Trump v Biden: Where they stand when it comes to the economy

By David Thornton

Personality politics, tribalism, congressional brinksmanship, even the real possibility of a contested result. Yes, this US presidential election is a burger with the lot.

It makes for entertaining, albeit high-stakes, viewing. But this noise has also distracted from the economic policy differences between US President Donald Trump and Democratic nominee Joe Biden.

So what exactly are they, and how might the election outcome shape the investment landscape?

Trump

Trump's view of himself as a master dealmaker directly informs his economic policymaking, especially on trade. For Trump, trade is a zero-sum, binary contest of winners and losers.

He expresses this on an almost daily basis, but this tweet from March 2018 sums it up pretty well:

"When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don't trade anymore-we win big. It's easy!"

Not surprisingly, then, the Trump administration has shunned multilateral and bilateral trade policies in favour of protectionist ones.

"Trump has been very ready to use tariffs unilaterally, not only against China, but against Canada and Europe, and there's more in the pipeline," says David Uren from the United States Studies Centre.

"It's very mercantilist - exports are good, imports are bad."

It hasn't helped Australia's trading position, which is already difficult to manage given the opposing interests of our economic relationship with China and our security relationship with the US.

"The potential for the unilateral approaches favoured by the Trump administration to undercut Australia has been shown with the 'phase one' deal with China, under which the United States is likely to gain barley sales in China at Australia's expense, while Australian liquefied natural gas (LNG) and beef exports to China are also vulnerable," says Steven Kirchner, also from the United States Studies Centre.

"You've seen China imposing anti-dumping duties on Australian barley, and it's buying it instead from the United States as part of that trade deal, so Australia has become collateral damage," adds Uren.

"That kind of threat would hang over Australia if Trump was re-elected."

To be sure, Australia's export competitiveness hinges on the system of free-trade promoted by the World Trade Organisation (WTO).

"The Trump administration would act to undermine the WTO and pursue further unilateralist approaches to trade that would be damaging to Australia's interests," says Uren.

The US economy has performed well under the Trump administration, with strong growth and, prior to the COVID-19 pandemic, falling unemployment.

Yet as the trope goes - correlation is not causation.

"There is debate about the extent to which the Trump administration's company tax cuts contributed to the increase in growth," says Kirchner.

Meanwhile, America's stockmarket has performed strongly under Trump. This matters for Aussie equity investors. Our shares are closely influenced by the American market. If US stocks go on a tear in overnight trading, it's highly likely the Aussie market will open higher come morning.

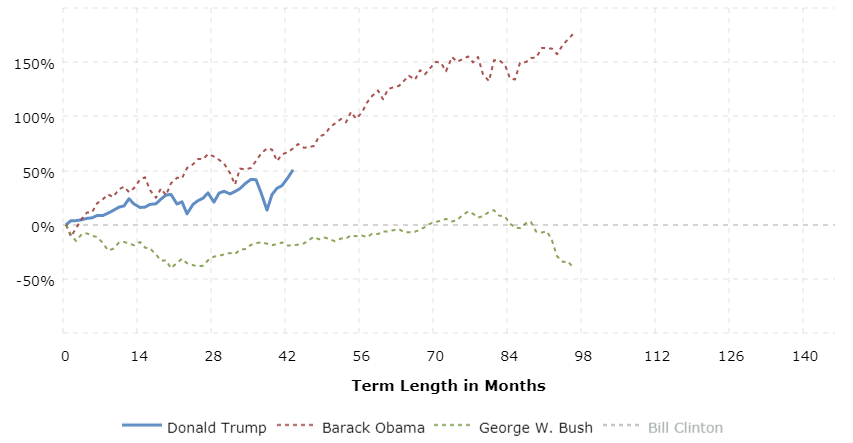

Trump's tenure has seen America's S&P 500 lift to historic highs, although it should be noted that, despite his rhetoric, Trump's market gains have fallen short of Obama's. This graph from macrotrends.net shows the running percentage gain in the S&P 500 by presidential term.

Biden

Joe Biden has premised much of his campaign on reversing Trump's policies. However, in terms of trade, it may not be the 180 degree flip one might expect.

Biden has reinforced the need to restore US economic and security alliances, and he's voiced strong support for multilateral institutions. Yet he still appears to be sympathetic to some form of US protectionism.

"He has articulated a 'buy America' campaign, which goes against WTO rules about being non-discriminatory," Uren says.

Still, "a Biden victory would remove some of the bilateral trade structures that would be contrary to Australia's interests".

While the American stock market has performed well during the Trump administration, a Biden administration may not be a bad thing for stocks.

According to analysts at JPMorgan, "The consensus view is that a Democrat victory in November will be a negative for equities. However, we see this outcome as neutral to slight positive."

A Biden victory could also be a boon for Asian equities.

"For Asian stock markets, we think both scenarios of a Biden win would be a more positive outcome," according to UBS.

"A more predictable and less openly hostile foreign policy would lower uncertainty on, for instance, the outlook for tariffs and the potential delisting of Chinese shares in the US. A tax hike would have little direct impact on Asia."

Get stories like this in our newsletters.