Millions of Australians losing out on super returns

By Dan Miles

Millions of younger Australians are missing out on higher superannuation returns by parking their retirement savings in default MySuper products, instead of exploring other investment options with a greater exposure to shares.

By increasing their risk levels a little and using a portfolio consisting entirely of equities, superannuation investors could improve on the returns being offered by MySuper investment products.

According to Innova Asset Management's analysis of APRA data, more than 5.2 million young Australians are missing out on higher superannuation returns by investing their retirement savings in default MySuper accounts.

Outperforming MySuper

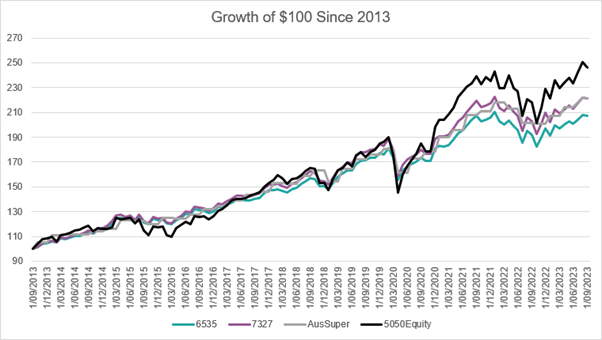

Our analysis reveals that an all-equities portfolio spread equally across Australian shares and unhedged international shares outperformed the typical MySuper 'balanced' fund by 13.6 percentage points over the decade ended September 1, 2023, and by 16.8 percentage points over the multi-decade period from January 1, 1995, to September 30, 2023.

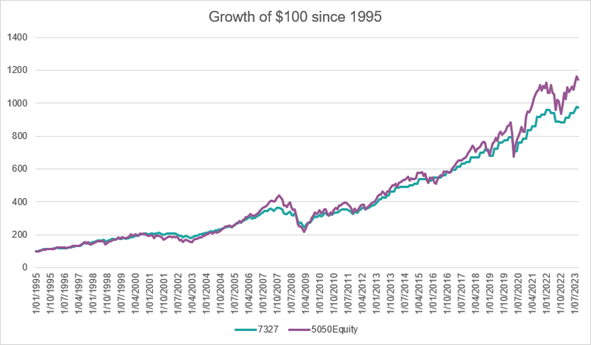

As MySuper hasn't existed since 1995 (it was introduced in 2012), Innova developed a simulated model and ran it from 1995 to test longer-term outcomes.

While an all-equities portfolio posted more volatility compared to MySuper accounts, this evened out over time, as shown in the graph below.

The chart compares a proxy MySuper offering (the 73/27 portfolio, with 73% invested in growth assets and 27% defensive), AustralianSuper's MySuper, a typical 65/35 growth/defensive portfolio of liquid indices, a 100 per cent equities portfolio.

However, this timeframe misses big stock market events like the GFC and tech-wreck.

To remedy this, Innova developed a MySuper proxy (labelled 73/27), which almost precisely tracks the typical MySuper offering in terms of risk and return.

We tested longer time horizons, with outcomes displayed in the chart below, where we ran the 73/27 portfolio from 1995 up until the MySuper data was available. This represented how MySuper would have performed since 1995. From 2013 onwards, we used actual MySuper data.

Implications for young Aussies

Our analysis reveals a significant outperformance with important implications for wealth creation.

Younger Australians are much better able to cope with negative returns that an all-equities approach will bring as they have ample time to recover and benefit from years when markets fall.

Innova's analysis of the APRA data reveals Australians under the age of 40 years hold more than 10 million MySuper accounts, so they typically face a 25- to 45-year investment time frame before their superannuation is accessible.

In short, younger investors can afford higher-risk options as their retirement is decades away.

According to separate research from the Productivity Commission released in 2018, being invested in an underperforming MySuper product could leave a typical new workforce entrant $375,000 or 36% worse off by retirement age.

A typical full-time worker who invested in the median underperforming MySuper product would retire with a balance 36% or $375,000 lower than if they were in the median top-10 product.

In summary, many younger Australians could be doing a lot better with their superannuation.

There are currently around 61 MySuper products which are intended as low-cost, simple products suitable for most investors.

Most are balanced funds, with a static 70:30 growth-defensive asset portfolio allocation, though a small number are lifecycle funds, in which investors' exposure to defensive assets increases as they approach retirement age.

MySuper products were designed to cater for a largely disengaged customer base given superannuation's distant payoff.

Those least likely to be engaged - and so invest in default MySuper products - are young people with lower education, those on lower incomes and people with lower financial literacy.

However, even younger Australians on higher incomes with relatively higher levels of retirement savings remain invested in lower-returning MySuper products.

To compare super funds, you can use the ATO's YourSuper comparison tool.

If you find that your MySuper product is underperforming, it's important to get advice on how you could improve your retirement outcomes.

Many younger Australians who are by default investing in MySuper products would be better off with financial advice.

This represents an opportunity for financial advisers to offer more affordable and scaled financial advice to young Australians so that they can get the most out of their superannuation.

Get stories like this in our newsletters.