Latitude refusing to bow to ransom demands

By Nicola Field

Why Latitude refuses to pay ransom, small city scores big on 20-year price growth, and landlord loans targeted by ATO. Here are five things you may have missed this week.

Latitude refuses to cough up ransom money

Personal lender Latitude Financial is refusing to bow to ransom demands from the crooks behind the recent cyber-attack on the company.

The decision is consistent with the advice of the Australian Cyber Security Centre, which says paying a ransom doesn't guarantee the stolen data will be returned, and it can make the company a target for further attacks.

Even so, research by cybersecurity firm Kaspersky found almost 80% of companies globally that experienced ransomware attacks in 2022 paid the ransom, chiefly to avoid adverse publicity.

Australian companies have limited chances of hushing up a cyber-attack. Reporting a hack is mandatory if privacy laws have been breached.

While Latitude has not disclosed the size of the ransom, Latitude Financial CEO Bob Belan, says, "Based on the evidence and advice, (paying the ransom) would only encourage further extortion attempts on Australian and New Zealand businesses in the future.

Tax office targets investment property loans

The Australian Taxation Office (ATO) has announced a data matching program for residential investment property loans (RIPLs) covering the 2021-22 to 2025-26 financial years.

It follows a sample audit of 2020 financial year results, which found a $9 billion gap between actual tax revenue from individuals and what the ATO expected to receive "if every taxpayer was fully compliant with tax law".

A significant driver of this gap is property investors incorrectly reporting rental property income and expenses - in particular, incorrectly claiming loan interest costs where the loan was refinanced or redrawn for private purposes.

The ATO lists 17 different lenders that it may contact for loan data including all the big four banks plus smaller lenders such as Bendigo Bank, Macquarie Bank, ING and RAMS.

As the ATO points out "this is a coercive power" meaning so lenders have to stump up the information requested.

Can active fund managers really beat the market?

Investors can face tough odds picking an actively managed fund that outperforms the market.

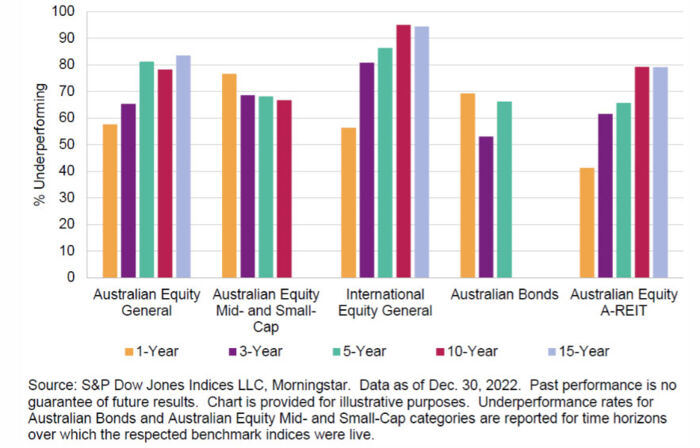

The 2022 SPIVA Australia scorecard tracks the performance of actively managed funds against their respective benchmarks.

The latest results show that in calendar year 2022, almost three out of five (58%) actively managed Australian share funds underperformed the ASX 200.

The likelihood of choosing an outperforming active manager is slightly better when it comes to funds focusing on A-REITs (listed property trusts), with two out of five failing to outpace market returns.

Percentage of underperforming active Australian funds - calendar year 2022

Underperformance rates tend to rise over the long term, especially among share funds, with more than 90% of actively managed international share funds failing to beat the market over 10- and 15-year timeframes.

Which Aussie city tops the league for 20-year price growth?

Sydney and Melbourne regularly steal the property limelight, but the nation's smaller cities have punched above their weight for house price growth over the past two decades.

Peter Koulizos, University of Adelaide academic and board member of Property Investment Professionals of Australia, says ABS data shows Hobart was the star performer by "a country mile" over the past 20 years.

The analysis found Hobart's median established house price increased almost sixfold, surging from $123,300 in March 2002 to reach $727,000 in late 2022.

Second-placegetter was Adelaide, where the median house price has quadrupled from $166,000 in 2002 to $680,000 by the end of last year.

Sydney, Melbourne, Darwin and Adelaide saw median values at least triple over the last 20 years.

Money maker issues profit downgrade

A licence to print money may not be so lucrative after all.

British banknote printer De La Rue has issued a profit downgrade as demand for cash plunges to a 20-year low.

The 200-year-old company is responsible for the design and printing of more than one-third of all the banknotes in circulation globally including the new King Charles III banknotes that will hit the wallets of Brits in 2024.

It's not the first profit warning De La Rue has issued over the past year, and the uncertainty has seen the company's share price tank by around two-thirds in the space of 12 months.

Here in Australia, the use of cash for day-to-day transactions has been in decline since the mid-2000s, with the pandemic further sounding the death knell for the folding stuff.

A recent Reserve Bank report found 74% of retailers with a physical store accept cash, but one in two of these plan to actively discourage cash payments in the future, mainly due to hygiene concerns.

Australian bank notes are printed in Victoria by Note Printing Australia Limited, a wholly-owned subsidiary of the Reserve Bank.

Get stories like this in our newsletters.