How to cash in on Australia's five-star aged care

By Greg Smith

Key statistics: ASX: EHE

Closing share price 1.11.17: $3.565

52-week high: $3.60

52-week low: $2.346

Most recent dividend: 8c

Annual dividend yield: 5.98%

Franking: 100%

The news-flow on aged-care provider Estia Health (ASX: EHE) has been fairly light in recent months but this has not stopped the share price from gaining further momentum and hitting a 14-month high.

We believe that the turnaround is starting to "sink in" with investors, and following the forecast beating full year result in August.

After an annus horribilis in 2016, the worm appears to be turning, with an improving technical picture confirming the fundamental revival in play following the recapitalisation of the company's balance sheet and entry of new management into the fold.

Estia Health is the owner and operator of aged care facilities in Australia, and had 5910 operational places. The company has a deliberate strategy of targeting higher income social economic metro areas. The company is therefore targeting its product at customers who are after a "higher" level of service.

The underlying thematic also clearly remains a compelling one. Australians are living longer, and many baby boomers are set to retire over the next 15 years, increasing the demand for high quality aged care services. This is particularly as studies show that most retirees will need to cash up equity in their own homes, and move into care to sustain themselves in their twilight years.

Estia Health has had a tough time over the past 12 months, but we possessed a certain degree of optimism heading into the full year results. Particularly given the balance sheet had been steadied by a capital raising, and that the highly experienced and well respected Norah Barlow had been installed as CEO.

A director at the time, Barlow was elevated to CEO late last year.

We hold her in high regard, as she had headed up NZ focused Summerset Group, one of the most respected retirement village operators in Australasia. High profile agitator Dr Gary Weiss was also elevated to the role of chairman in February, and we believe this has significantly strengthened the company's management and oversight.

It is still early days, but the first set of full year results under the duo are very encouraging. Total revenues rose 17.7% to $525.7 million, while the full year net profit before tax to June 30, 2017 rose some 47% to $40.7 million. EBITDA was in line with guidance at $86.5 million.

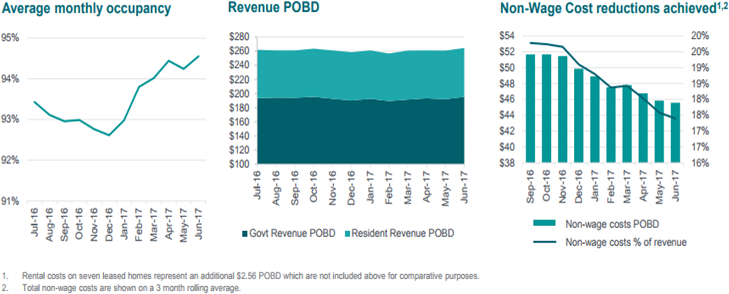

A focused effort has also seen occupancy levels lifted, and during the course of the year this came in at 93.5%. We expect this to rise further as the company engages in a material refurbishment program.

The company invested a total of $57.8 million during FY17, including an expansion of the footprint with the Twin Waters (114 beds) and Kogarah (72 beds) greenfield developments. The facilities upgrade should also be pivotal in lifting margins in our view.

The company has also made progress on controllable costs as well, with non-wage expenses (excluding facility rentals) falling by $4.30 per bed from H1 to H2 to $44.20.

Thanks to a $136.8 million capital raising earlier this year and strong operating cash and RAD (refundable accommodation deposit) inflows, Estia's balance sheet is also 'night and day' compared to where it was a year ago.

Net debt has more than halved to $102.3 million, and the company's gearing ratio fell to 1.2 times EBITDA, and significantly below the company's target range of 1.5 - 1.8 times.

The care space has some regulatory risk, but also clearly remains highly fragmented which may create opportunities for Estia down the track given its balance sheet strength.

Overall, we view the company's valuation is undemanding at 20 times FY18 earnings, and with a near 4% dividend yield.

Get stories like this in our newsletters.