New cheap and fast ways to send money overseas

By Effie Zahos

So you want to send some money overseas? Be very careful who you choose to do this for you because currency may be a commodity but it doesn't always carry the same price tag.

With hidden fees and margins on exchange rates (this varies based on the provider's cost of doing business) you can find that by the time your money reaches the other side a chunk of it has been lost in transit.

How can I send money?

There are several ways you can send money to another country.

The most obvious is through your bank, via a telegraphic transfer.

Other ways include a cash transfer, or an international money order. Online international money payment specialists are another service that could be quicker and cheaper.

Am I getting the best deal?

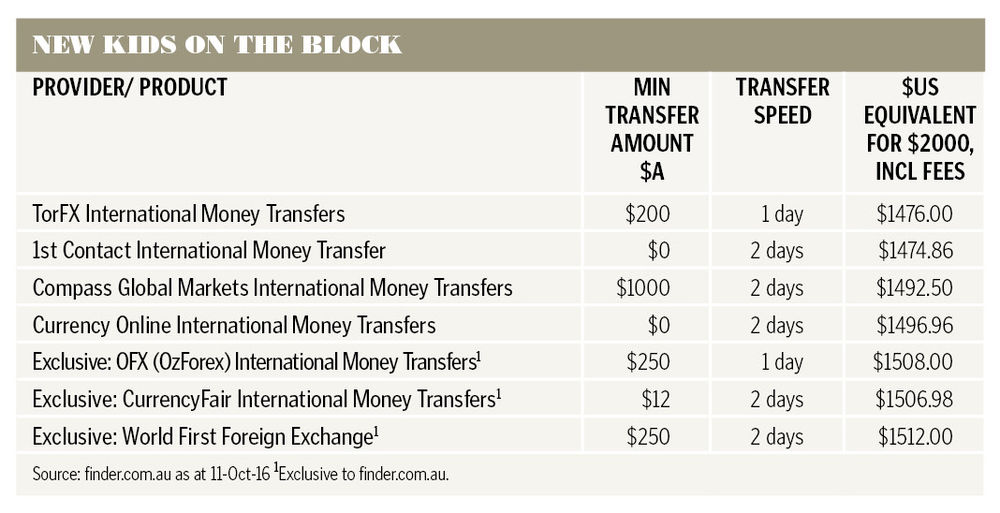

According to comparison site Finder, had you transferred $2000 into US dollars on October 11 you would have been $66 better off by using a specialist online money transfer service rather than a big bank.

The average exchange rate and fee per transfer across the big four banks was US72.05c and $20.05 respectively, while the exchange rate and fee across the seven providers that Finder compared for Money were US74.98c and $9.45.

So why do most of us still use a bank?

"Banks charge more because they can," says Richard Kimber, chief executive of OFX (previously OzForex).

"Our market research shows that 81% of Australians would use their bank to send money overseas, so the banks don't have to work as hard to earn your business."

International payment specialists such as OFX are still considered an emerging market category globally. In Australia the banks dominate the cross-border payment market, and online money transfer providers account for less than 10%.

With billions of dollars transferred overseas each year, it's big business for the banks but one that Andrew Porter, managing director at online money transfer specialist World First, says has more to do with the fact that consumers are simply unaware of their alternatives.

"There's a lack of awareness in the marketplace about international money transfers, which is something that banks are more than happy to take advantage of," he says.

"People default to using their bank out of perceived convenience. That's where their money is, that's who they are used to dealing with and they often don't know there is another option."

Get the best deal

Depending on how payments are made, both sending and receiving banks charge fees on the funds sent and both the payer and receiver pay.

"Many customers also don't realise that it's standard practice for their recipient to be charged an additional $25-$50 by the receiving bank," says Kimber. "So senders don't know how much their transfer is really going to cost until it's too late."

To locate the best exchange rate, Finder suggests using a resource such as XE, which provides live conversion rates. Keep in mind that the fees for your transfer must also be competitive.

Check the fine print

But do be careful you if are quoted an exceptional exchange rate.

As Kimber says, price isn't everything.

"If you see a price that looks too good to be true, it could be because your provider is taking short cuts or excessive risks, which are definitely not in the customer's interest long term."

OFX was the only transfer company that stayed open during the Brexit turmoil.

Locking in a forward exchange contract is also a good idea, says Finder's money expert Bessie Hassan.

"If you don't have the funds handy now but you want to lock in a competitive rate, you can enter into a forward contract. This involves an 'agree now, pay later' agreement whereby the transaction occurs on a predetermined future date. However, bear in mind that you'll need to complete a deposit which is held as security for the transaction."

The good news is that there are now a number of alternatives for money transfers. The bad news is that you may just be spoilt for choice.

Get stories like this in our newsletters.