Why Charter Hall Group is a buy

Charter Hall Group (ASX Code: CHC) invests in and develops real estate in Australia.

The company operates across commercial, residential and industrial properties.

The group is split into two main businesses, property investment and fund management.

Property investment

The property investment business directly invests in properties, usually alongside partners such as superannuation funds and companies, and collects rental income from tenants.

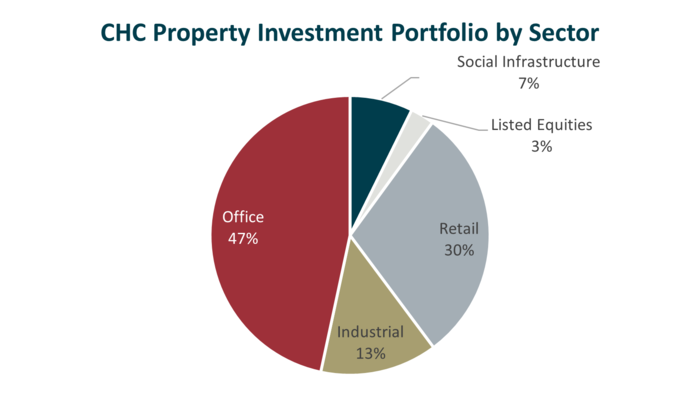

Its investment portfolio, worth $2.85 billion and comprising of 1445 properties is spread across Australia and is diversified across the office, retail and industrial sectors.

The company also invests in social infrastructure such as early learning centres and local government buildings. The below chart summarises the sector breakdown.

Funds management

The funds management business invests in both listed and unlisted properties on behalf of clients, and it receives a fee for doing so. In addition to this, it provides other services such as project management, leasing, development and property management.

The client base consists of wholesale investors (super funds and sovereign wealth funds), listed funds and retail clients such as high net worth individuals.

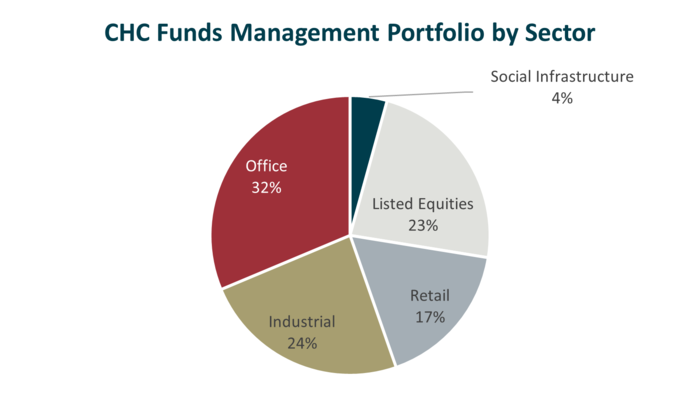

Their portfolio is well diversified across office, industrial, retail and social infrastructure as shown in the below chart. Tenants are mostly high quality and include the Australian government, Wesfarmers, Coles, Telstra and Amazon to name a few.

Property funds under management (FUM) stands at $61.3 billion and has grown by an impressive 28.5% per annum over the past five years due to acquisitions of other funds or investment managers and through organic growth.

Charter Hall recently announced the acquisition of a 50% stake in Paradice Investment Management which diversifies the business away from real estate and into listed equities and adds a further $18.2 billion in FUM.

Strategy

CHC has a strong track record of outperforming industry benchmarks, delivering superior rates of return through its investment strategy which prefers long WALE (weighted average lease expiry) and high-quality tenant covenants.

These measures mitigate some of the risks of rent variability and exposure to tenant default risk. It has a clear focus on accessing capital from clients and to deploy this to attractive investment opportunities.

Returns

Charter Hall's share price has returned an impressive 27.7% annually, over the past 10 years, including the reinvestment of dividends. This compares with an annualised return for the ASX Property Index of 12.2%pa and for the ASX200 a return of 11.5%pa.

Share price growth has made up approximately 60% of this return, with the remainder coming from dividends which have been growing at 6.8%pa over the past five years. The yield on the stock is currently 2.5% and is 40% franked.

The recent first half 2022 result was ahead of market expectations due to stronger performance in the funds management business. Earnings guidance for the full year was upgraded for a third time (in how many months?) by the company.

ESG considerations

Environmental considerations for a real estate company are focused around green building ratings, energy efficiency, carbon emissions and renewable energy usage.

Charter Hall has committed to 100% net zero carbon emissions by 2030 and 61% of operations are powered by grid-supplied renewable energy. Our ratings show that Charter Hall has an above-average environmental score and rates particularly well on its resource reduction initiatives.

The company scores very well on social matters, which can be attributed to the company's employer awards and community work via FoodBank and UNICEF.

Recommendation - BUY

Charter Hall is one of our preferred real estate holdings and as such we rate it a Buy. The company rates well on both our fundamental (quality, growth and valuation) scores and sentiment metrics as well as being well regarded by our ESG metrics has favourable ESG metrics. The company has consistently improved its return on assets, invested capital and equity over time.

The short-term outlook is positive supported by the fact that the company has upgraded its 2022 earnings guidance three times since November 2021. Recent share price moves reflect a possible concern by the market that the Paradice investment takes the business away from its core competency of real estate funds management but there are perhaps some synergies on the revenue side with regards to new client relationships to take advantage of.

Longer-term, Charter Halls diversified exposure is well placed to combat any potential risk of a work from home movement which could see demand for office leases reduce. In addition, funds under management could be affected negatively by any interest rate rises which would take the heat out of asset values and positively from the structural, underlying growth in superannuation contributions and a stable allocation to property.

Overall, however, Charter Hall is top tier real estate manager that is well diversified across sectors, has a strong record of growing funds under management over the past five years and also scores well from a valuation perspective.

Get stories like this in our newsletters.