Has parts supplier GUD Holdings hit top gear?

Despite the weird name, GUD Holdings (ASX:GUD) has been a stalwart of the ASX for almost 60 years. That sort of longevity implies it must be doing something right. It has undergone a lot of change over the years, buying and selling businesses. Revenue has almost doubled over the last two years as a result of acquisitions.

GUD is now primarily an automotive parts and accessories business with 89% of revenues in the most recent interim results coming from this segment. The balance comes from the water segment.

The water business consists of Davey Water Products which supplies water-related products for farming and irrigation, home and garden applications, pools and spas, commercial and water treatment purposes.

Revenue declined a bit in this segment, in the most recent interim results, as export sales were severely impacted by destocking activities, especially in Europe. Margins are also quite low for this part of the business at sub 5%.

The automotive sector consists of a host of different brands and products. It includes APG Group which was acquired in January 2022 and accounted for 27% of total revenue in the most recent half.

GUD manufactures a lot of its own products as well as being a distributor.

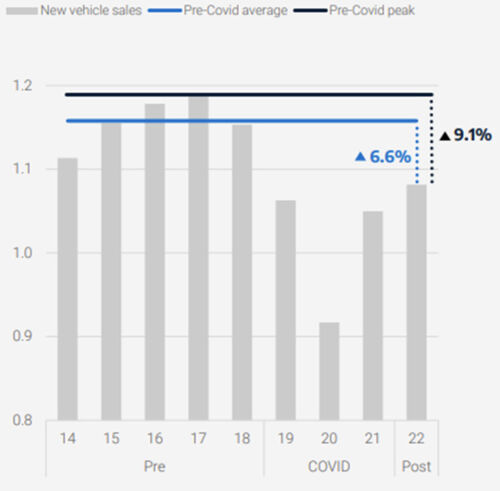

The fortunes of GUD are tied closely to those of the car industry. New car sales have rebounded since the depths of the pandemic, but are still 9% below their highs in 2017 and 7% below the five-year pre-COVID average.

In the 2022 calendar year, the overall market for new cars was up 3.0%, but for the top 20 models for GUD sales rose by 4.7%. GUD's products are more targeted at pickups (utes) and SUVs. Sales of particular vehicles have been very volatile as supply has fluctuated wildly. Wait times have been pushed out to as much as 250 days.

These trends have a flow-on effect for GUD, as people often kit out their four-wheel drives with a bunch of cool accessories when they pick them up from the showroom floor.

But GUD is not entirely at the mercy of new car sales. In fact, 80% of the automotive revenue (excluding APG) comes from non-discretionary spending, that is replacement parts for wear and tear. This side of the business benefits as the average age of cars on the road increases and that has been gradually increasing and is forecasted to keep growing.

Investors may be concerned that, as car demand steadily marches away from internal combustion engines (ICE) cars, demand for GUD's products will fall. That is certainly the case for some products, but according to the company, 69% of GUD's automotive revenue profile is not dependent on ICE vehicles.

GUD's balance sheet has been impacted by these acquisitions. They are carrying a fair bit of debt although they are trying to manage it down with a target of getting net debt down to two times underlying EBITDA by June. At December it was 2.5 times.

This has led to the Bankruptcy risk (Altman Z1 - score) being in the Distress zone although it has improved following the latest result and is getting close to the cautious zone. The debt maturity profile is reasonably balanced with maturities extending out twelve years, however, there is $137 million in debt maturing in 2024 and that will need to be refinanced.

That should not be a problem, however, it is likely to be refinanced at a higher rate given the current interest rate environment.

The acquisitions have also been partially funded by equity capital. Shares on issue have increased from 90 million to 129 million over the past few years. This will often result in retail investors having their shareholding diluted.

The most recent interim results were reported on February 15 and were very well received by the market. The share price has jumped 21% since. EPS is now forecast to almost double to 81c in FY23 followed by further growth of 11% in FY24. EPS fell markedly in 2022.

Reviewing the Stockopedia StockRank we can see that it has improved from 81 to 87 out of 100 since reporting. This has largely been driven by improvements in the Quality Rank. A significant contributor to the Quality Rank is the Health Trend which is based on the Piotroski F-score and went from three to five. Operating margins, return on capital employed and return on equity all also improved.

The other two components of the StockRank, being Value and Momentum, declined. The sharp share price rise makes the value metrics look a bit less attractive than previously, however, they are still relatively good. The forecast PE ratio is 12.4, and the PE to Earnings growth (PEG) ratio is 0.6. The dividend yield is 4.1%, fully franked.

The rankings are a relative rank relative to all the other companies listed on the market. Therefore, the movements in the rankings do not only reflect the fundamentals of the business in question but also movements across other companies.

Trading activity in January and February has been quite strong across each area of the business. There are still capacity constraints due to ongoing tight supply of new vehicles, but the expectation is that this will gradually ease. Overall, the business seems to be well-managed and continuing to grow despite a challenging external environment.

Get stories like this in our newsletters.