Why gold stocks are gleaming right now

By Arian Neiron

The volatility in sharemarkets this month is a reminder of how fragile financial markets really are. Equity markets have had a record run in the US and in Australia this year, but further gains are by no means guaranteed as risks mount in the global financial system.

With the threat of the tapering back of quantitative easing in the US, the rapid spread of the Delta COVID-19 variant raising doubts about the global economic recovery, and now, concerns about Evergrande and big debts in Chinese property markets, equities may be in for a volatile ride ahead.

These factors, along with other systemic financial risks, could support the gold price back over record levels.

We still see plenty of tail-risk drivers that have the potential to drive gold over US$2000 per ounce and Australian gold miners will join the likely rally. We believe inflation is a longer-term problem and will persist into 2022. Economic growth is at risk once the massive fiscal spending has run its course and is further threatened by the potential removal of monetary stimulus.

The scenario of ongoing low interest rates also will help to sustain the gold price too. Historically low bond yields and negative real interest rates have helped to push gold higher. When real rates are negative, investors are not getting any return at all on cash deposits, so gold becomes competitive with interest-bearing assets.

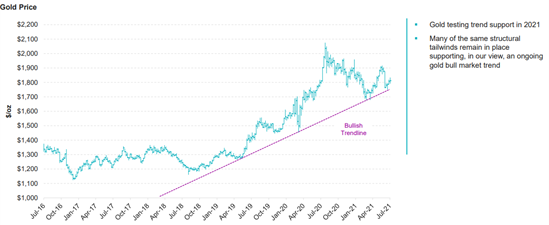

These structural tailwinds support an ongoing gold bull market trend, with a test of the record high of $US2079.68 struck back in August 2020.

In the shorter term, gold may spend longer than anticipated consolidating around the US$1800-US$1900 per ounce range, but that is still much higher than where it has been in recent years. Gold was quick to rebound from a flash crash in early August and so a show of continued resilience should help re-establish a bull market trend for gold.

Similarly, we maintain an optimistic outlook for gold miners. Current gold prices are still well above the gold industry's average cost of production and managements are as committed as ever to ensuring the financial stability, project execution, and capital return objectives for their companies.

Gold companies' operating margins have expanded significantly in recent years. Not only has the gold price reached record highs, but companies have also reduced and controlled costs, allowing margins to increase to record levels.

Gold companies are able to generate substantial free cash flow at current gold prices. While markets may be concerned about rising costs, we believe gold companies will remain disciplined and continue to defend margins. The gold mining sector of today is well-positioned to sustain profitability and demonstrate its appeal for those seeking gold exposure but also to earn its place as an investable universe within the broader equity market.

Indeed, gold miners are making a strong case for value investors right now; debt reduction and free cash flow generation has fundamentally transformed how these companies look on both an absolute and relative valuation perspective.

Like many other assets, you can hold gold directly or through a managed fund, but holding gold bullion comes with significant extra costs including storage and insurance. A more convenient way to invest in gold is by buying units in a gold-themed exchange traded fund (ETF). Some ETFs invest directly in gold bullion while others invest in gold miners. The advantage of buying gold miner ETFs is that they pay dividends and allow investors to capitalise on the leverage miners enjoy from any rise in the gold price. ETFs are simple, cost efficient, and offer a quick way to access gold and gold miners.

Get stories like this in our newsletters.