Single parents slugged more for health cover

By Nicola Field

The unfair health cover trap facing single parents, tax man warns about capital gains on family home, and CommBank teams up with Tesla. Here are five things you may have missed this week.

Single parents slugged more for health cover

Analysis by consumer group CHOICE, shows single parents who add children to their health insurance policy pay significantly higher premiums than two parent families.

CHOICE spokesperson Mark Blades, says, "CHOICE found that if couples wanted to add children to their health insurance policy, it would only increase their premiums by 5-10% - or in some cases, by nothing at all.

"Unfortunately, single parents aren't given the same benefits, often getting slugged with an increase of 60 to 70% if they want to cover their children."

CHOICE says the worst health insurance providers for single parents looking to insure their children are:

- St Luke's Health (across all policies)

- Reserve Bank (Gold)

- Hunter Health (no policies specifically available for single parents, which means you have to pay for a family policy)

- NIB-brand funds (NIB, AAMI, ING, Priceline, Suncorp, Real and Seniors) charge single parents more than couples for Gold Hospital cover policies. This means it costs you more to add a child than an adult to your Single policy.

"These hospital policies all charge unfair pricing for single parents wanting to add children to their policy, with premiums that cost the same as the premium for two adults," says Blades.

CHOICE says health insurers offering single parents a fairer deal include:

- Medibank Bronze Plus Assured with excess at $500 or $750. Single parents pay a 33%-43% premium increase compared to a singles policy

- Navy Health Gold, Silver Plus and Bronze Plus policies charge 40% extra on top of standard singles cover

- HCI Gold charges a 40% premium increase for single parents.

Tax man issues stern reminder about CGT on family home

"If you think you can slide under the radar and avoid reporting a capital gain, think again".

Those are the strong words of Tim Loh, Assistant Commissioner at the Australian Taxation Office (ATO), who is urging taxpayers not to overlook capital gains tax (CGT) on investments.

However, Loh says the ATO is seeing mistakes when people incorrectly claim the full 'main residence' tax exemption when selling their home.

"Generally, your main residence (your home) is exempt from CGT," says Loh. "But if you've used it to produce income, such as renting out all or part of it, including through the sharing economy, like through Airbnb or Stayz, or running a business from home, then you may have to pay CGT."

CGT isn't a separate tax, it's part of income tax and any capital gains you declare will be taxed at your marginal income tax rate.

If you're an Australian resident and you've owned your asset (or home) for 12 months or more, you can usually reduce your taxable capital gain by 50%.

"Records are key, and will help you calculate the correct capital gain to ensure you are meeting your obligations," Loh adds.

CommBank offers Tesla finance

The Commonwealth Bank of Australia (CBA) has announced that it is a preferred finance provider for Tesla Australia.

This will allow CBA's business and retail customers to apply for a car loan directly from the Tesla website. The bank's rate on secured loans is as low as 5.49%.

CBA's research shows 64% of its customers would consider buying an electric or hybrid car if there was a financial incentive. The trouble is, some of these are reaching the end of the road.

The NSW state government will scrap the $3000 rebate on EV purchases from January 1, 2024.

Victoria ended its EV incentive scheme on June 30, 2023.

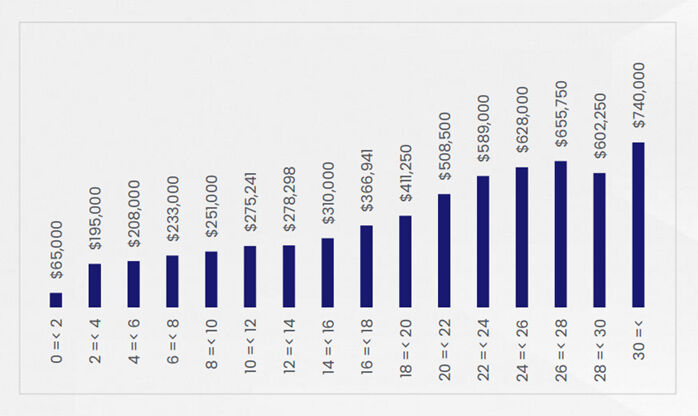

How to make $740,000 on the sale of your home

Eager to make a motza on the sale of your home?

One of the best ways to make a supersized profit is to hold onto the place for longer. And that's exactly what plenty of us are doing.

Domain's Tenure and Profit Report shows that 10 years ago, we typically stayed in the same home for seven years. Today, that timeframe has stretched to nine years.

Poor housing affordability and the high transaction costs are deterring home owners from upgrading, and the lack of turnover is helping to push home prices higher.

For home owners though the decision to stay longer can be lucrative.

CoreLogic looked at property resales in the June 2023 quarter, and found homes held for less than two years made a median profit on sale of $65,000. Those held for 4-6 years notched up a profit of $208,000.

The big bucks went to property owners who sat tight for over 30 years. These long-termers made a median profit on sale of $740,000.

Betashares launches new ETF

This week saw Betashares launch its new Inflation-Protected US Treasury Bond Currency Hedged ETF (UTIP).

The ETF aims to track the performance of an index that provides exposure to a portfolio of US Treasury Inflation-Protected Securities (TIPS).

TIPS provides protection against a higher inflation environment by indexing both principal and coupon payments to the US CPI.

Betashares says that as part of a broader portfolio, UTIP may provide defensive benefits during times of significant global economic weakness.

At the time of writing, the ETF was trading at $24.85, and has a management fee of 0.22%.

Get stories like this in our newsletters.