Why you only need $253k in super to retire

By Susan Hely

There is a winning number that pre-retirees and retirees need to know. We call it "the sweet spot" - the point where superannuation combines with the full age pension.

The sweet spot has been harder to hit since the federal government tightened the assets test taper rate in January 2017.

Combining the age pension with super is harder for homeowning couples with super, plus other assets, above $401,500, which is the cut-off point for the full pension. With this amount in assets, their pension shrinks until it cuts out at $880,500. But the catch is this: their income from super isn't high enough to compensate for the loss of the pension.

They're not necessarily wealthy. Many middle-income earners, who have been diligently building up their savings through their working lives, are shocked to find out that their super is a drag on their retirement income because of the assets means test.

In fact, people with less in super who qualify for a full age pension can do better.

For example, a homeowning couple with super of more than $401,500 will be worse off in terms of income than a couple with $386,500 who qualify for the full age pension of $37,341. The couple with the higher balance lose $3 a fortnight in the age pension for every $1000 above the assets threshold. That is $78 a year or 7.8% of their incremental assets. In the current interest-rate environment, their savings can't earn nearly enough to offset that penalty.

A single homeowner with $253,000 in super, plus a few other assets, qualifies for a full age pension of about $24,700 a year. Under the assets test, the cut-off for a part pension is $585,750. So if a single person has saved, for example, $750,000 in super, they miss out on the age pension and have to live off the income generated by their savings.

In the analysis for our cover story, we assume our case studies have only a modest $15,000 in other assets, such as a car. The numbers would be different in other situations. Also, there are different assets thresholds for non-homeowners.

For non-homeowners, the sweet spot would be $467,500 for singles and for a couple it would be $601,000.

Increasingly middle-income earners are caught in what Andrew Boal, chief executive at Rice Warner and chair of the Actuaries Institute's retirement strategy group, describes as the taper trap.

"With the taper rate at $78, the retirees [a couple] could be as much as $40,000 [income] worse off. In other words, the more they save, the worse off they are," says Boal.

The sweet spot has come into sharp focus in the past year, especially because of low investment returns. In fact, some pre-retirees have decided it is better to spend some of their super and to rely on the certainty of the age pension instead.

Case studies: How it works

Couples

A 66-year-old couple, Stephen and Anna, who own their home, have $386,500 in super plus home contents and car worth $15,000, taking their total assets to $401,500. They just qualify for the full age pension.

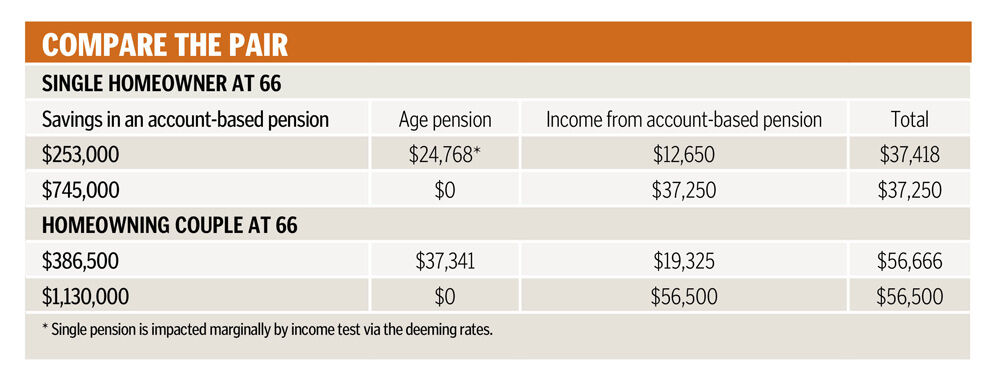

Their income from the age pension ($37,341pa) combines with a $19,325 drawdown from their super's account-based pension. This assumes they draw down their super at the normal minimum rate of 5%. Their total retirement income is $56,666 a year.

This compares with Peter and Jill, who have super of, say, $1.13 million in an account-based pension. Peter and Jill do not qualify for the age pension because their assets are too high. They will have a similar income of $56,500 based on a 5% drawdown of their account-based pension.

So, Stephen and Anna, with $386,500 in super, will have the same income as Peter and Jill, who have saved almost three times as much.

The super sweet spot at age 66 for a homeowning couple with modest other assets is $386,500.

Singles

In the case of a single homeowner, Phoebe, the sweet spot is $253,000. We'll assume she has home contents and car worth $15,000, keeping her total assets below the threshold.

With this level of savings Phoebe qualifies for a single age pension of $24,768 and, combined with an account-based super pension of $12,650, she will have an income of $37,418.

On the other hand, Johnno, who has $745,000 in superannuation, does not receive any age pension because of the assets test. He will earn slightly less than Phoebe from his account-based pension - $37,250 based on a drawdown of 5% of his balance.

As these examples show, after you have moved above the sweet spot your chances of receiving government assistance fall away sharply and you have to rely more heavily on your own savings, which is increasingly difficult while cash rates are so low.

Aussies spending big to offload assets

The federal government's idea behind the harsher assets test taper rate introduced in 2017 was to push Australians to be more self-sufficient and use their own resources in retirement. It wants retirees to draw down their capital - and increasingly tap into the equity in the family home - rather than leave an inheritance.

But the "taper trap" has encouraged some retirees to spend their savings quickly and live on the age pension alone, says Rice Warner's Andrew Boal.

This has the unintended consequences of not only distorting how people save but also how they spend their savings, says Peter Humble, independent financial planner at Rise Wealth.

He has some clients who are divesting themselves of assessable assets. "There are some interesting spending choices - people go hard and have a bit of a party to spend some of their capital."

The government's move to restrict age pension entitlement is encouraging people to pursue a full pension instead of a part pension.

They are converting their nest egg's assessable assets, which could earn income, into non-assessable assets such as home improvements, according to Matthew Linden, deputy chief executive of Industry Super Australia.

In this real example, Les sells his home and buys a bigger one so he can qualify for the age pension.

A widower, he is retiring with $470,000 in his super. His adult children live in Queensland, so Les decides to sell his house in Victoria and move north. He wants to receive the full age pension.

"I have worked hard and paid tax all my life."

He is aware of the effects of the taper rate. "I'm no worse off on the age pension from a cash flow point of view," he says.

The real estate agent tells Les he will get $500,000 for his house. Les decides to upgrade it and put more, around $670,000 in total, towards a place on the Sunshine Coast. This way he will have around $270,000 left (after moving and conveyancing costs) and will qualify for the full age pension.

Regular income without risk

If you receive the age pension, you are guaranteed an income. Also, it is indexed to the consumer price index, so it increases over time.

Humble says the couples pension rate of $37,341pa (including the pension supplement and energy supplement) is attractive for its risk-free nature. He says a self-funded retiree would need millions of dollars to invest in assets such as cash and term deposits to get a risk-free $37,000.

Instead, self-funded retirees take on more risk to get a reasonable rate of return and typically roll over their superannuation into an account-based pension that is invested in local and overseas shares, property, fixed interest, cash and some alternative assets.

But this isn't the approach for everyone.

"Some people will eat into their capital rather than take risks with their money," says Humble.

Retirees must draw down a minimum from their account-based pension, set at 5% from 2021-22 for people aged 65 to 74. That minimum increases beyond 74.

Some retirees undervalue assets such as their car and caravan to access the age pension, but financial planner Mark McShane, at Minchin Moore, says there are cases where the government checks up and he recommends always using true valuations.

If you ask financial experts how much money you need in retirement, they will typically tell you 65%-70% of your pre-retirement income.

The FIRE movement (financially independent, retire early), which includes people who choose to retire young and live off the income from their capital, uses a simple formula: work out how much you need to live on and multiply it by 25.

Others point to figures that support the retirement standard promoted by the Association of Superannuation Funds of Australia (ASFA). Couples aged 65 to 85 need $62,562pa and a single person needs $44,224 for a comfortable life, including such things as health insurance, streaming services and holidays.

But few Australians ever build up enough super to generate this sort of income. The median balance for men aged 60 to 64 is $204,107 and for women $146,900, according to tax office figures.

Retiring members of the REST super fund, which primarily covers the retail industry, find the often quoted $1 million savings target very discouraging, says Greg Fleming, head of advice at REST.

The average balance of members in the REST pension product is $260,000. Fleming says they are relieved when they find out what their income will be with their savings plus the age pension.

Super balances will increase as the system matures. When the compulsory employer contribution began in 1992 it was only 3% of earnings and has been 9.5% since 2014 (it is due to increase to 10% next financial year).

Ways to bridge the gap

Rice Warner's Andrew Boal says that while the current system is relatively immature, over the next 20 years more than 60% of super balances at retirement will reach $250,000 or more, and over the next 40 years around 40% will hit $500,000 in today's dollars.

Combining the age pension and income from savings would still leave a couple with $385,500 in super, which is short of the ASFA standard for a comfortable retirement by $5896 ($62,562 minus $56,666), or about $115 a week.

One way to reach it is to draw down at a higher rate from an account-based pension, say 6.5% instead of 5%. If the investment environment is healthy it might be possible to do so without running down the balance over time. But assumptions about future investment returns from super are by their nature very uncertain and few would argue the toss between 5% and 6%.

Another way to add income is to work a few hours in retirement. Part-time work is means-tested and can impact on the age pension rate. The sweet spot amount for a couple will generate deemed income of $6914 a year, which is under the threshold of $8216. You lose 50 cents from the age pension for every dollar you earn over the limit.

If a couple earned an extra $10,490 a year through part-time work (around $400 a fortnight), the first $1302 would still be under the income threshold. The balance would reduce their age pension by $4594, so that they had a net income increase of $5896, bringing them up to ASFA's comfortable standard.

In the case of a single person, the deemed income exceeds the threshold so there is no headroom for additional income.

The single person is short of the comfortable standard by $6806 ($44,224 minus $37,418). They could bridge this by drawing down 7.7% of their super pension account, which is less likely to be sustainable in the long term because it will run down the balance unless the investment returns are as high as that drawdown.

A combined approach might be to draw down their super at 6%, adding an extra $2530 of income, and take on part-time work for $8552 a year, which would reduce their pension by $4276 so that the net income gain from work was $4276.

Together with the additional drawdown of $2530, this would add $6806pa of income so that they achieve the single person comfortable standard of $44,224.

Keen to preserve capital

While financial planner Peter Humble sees the taper rate as a "bizarre distortion that creates a disincentive for people," other financial planners, such as Anne Graham, from Story Wealth Management, say it's not especially unfair. Before the taper rate was changed in 2017, she says couples with $1 million could get a part age pension and health concession card, which was costly for the economy.

"You have a growing ageing population and a reducing working population to support older Australians. There is only a limited amount of money and the age pension is supposed to be a safety net."

She says everyone has a different strategy for retirement. She sees her role as explaining the advantages and disadvantages to clients who want to receive a full pension. There is a perception among some people who don't qualify that friends or neighbours who do get the pension actually have more money and other assets than they do.

Humble says his older clients are keen to preserve their capital. They want to leave a bequest to their children and grandchildren, particularly in a time of rising, unaffordable property prices. But he observes that baby boomers are far more prepared to spend their capital.

"Some people see Centrelink as a right. Others see it as a form of welfare," he says. "My job is to tell them the rules. Engaging with them is challenging. Australia has built a complex system with a patchwork of exemptions and exclusions that don't make a lot of sense."

Graham says some people don't want the age pension because they don't want the government knowing anything about them. They don't want to do the paperwork or to go through the application process. Others don't know they qualify.

Humble says retirees keen on the age pension are more likely to upgrade the family home or spend up to $250,000 on a new four-wheel- drive and a caravan.

"They ride the bumps a bit more." Be aware that vehicles should be declared as assessable assets.

One of the problems with people spending some of their superannuation on the house to claim the age pension is that most of their wealth is in an asset that doesn't provide an income. What happens when they need money for an emergency?

"I'd always rather have more money," says Humble. "Heading down the road on a free-form spending spree is fraught with danger. It assumes you can see the future and it assumes nothing will happen to your life. It also assumes rules around the age pension won't change. If the government were to reduce the severity of taper at some point, the spending spree would have been unnecessary."

Risks in early retirement

One of the reasons to save more in superannuation is to cover the risk of an unexpected health issue or a forced redundancy.

The average age at retirement in 2018-19 was 55.4 years, but the average age at which people intend to retire is 65.5, according to the Bureau of Statistics. Women typically retire earlier at 52 while men retire at 59.5 years. These figures go against the government's expectation that people will work longer.

The problem with leaving the workforce early is that you will not qualify for the age pension until you are 66, rising to 67 on July 1, 2023. Your super could fund those five to seven years until you qualify for the pension, otherwise you may have to turn to JobSeeker.

For example, if you retire early and you need $50,000pa for six years, you would have to add another $300,000 to your $385,500 retirement sweet spot savings, which will deliver you the age pension at 66.

Also, more people are retiring with debt because of bigger mortgages and the desire to help adult kids get into the property market. Industry Super Australia says 47% of couple households in 2018 had a mortgage or personal debt nearing retirement. If it were repaid at retirement, around half of couples with debt and two-thirds of singles would deplete more than half their balance.

Story Wealth's Anne Graham says often the reason her clients head into retirement with housing debt is because a relationship has broken down and the assets have been divided.

She recommends paying down the mortgage before retiring. With interest rates so low, some people prefer to put extra money into superannuation, where it is taxed at 15% instead of their full rate. Once in super, the money can earn 6%-7%pa.

Reduce the uncertainty

Financial planners see their role as encouraging their clients to boost their superannuation. There is a new concessional contribution limit from July 1 this year of $27,500, up from $25,000.

"It pays to optimise your superannuation balance because you can get a tax benefit after you turn 60 and pay yourself an income stream with no tax," says Minchin Moore's Mark McShane. He says if your employer doesn't allow you to salary sacrifice you can add extra yourself and claim the tax deduction.

The sooner you start pumping up your super, the sooner compounding kicks in. But typically people start salary sacrificing in the last five to 10 years of employment.

McShane says that if you put more into super early, you have greater control over your future, and are not living with the uncertainty of what happens to the age pension, health care cards and aged care.

Part 2: What if you have too many assets?

Get stories like this in our newsletters.