ESG activists under fire from Morrison government

By Susan Hely

One of the biggest investment trends, known as environmental, social and governance (ESG) investing, is coming under pressure from the Coalition government.

ESG investing is informed by specialist groups and the government is seeking to outlaw informative activism.

In a speech to the Queensland Resources Council in November, the prime minister, Scott Morrison, said the government would outlaw activists who drive boycott campaigns against businesses.

He argued that environmentalists targeting businesses that invest in non-renewable industries pose a threat to the economy.

"Together with the Attorney-General, we are working to identify mechanisms that can successfully outlaw these indulgent and selfish practices that threaten the livelihoods of fellow Australians, especially in rural and regional areas."

Investment managers are hitting back at the moves. Australian Ethical Investment, which has been specialising in ESG investing for 35 years, says environmental activism is hardly a fringe or niche movement.

"When you can't win the debate on climate, you try to shut it down," says Stuart Palmer, head of ethics research at Australian Ethical Investment.

"It's sad but not surprising that the government will try to shut down climate campaigns and debate. If you're a master of climate inaction, it's pretty embarrassing when people get on and start making changes without you."

Twenty-five per cent of global investment portfolios integrate ESG principles, according to a survey of global asset managers and pension funds by the index provider MSCI. It found that increasingly managers would not win mandates unless they integrate ESG principals into their investment processes.

Investment managers said they expect ESG principles will influence 50% to 65% of assets in the next five years.

Palmer says the prime minister's language about environmental activists seeks to demonise them.

"Could it be that it's not the fringe but the growing realisation that the economic opportunities of the low-carbon transition are far greater than the risks of clinging to yesterday's technology?" he asks.

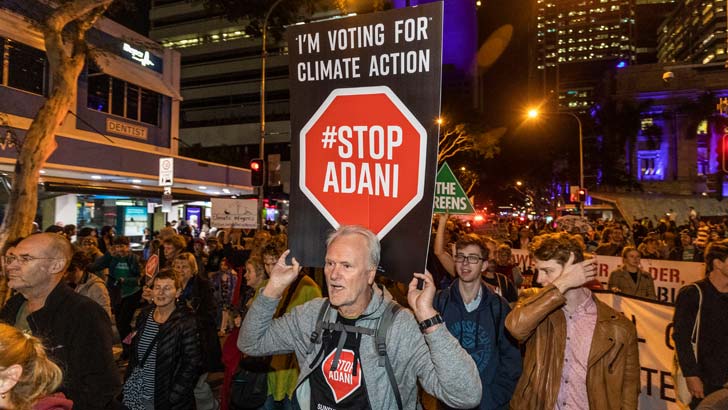

The mining industry is feeling the heat from investors. For example, banks, insurers and engineering companies have come under pressure from the ESG movement not to support the controversial Adani coal mine in Queensland.

A sound ESG stance is attracting more investors and Australian Ethical is one of the fastest growing investment managers, with $3.6 billion under management.

Palmer says it engaged with 250 companies over the 2018-19 financial year. It relies on civil society research groups such as Market Forces.

He says Australian Ethical has influenced positive change on issues relating to the environment, animal protection and the treatment of people.

Climate change is changing companies' business strategies because of the inherent economic risks, he says.

"Is it OK for politicians to abuse and threaten companies who are planning and investing for a low-carbon future, but not for citizens to speak up when they see businesses behaving badly?

"Is it OK for government to give away taxpayer dollars for new coal mines, but not for consumers to decide who they spend their hard-earned money with?"

Shareholder activism is on the rise, particularly from superannuation funds, managed funds, research groups and not-for-profit investor organisations such as the Australian Shareholders' Association, which pools individual shareholders' votes.

It is the shareholders who own companies by buying shares. They have been shining a spotlight on toxic corporate behaviour and poor environmental policies that could be dampening down the share price.

Other issues are undeserving director and manager remuneration.

Increasingly shareholders are asking companies to explain their environmental policy, broaden the diversity on the board and address other high-profile issues. Activists have ammunition such as the "two strikes" rule for remuneration.

Get stories like this in our newsletters.