Should you buy, hold or sell Temple & Webster shares?

By Simon Brown

Temple & Webster (TPW) is Australia's largest online furniture and homewares retailer, founded in 2011 by ex-eBay and News Corp executives.

One is the current CEO, Mark Coulter, who is also a major shareholder, and the other founders also retain significant interests or management positions. TPW is named after two convicts, William Temple and John Webster, who made fine furniture in the 1820s for Governor Macquarie

The company offers an industry-leading product range with more than 200,000 products, including chairs, sofas, beds, tables, rugs, lighting, art, bedding, kitchenware, bathroom accessories and outdoor furniture from over 500 suppliers, which can be purchased from the company's website or app.

Most of the products (branded) are delivered directly to customers from suppliers, managed by TPW's logistics team in tandem with their supplier network. The remaining sales are from the company's private label range, which are shipped from its own warehouse network.

This model has allowed TPW to quickly scale up to become a major player in the furniture market in Australia, unconstrained by store size.

Without an expensive store and sales network to support, it is generally able to offer products at comparable prices their offline and omni-channel peers find difficult to match.

Temple & Webster's strategy and outlook

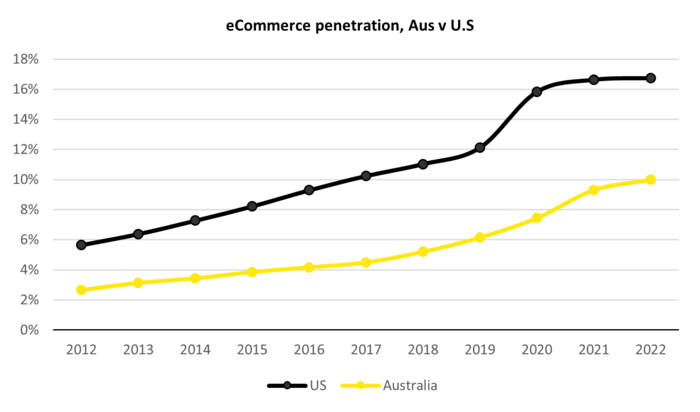

Over the past decade, there has been a significant rise in e-commerce penetration in Australia (the number of online sales versus physical stores sales).

Despite this, Australian e-commerce penetration still lags behind other Western countries such as the US. It is expected that over the next decade Australia's e-commerce penetration will continue to rise as digital technology sees further improvement, following the trajectory seen in the US.

TPW has ambitions to reach $1 billion in annual sales in the next three to five years, becoming Australia's number one furniture and homewares retailer.

This would imply a topline compound annual growth rate (CAGR) of 20-36% (compared to sales growth of 27% CAGR since its listing in 2015). A key facet of the strategy is increasing marketing investment. We think this makes sense, with customers increasingly in search of value and the significant pool of untapped customers (78% of furniture and homewares shoppers have never visited TPW's website).

TPW has the largest online product range in Australia, which means as more people look to buy furniture online (in an increasingly tech-savvy population), a larger number of search terms will land you on the TPW website. In addition, this means that TPW can be more targeted with its digital marketing.

The company has also been working on new features to optimise its return on this marketing spend, which has seen both an increase in average spend per visit and customer conversion rates.

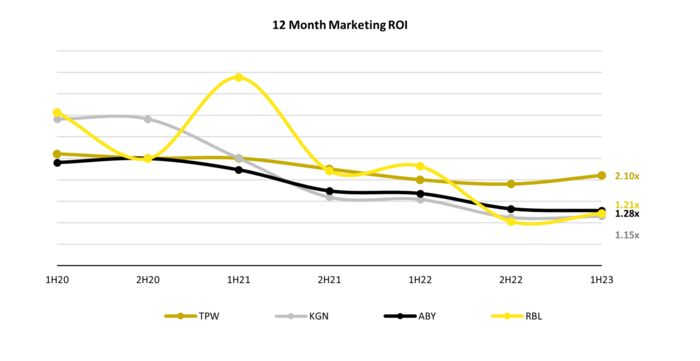

This results in favourable customer unit economics - each time it acquires a customer, it sees a two times payback in just the first year. On top of that, 54% of customers come back to repeat purchase.

Compared to other ASX-listed e-commerce peers, this is the strongest return on marketing investment.

With $100 million cash in the bank and profitable, TPW is now solely focused on winning market share to hit its $1 billion sales target and further entrench its market-leading position.

In 2024, the company is investing in a brand campaign, which should increase general awareness and lead to higher organic traffic.

This strategy has been highly successful to date, with the company growing revenue at a 27% CAGR since its listing in 2015.

A proven model in the US

Before listing, TPW acquired ZIZO, which was previously the Australian operation of leading United States (US) online furniture retailer, Wayfair. TPW and Wayfair now operate with largely the same business model.

Wayfair is the number one furniture retailer in the US by revenue, beating out physical retailers such as Home Goods and Ikea and online retailers such as Amazon.

Wayfair generated $12 billion in sales in 2023 and commands an estimated 15% market share. By contrast TPW has just 2-3% share of the $19 billion market in Australia. It's target of $1 billion in sales taking them to just 6%.

This is before we include natural adjacencies such as business-to-business and home improvement, which would at last double the company's addressable market and provide diversification benefits.

Considering Australia lags behind the US in e-commerce penetration, Wayfair appears to have paved the path for TPW to follow and has done so competing with some of the strongest global brands, giving us confidence that the business model holds up.

Recommendation

TPW currently has an enterprise value of about $900 million.

In addition to the $1 billion sales target, TPW has stated that it believes that over the long term, the company will generate more than 15% EBITDA margins.

Considering the company's track record and current trajectory, we believe those targets can be met. If they are, we think TPW could justify a valuation multiples higher than current levels.

As such, we have a buy on TPW.

Get stories like this in our newsletters.