Super guarantee increase won't lower your take-home wages: report

By Darren Snyder

Plans to boost your retirement savings with an increase in the super guarantee won't mean less take-home pay, latest research shows.

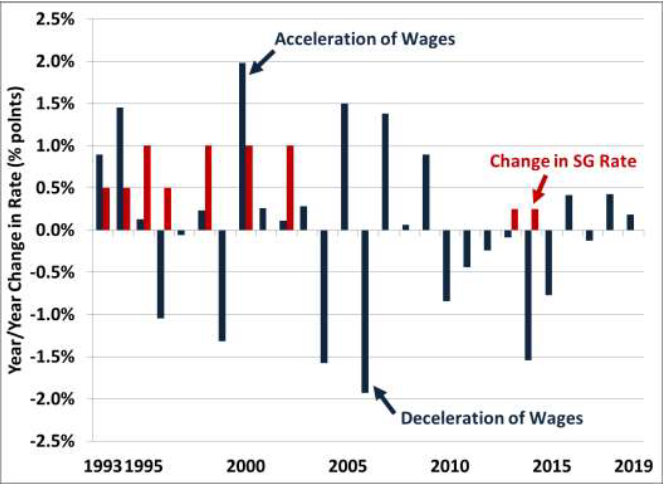

The Centre for Future Work at the Australia Institute says there is no historical link between increases in the super guarantee (SG) and lower or slower-growing wages.

"To the contrary, average wage growth has tended to be slightly stronger in years when the SG rate was increased, than in years when it was frozen - and wages were more likely to accelerate than decelerate in those years," says the centre's report.

The SG is currently legislated to grow from 9.5% of Australians' wages to 12% over a five-year period, beginning July 1, 2021.

Report author Dr Jim Stanford says Australia's economy can afford both higher wages and higher employer contributions to superannuation.

"The research refutes claims made by some commentators and lobbyists that higher superannuation contributions would automatically lead to lower wages, and hence would be self-defeating," says Stanford.

He points out that the current weakness of wages cannot be attributed to employers' superannuation contributions, especially given that the SG rate has remained the same for more than five years.

The report was commissioned by Industry Super Australia and adds that "record-low wage growth will not be fixed by giving up planned increases in compulsory superannuation contributions by employers."

Figure 1. Wage acceleration and changes in the SG Rate, 1993-2019

The Centre for Future Work says weak wage growth should be supported by measures that directly tackle the problem, including a higher minimum wage and expanded modern awards among others.

The findings are similar to those made by the McKell Institute in September. It found that cancelling the scheduled increases in the SG will only harm workers' overall wealth and income.

"And there are no conditions in place to translate such a policy into direct wage increases," the institute says.

The Grattan Institute is arguing that employees will bear the burden of the SG increase. Grattan assumes a one percentage point increase in the SG leads to a one percentage point reduction in nominal wage growth.

Get stories like this in our newsletters.