three businesses. The results from CSL's largest ever clinical trial, known as CSL 112, is set to be announced in 2024 with the potential to be a major catalyst. If successful, this could be a new "block buster" plasma derived therapy. The earnings upside is large given the marginal cost of an additional plasma therapy is minimal and the market - people who have suffered a heart attack - is very large.

Returns

CSL has historically generated very impressive returns with a return on equity (ROE) approaching 50% in the years before the pandemic. This started to moderate ahead of the pandemic as the group stepped up capex to build future capacity.

Returns were then hit by reduced earnings due to the pandemic, and more recently by the US$12 billion Vifor acquisition. I expect returns to recover over the next few years as earnings rebuild and CSL Vifor becomes more profitable.

Recommendation

We recommend buying CSL.

Get stories like this in our newsletters.