Hot stock: Why we think Champion Iron is a buy

By Simon Brown

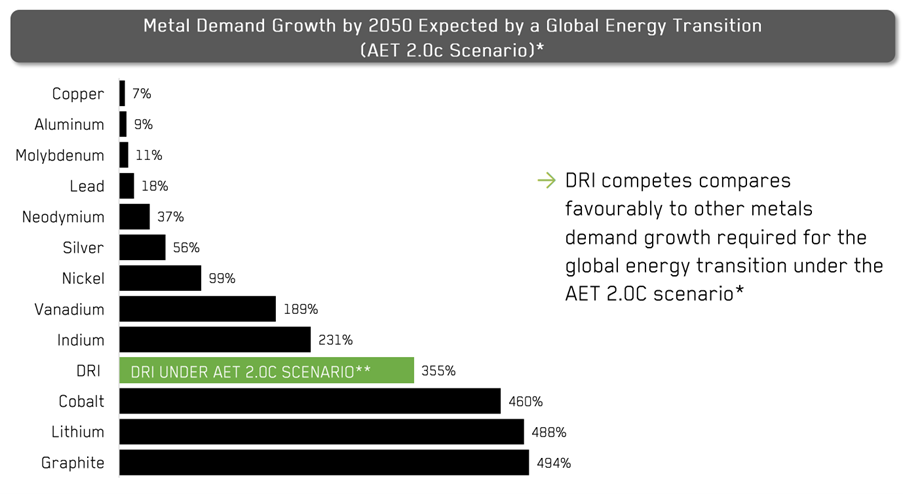

With the global drive to reduce greenhouse gas emissions as part of the Paris Agreement on climate change, much of the market's attention is currently on electrification and battery metals ingredients such as lithium and copper.

However, the steel industry currently accounts for 8% of global emissions, increasing from 5% over the past 20 years.

Improving raw material input quality and shifting to a greater proportion of Electric Arc Furnace (EAF) production, that can run on power from renewable energy sources (and away from more traditional high-emission blast furnaces), is a valid adaptation pathway for the hard-to-abate steelmaking industry.

Champion Iron's Direct Reduction Iron (DRI) ore concentrate can be used by EAF steel producers in conjunction with renewable energy sources to make steel-making a cleaner process. Champion's 67.5% pellet feed concentrate, considered high by global standards, is used by EAFs to produce steel can reduce emissions by 50% relative to Blast Furnace/Blast Oxygen Furnace steel-making process. DRI can also be used in BF/BOF to reduce emissions versus more traditional lower-grade iron ore inputs.

What it does

Champion Iron is the owner of the Bloom Lake Iron Ore mine in Quebec, Canada. It was an opportunistic purchase ($10 million for 63% initial stake) during a collapse in the iron ore price in 2016, whereupon the mine had been placed in administration.

Since then, prices have recovered, and the company has invested to expand production, leveraging the existing mine and port footprint where costs were sunk by the previous owners. The mine produces high grade/low impurity iron ore, with additional investments planned to pelletise their product to further increase Fe content.

Management is experienced and has a track record of value creation. Founder Michael O'Keefe, who also founded Riversdale Mining which later sold to Rio Tinto for $3.8 billion, retains a 10% stake in the company.

Since purchasing their Bloom Lake mine, the company has made investments that reduced GHG emissions by 36% annually per tonne of iron concentrate produced. In all, 65% of its energy consumption is from renewable hydroelectric generation. Energy intensive expansion into pelletisation can also be powered from these government-owned renewable sources at favourable pricing.

Strategy

We see support for steel-intensive economic growth keeping demand flat out to 2030, as the Chinese government's environmental policies give way to the economic growth imperative.

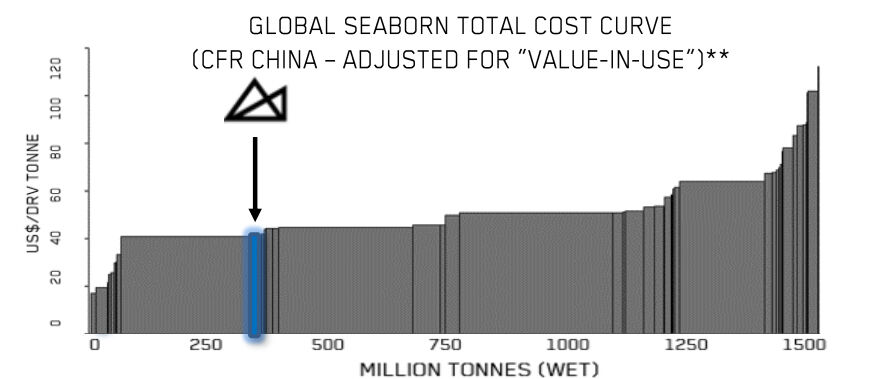

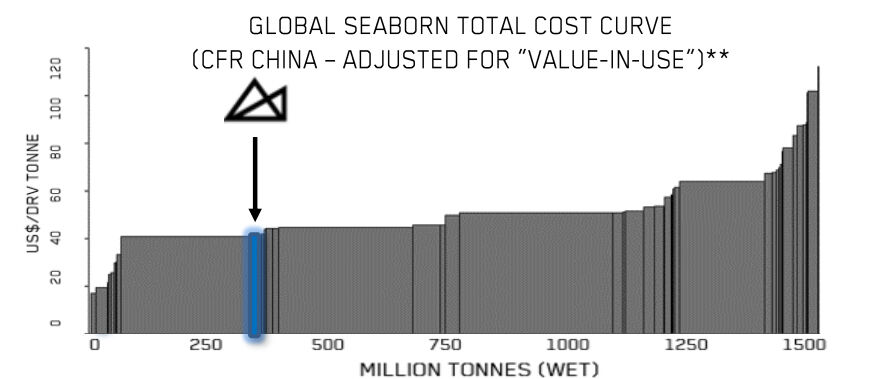

Russian invasion and delays to expansions/replacement tonnes in Brazil and Australia have supported prices. As additional tonnes come to market in the medium term, we think Value-In-Use will become a key focus, as de-carbonisation premiums benefit cleaner iron feedstocks such as DRI.

Champion's quality product position is now supported by a competitive cost base after recent investments. Improvements at the process plant and a mine plan optimisation lowered strip ratios, increased recoveries and subsequently raised production above nameplate.

While electricity costs have traditionally been low in Quebec, Bloom Lake's cost position is now enhanced from lower labour costs, foreign exchange and a logistics solution reset, which lowers costs in getting product to market.

The Bloom Lake region of Canada is the second largest hub of high-grade iron ore exports. The Champion mine has had over $US4 billion invested in mine and infrastructure, predominantly by previous owners.

It has over 20 years of mine life with substantial reserves and resources available for future expansion.

Champion also is nearing completion of its study aiming to bolt on a reprocessing circuit to further upgrade product to a DRI pellet feed specification.

The project may cost US$300 million in capital expenditure and add US$5/dmt to its cost base, but would add US$15-20/dmt in premiums. Steel mill customers are logistically well located across the border in the US.

The steel industry will need to transition to lower carbon inputs to satisfy commitments to materially reduce emissions by 2050. We believe this will drive strong demand for Champion Iron's product over the medium to long term.

Returns

Over the past five years, an investment in Champion would have returned 36% a year, this compares with an annualised return for the S&P/ASX 200 Accumulation Index of 7%.

Champion paid an inaugural dividend in February 2022, as the company started to produce material cashflows, with another dividend in June, both unfranked.

At its current share price, this represents an annual yield of 4.7% and a payout ratio of around 32%. We believe there is scope for the board to lift this payout ratio, delivering materially higher dividends should current commodity prices be broadly maintained.

Recommendation: Buy

We rate Champion as a strong buy. The company sits at a material discount to its peer group, despite having vastly superior sustainability attributes and growth profile, in our view.

While the company is not the only operator in the region, we believe the drive to de-carbonise will see customers increasingly focus on sourcing from the region given the sustainability and low-emission attributes.

We're attracted to Champion's ability to leverage the move to higher quality iron ore in the future, including the combination of mine planning and execution, processing and marketing to produce a product that meets customers' increasing focus on quality.

Champion's single asset footprint and low volume carries a risk (which can be mitigated) from being able to extract full economic rent from its infrastructure and quality advantage. Key additional risks include commodity prices, changes in financial market conditions and potential poor capital allocation (we think unlikely).

Get stories like this in our newsletters.