ASIC slams school banking programs as 'persuasive advertising'

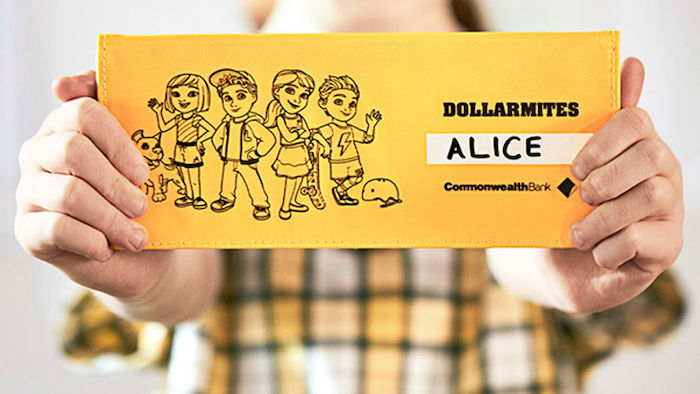

The Australian Securities and Investment Commission (ASIC) has slammed school banking programs for being marketing campaigns with no educational benefit. And they could be costing your kids hundreds in earned interest.

In its review of school banking programs, released yesterday, ASIC found the programs:

1. do nothing to improve the short- or long-term saving habits of account holders, despite providers claiming that participation leads to an increased understanding of money and savings;

2. are persuasive advertising strategies to develop brand loyalty, despite students having little or no ability to filter marketing messages;

3. fail to disclose their strategic objectives to acquire customers;

3. and create a conflict of interests through the kickback payments to schools in order to incentivise participation.

The findings been welcomed by consumer advocacy groups.

"ASIC has painted a damning picture of school banking programs, making it clear that a key objective of programs is to recruit customers at a young age," says CHOICE CEO Alan Kirkland.

"Most importantly, ASIC has warned school communities not to rely on claims that these programs help kids to develop good savings habits, describing these as 'unsubstantiated'."

Sally Tindall, research director at RateCity.com.au, says the report exposes the weaknesses of letting banks into our schools to teach our kids about money.

"School should be a safe environment where kids aren't exposed to financial marketing and advertising," she said.

"If McDonald's came into schools to teach kids about healthy eating there would be an outcry. When it comes to teaching kids about money, parents and teachers should be taking the reins.

Tindall believes financial education should be included in schools' core curriculum.

"Learning about money is a life skill but right now it's buried in the curriculum. It should be a stand-alone subject," she says.

"School banking is a convenient way to get your kids to learn about banking, but parents can easily do this at home without being forced to use one specific provider."

Failure to shop around could cost students thousands come adulthood.

Financial educator Nicole Pedersen-McKinnon has developed an interest integrity index which calculates the difference in interest rate between the average big four and the best product in the market, across the average Aussies' credit card, personal loan and home loan.

These interest rate differentials add up to an estimated $150,346.

So what youth saving accounts generate the biggest returns?

RateCity.com.au has crunched the numbers of 25 kids' accounts to see how much interest they earn when a child deposits $10 a week into the account from kindergarten through primary school.

It found that when factoring each product's terms and conditions, the highest interest rates didn't necessarily turn into the biggest returns. The account with the highest interest rate (LCU) ranked last in terms of interest earned due to onerous terms and conditions.

RateCity also found that CBA's Youthsaver ranked 22nd in terms of rate and 21st in terms of interest earned. At the other end of the spectrum, CUA's Youth eSaver earned the most interest over the seven years from kindergarten to year six.

"CBA's YouthSaver is offering a rate of just 0.80% - parents can teach their kids to do better than this by shopping around," says Tindall.

Get stories like this in our newsletters.