Jewellery chain Lovisa is making a beeline for growth

By Gaurav Sodhi

The accessories retailer has fast-tracked its growth with an excellent acquisition at an unbelievable price.

The best businesses not only have great economics, value-adding products and competent management, they typically have hustle - a never-ceasing hunger to be better than the competition.

We weren't sure if Lovisa fell into this category, until now. The business has announced one of the best acquisitions we've seen in years.

Amid the pandemic-induced mayhem in Europe, with case numbers rising and renewed restrictions, Lovisa has bought 84 store locations from European distributor Beeline.

The acquisition adds six new countries to Lovisa's portfolio, with 54 stores in Germany and the remainder spread across The Netherlands, Switzerland, Belgium, Austria and Luxembourg. No debt, apart from lease liabilities, will come with the purchase and the acquired balance sheet will include almost €10 million (about $16 million) of cash.

How much did Lovisa pay for this tidy purchase? The grand sum of €60 - roughly equivalent to a round of beers at last year's Oktoberfest.

All good news

For Lovisa, there are several major benefits. The business has been focused on growing in North America but has, so far, only been selectively opening stores in Europe. That's mostly because sites are hard to locate in many European cities which typically come with heavier regulation.

At a stroke, it will be able to test its stores at scale in new markets, potentially creating a new avenue for growth. There is no guarantee that it will be successful - it has already left Spain after failing there - but this a low-cost option with huge potential upside.

Lovisa will convert the sites into its own format and brands. Inventory and store fit-out across the acquired network is exp

The company has also entered into a put option for Beeline to sell it 50 stores in France, once Beeline has completed mandatory worker consultation. That would bring the total purchased network to 114.

That's enough scale to be able to build a warehouse and trial instore and online sales in new markets. The alternative would be to build locations one at a time, a lengthy process that would come at higher cost, higher risk and without the benefits of scale.

The purchase is made possible because the target, Beeline, is motivated to keep employment for its workforce rather than close stores that aren't working. Lovisa will thus inherit the locations, workforce and leases which average two to three years per site.

During the conference call, Lovisa's management highlighted that a similar business, Claires, operates about 300 stores across Europe. Successful operation at the acquired sites could allow Lovisa to build a similarly-sized network across the continent.

Back on track

The purchase also confirms that Lovisa remains intent on rolling out stores. With COVID-19 restrictions impacting sales in all countries (except perhaps Australia and NZ), we were concerned that the business would retreat and limit openings. That doesn't appear to be the case.

In fact, management suggests that, as a result of the downturn, better locations at more attractive prices have become available. Like all great businesses, it will continue expanding counter-cyclically.

The market has responded enthusiastically to both the deal and the earlier news of a vaccine; the share price has rocketed 40% in the past week alone. That's a big move, but it's not without foundation. As the economy recovers, Lovisa should be able to rebuild earnings per share from last year's 15 cents back to about 40 cents by 2022. If, that is, the virus is contained and economies reopen everywhere.

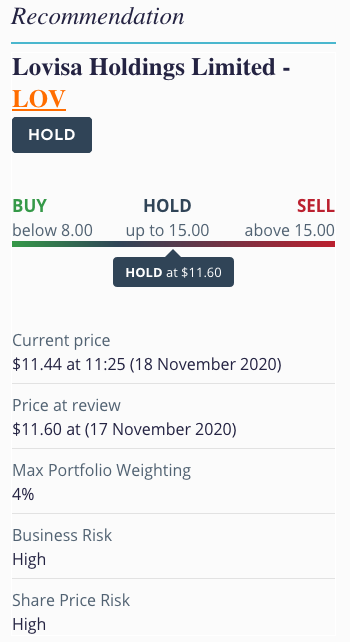

At close to 40 times normalised earnings today's price largely anticipates that recovery. However, with decent sales and new growth options, we'd still be interested at lower prices. Lovisa has the best economics of any retailer we've seen and retains its founder at the helm. This is a retailer worth chasing. We're raising our Buy price from $6 to $8. HOLD.

Get stories like this in our newsletters.