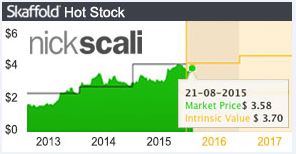

Now could be the time to pick up shares in Nick Scali

By Money Team

Key statistics: ASX:NCK

25.08.15 closing share price: $3.400

52 week high: $3.790

Most recent dividend: 8c

Annual dividend yield: 4.34%

There are very few companies listed on the ASX that have achieved Skaffold's coveted A1 and A2 stock rating for the past 10 years - less than you can count on one hand in fact.

That makes furniture manufacturer Nick Scali a very rare commodity indeed.

If you're the kind of investor who wants to bank solid returns without incurring too much volatility, then NCK should be at the top of your wish list.

Over the past 10 years NCK's share price has returned 112%, or 8%pa. When you include dividends, the total return jumps to just over 165%.

Founded more than 50 years ago, Nick Scali now imports 4000-plus containers of household furniture products every year.

Last financial year the company opened seven new stores on the eastern seaboard, and commenced trading in Western Australia. Its low-cost Sofas2Go brand is also expanding.

Nick Scali's future growth is closely tied to the housing market. Whilst there will always be a demand for furniture, when new houses are being built, the need for a shiny new lounge is all the more important.

Skaffold forecasts growth of around 10% a year and with its share price offering value at the moment, now could be an opportune time to pick up shares in this top-notch business.

Get stories like this in our newsletters.