How Aussies are saving $280 a month

By Nicola Field

How to save $280 each month, scammers face off against fusion cell, and telco teams up with Tesla boss. Here are five things you may have missed this week.

'Considered consumers' save $286 each month

Research by NAB shows Australians are saving an average $286 per month by making cutbacks or shifting their spending to focus on things they value most.

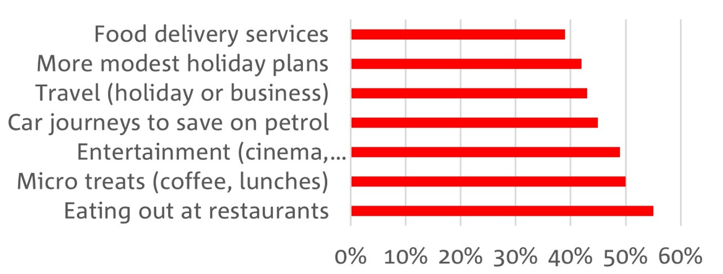

The top areas where people are cutting back on spending include:

- 55% of us are cutting back on restaurant dining. Monthly saving: around $115.

- 50% of Aussies are ditching micro treats such as coffees, lunches out and trips to the movies. Monthly saving: $55-$60.

- 40% of us are making fewer car journeys and cutting out food delivery services. Monthly saving: $60-$80.

The figures come from NAB checking in with more than 570,000 customers since May 2022.

NAB's group executive of personal banking Rachel Slade, says, "Australians have become 'considered consumers' by prioritising those things that they consider personally valuable.

"For some, that means keeping the daily coffee and croissant while for others that means saving on takeaways to secure Taylor Swift tickets. It's about personal choice and deciding what trade-offs suit your own values and lifestyle."

Anti-Scam centre make investment scams top priority

The National Anti-Scam Centre is up and running, and its first job will be combatting investment scams, which cost Australians more than $1 billion last year.

To tackle the task, the Centre is setting up a 'fusion cell' - a team of experts from the ACCC, ASIC, the banks, telcos and digital platforms.

ACCC deputy chair Catriona Lowe, says investment scams are being given priority as they "lead to the highest level of reported individual losses and cause emotional devastation for victims."

The fusion cell will aim to:

- Disrupt investment scams by stopping scammers reaching potential victims

- Remove scam websites from the internet

- Share information to help consumers avoid investment scams.

There's still plenty we can do to protect ourselves.

ASIC recommends being suspicious of anyone offering easy money.

Investment scams often involve promises of big payouts for little or no risk, quick money, or guaranteed returns. But there's always a catch.

Telstra partners with Starlink

Telstra announced this week that it has signed up to become the first provider in the world to offer voice-only and voice-plus broadband powered by Starlink to rural and remote Australians.

Pricing and device details will be advertised closer to launch, which Telstra expects to be in late 2023.

However, the big telco may have missed the gun.

Starlink, the brainchild of Twitter and Tesla owner, Elon Musk, has already become the darling of many regional Australians.

An estimated 100,000 country residents have signed up to Starlink despite the upfront hardware cost of $199 and $139 monthly price tag.

The appeal is that Starlink is a low-earth orbit player, and delivers faster speeds than the NBN's geostationary satellite Sky Muster.

Telstra CEO Vicki Brady "What will set our offer apart is the addition of Telstra voice service, a professional install option and the ability to get local help with your set up if needed."

It will be interesting to see if this support resonates with notoriously resourceful country folk.

Already, Starlink's portable satellite dishes, which are easy to set up, can be spotted strategically positioned in front yards from Moree to Muswellbrook.

Can't lose with property? Think again

The latest Pain and Gain report from CoreLogic shows that residential property is not always a sure thing.

The study found that among homes resold in the three months to March 2023, 92% made their owners a profit, with the average gain being an impressive $276,500.

That still leaves almost one in 10 properties resold for a loss, typically leaving sellers out of pocket by $40,000.

The highest proportion of loss-making sales for the quarter were in Darwin, where over one in four (29.5%) properties were sold for less than the price paid by the seller.

Hobart saw the lowest level of properties sold at a loss - just 1.0%.

CoreLogic also found the longer a property is held, the bigger the profits on resale are likely to be.

Properties held for less than two years notched up median profit on resale of less than $73,000.

Those held for 30 years-plus were likely to reward owners with a $700,000 profit.

Australians race to refinance before cashbacks end

All eyes may have been on interest rates this week, but home owners haven't dropped the ball on cashbacks available to refinancers.

Mortgage Choice says borrowers rushed in to get a better deal during June, before many lenders shelved their cashback offers on June 30.

Mortgage Choice CEO Anthony Waldron says, "Home loan submission data shows the biggest spike in refinancing activity this year, with 52% of all loans submitted by Mortgage Choice brokers in June being refinance transactions."

Cashbacks are still available through a variety of lenders though some have set a use-by date.

St George Bank's $2000 cashback ends August 31. IMB's cashback worth up to $4000 ends July 31.

Other lenders including ANZ (up to $4000) haven't yet set an end date for cashbacks.

Waldron adds that borrowers appear to be chasing certainty.

He says, "During June, we saw a surge in demand for fixed rate products, with 14% of loans submitted by our brokers having a fixed portion, compared to just 7% in the month prior."

Get stories like this in our newsletters.