Is Imdex a buy, hold or sell?

By Simon Brown

Imdex (ASX:IMD) is a leading global mining technology company that seeks to help drilling contractors and resource companies to drill faster and smarter, obtain accurate subsurface geological data and receive critical drilling information in real time.

Its end-to-end solutions combined with cloud connectivity (via its client platform HUB-IQ) is unique, and extensive industry feedback supports the view that Imdex has market-leading technology and is well-positioned to maintain its strong competitive position given its scale and its commitment to investment in research and development (R&D).

Imdex is commodity agnostic but is most exposed to gold and copper and operates globally in more than 100 countries and has 22 facilities in all key mining regions of the world.

Historically, Imdex has been highly leveraged to the minerals and precious metals exploration cycles.

While this cycle has rebounded, we think the underinvestment over the past decade in commodities, particularly in the face of the electrification thematic, should sustain front end exploration trends as old mines deplete and new mines are required.

Today, as the company has built out its technological capability, it has deepened relationships with key end customers (tier 1 miners) through sales of integrated solutions that are designed to save clients time and money when evaluating new mining deposits or extension of existing ones.

Together with a push towards more production-exposed revenues, over time these strategies should help reduce earnings cyclicality and afford the company a higher valuation, all else equal.

What Imdex does

As the cost of drilling increases, the need to improve productivity is becoming paramount. Additional costs caused by higher operational standards, environmental restrictions and increased hole depths has resulted in miners seeking solutions to help reduce costs, risks and improve productivity.

Imdex has end-to-end solutions for the mining value chain, spanning across four portfolios: drilling fluids, drilling optimisation technology, rock knowledge sensors and software.

In all four of these key areas, Imdex has developed market-leading products with the intention of delivering a value proposition that makes it hard for clients to ignore.

Drilling fluids have an impact on 30 to 60% of all drilling operations, however account for only 5 to 15% of costs. Imdex products aim to optimise drilling productivity, drill hole and core integrity, while its fluid aims to also meet the highest standards in biodegradability and toxicity.

Drill-hole optimisation technology is focused on downhole navigation of the drill-bit together with structural geology and geo-analysis of drill holes.

These tools enable the client to better and more accurately direct their drilling while also providing real-time data on geology and structure that can enable more timely decision making out in the field.

Software is a key enabler via the IMDEXHUB-IQ, which is a secure, cloud-based portal for validating field data, seamlessly transmitted from the drill rig and integrated with leading industry software.

Given the remote locations where much of the drilling activity is conducted, the real-time ability to collate data across a client's portfolio of drilling is a key competitive advantage.

Most of Imdex's products represent small and relatively insignificant costs to miners yet can have some of the largest impacts on mine costs and profitability.

The drilling fluid market is a consumables market and products are sold. Meanwhile, the fleet of downhole sensors and drilling optimisation tools are rented to clients and software is charged on a SaaS basis.

Strategy

Imdex aims for technology leadership via a material R&D investment program. New versions of existing tools that enable connectivity, better accuracy, efficient processing or more automation cements their value proposition with clients and help win new ones.

They are often able to pass through higher pricing given the benefits of new generation tools, lifting ARPU. These connected tools also pull through software revenue as clients connect to IMDEXHUB-IQ, generating additional recurring revenue.

More recently, Imdex has targeted sales of integrated solutions rather than individual products. This results in clients taking more Imdex tools, with 44% of their top 250 clients now have greater than three products, up from 33% last year.

Further, metres surveyed with IMDEXHUB-IQ were up 26% in the past 12 months.

Through its R&D program, Imdex has extended into mining production with its IMDEX BLAST DOG moving from engineering prototype to commercial contract with a tier 1 miner in the Pilbara.

The fully automated tool analyses blast holes prior to detonation, providing information on rock location, texture, grade and mineralogy, with automated data feeding into 3D visualisation software for those responsible for blasting programs to analyse. The addressable market highlighted by management is approximately 1200 mines and potentially upwards of $1.5 billion in addressable revenue over time (Imdex FY22 revenue $342 million).

Lastly, Imdex has targeted strategic acquisitions of emerging or established technologies and software that complement existing revenue. Recent examples include Ausspec and Datarock acquisitions which tied directly into and enhanced the Imdex value chain, enabling deepening relationships with clients and additional revenue opportunities.

ESG

Mining is seen as an essential part in providing the materials required to assisting in achieving Global Greenhouse Gas reduction targets.

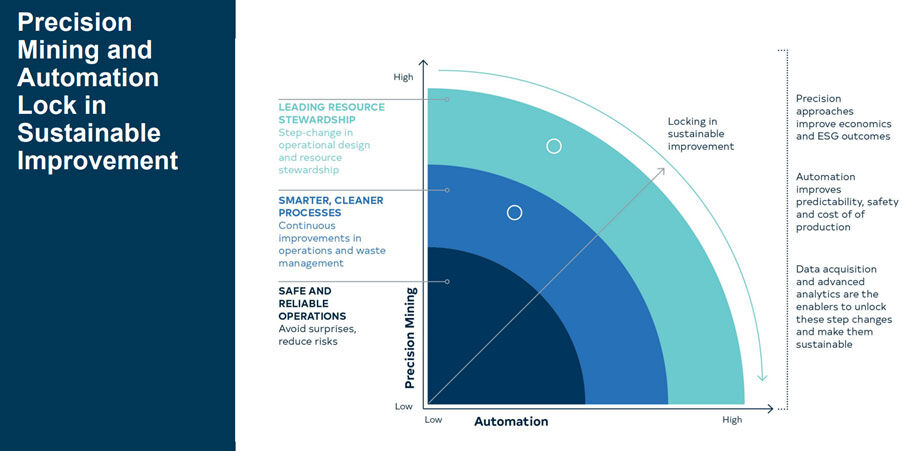

Imdex and its technologies are geared towards enabling precision mining, which targets more sustainable operations with smaller environmental footprints.

Returns

Over the past five years, an investment in Imdex would have returned 20% a year, this compares with an annualised return for the S&P/ASX 200 Accumulation Index of 4%. Imdex has paid a semi-annual dividend since 2019, alongside its investment in R&D and acquisitions, highlighting the strength of cashflows.

At its current share price, this represents an annual yield of 1.7% and a payout ratio of around 32%. Given the growth opportunity ahead of the company, we anticipate continued investment for growth while maintaining dividends in the current payout range.

Recommendation: Buy

We rate Imdex a strong buy. The company trades at a material discount to any technology related peers, largely due to the cyclical exposure of earnings.

We believe the shift to electrification should underpin exploration volumes for battery metals moving forward, potentially softening any decrease in activity in other commodities should they occur.

Their strategies should drive a degree of growth independent of the cycle, with increased adoption of integrated solutions by clients, additional and higher yielding tools per client along with penetration into less cyclical areas such as production with new technology such as IMDEX BLAST DOG.

The addressable market highlighted by management is approximately 1200 mines.

Recent transactions within the space such as Orica's acquisition of smaller competitor Axis Mining Technology highlights the value within Imdex, with the multiples paid by Orica implying between 20 to 55% upside to the current share price.

Get stories like this in our newsletters.