Will a housing slump take the gloss off Dulux shares?

By James Greenhalgh

Key statistics: ASX: DLX Closing share price 30.05.17: $7 52-week high: $7.185 52-week low: - Most recent dividend: 13c Annual dividend yield: 3.62% Franking: 100%

DuluxGroup lives the decades-old slogan of its Berger paint brand: the company "keeps on keeping on".

It probably won't shoot the lights out but its strong collection of brands, including Dulux, British Paints, Porter's, Cabot's, Feast Watson and Selleys, mean it's top of mind for renovators.

For the half-year to March 31, the company produced sales growth of almost 5% in Australia, compared with market growth of only 0.5%, as it took market share and consumers shifted to premium brands.

Even so, the Australasian paint and coatings business produced the weakest earnings growth of all divisions, with first-half operating profit rising 7% to $89 million. But this division is undoubtedly the company's heart and soul - it generates just over half of sales but more than two-thirds of profit. It's a fantastic business with operating margins above 17% and a market share of around 46%.

The remainder of DuluxGroup's businesses aren't as strong, but the best of them is Selleys Parchem, which manufactures the ubiquitous No More Gaps as well as construction chemicals. Here earnings rose 11% on flat sales due to cost reductions.

However, B&D Group - acquired with the Alesco takeover in 2013 - has never quite lived up to expectations. The garage door manufacturer now earns less than it did under Alesco's ownership, but managed to produce a 13% increase in operating profit in the first half.

Lincoln Sentry, which makes cabinet, window and door hardware, has performed somewhat better since the takeover and generated a 22% lift in first-half profit.

In total, DuluxGroup's first half sales rose 4%, while underlying net profit rose 9%.

So what of the future?

DuluxGroup is not as cyclical as other building materials companies. Paint is a low-value, high-impact way to renovate your home, and maintenance and home improvement account for about two-thirds of the market.

Nevertheless, we can imagine earnings falling 10%-20% in a "regular" recession or housing downturn, with the non-paint divisions most at risk.

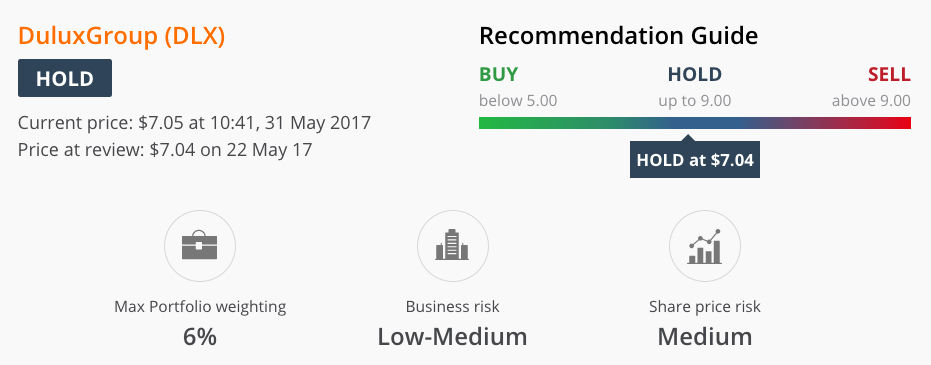

The stock is priced on a forward price-earnings ratio of 20, which certainly isn't cheap. Yet this is a higher-quality business than it appears at first glance. HOLD.

Get stories like this in our newsletters.